- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: BBVA ClearPoints question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BBVA ClearPoints question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@KLEXH25 wrote:

@JNA1 wrote:

The purchase eraser isn’t really much different than statement except you can target a specific purchase to to use cash back to pay. Let’s say you say to yourself “When I save up $100 in cash back, I’m gonna buy myself a $100 pair of sunglasses.” When you reach that $100 in cashback, you can buy the glasses, and pull up that purchase and pay for it with the cashback you earned. It’s a great card though. The the 2X and 3X and categories are very broad!

They regularly offer 4X offers on groceries, restaurants, etc. We earned 6X points on restaurants for all of January. https://ficoforums.myfico.com/t5/Credit-Cards/BBVA-4X-Points-at-Restaurants-in-January-Offer/td-p/58...That's awesome! But if you don't know what the bonuses will be, and you've already chosen your categories, it's sort of like a lottery then? I have most categories covered with my other cards, but it'd definitely be nice to earn a little more once in a while. I was curious about the Utilities category and what would be covered. Any categories that cover cell phones and/or cable bills?

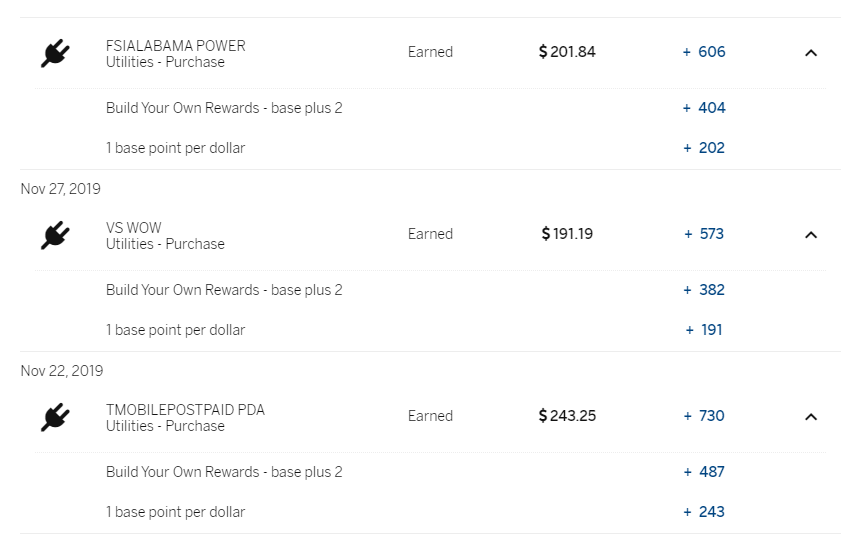

Utilities covers cell and cable. That's what I use mine for.

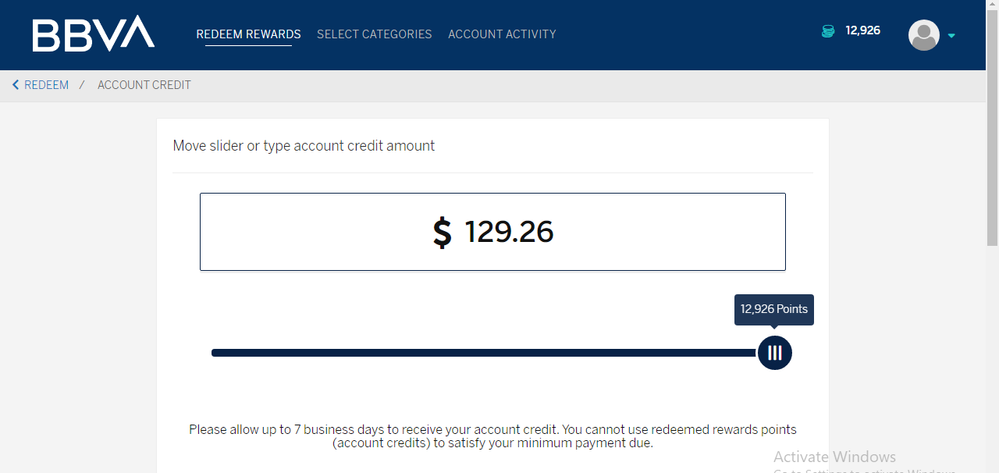

As to the purchase eraser question, it's really only used if you want to use your points before you hit the $25 redemption threshold but you can use points to cover exact dollar amount purchases (so you have to have points to cover the entire purchase) and it just gets removed from your points balance, it doesn't cost you anything more than a statement credit, it's just a hack that allows you to pay off that burger without waiting to hit $25.

Also the bonus offers are stacking offers so if you get a 4X offer, it's 5X if it's not the category you selected, 6X if it's a 2X, or 7X if it's the 3X. They are usually pretty awesome unless you have a rotator with the same category that month but since BBVA offers are generally for a month and tend to have high caps on spend, they can put a decent chunk of points in your account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@NoMoreE46 wrote:

Could someone post a picture of the app/consumer website for BBVA please?? I gotten over 7 or 8 mailers from this bank and am so tempted but have a feeling the UI may look like TD’s Redcard.

It's definitely not that awful.

The app is actually pretty good.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@Anonymous wrote:

@NoMoreE46 wrote:

Could someone post a picture of the app/consumer website for BBVA please?? I gotten over 7 or 8 mailers from this bank and am so tempted but have a feeling the UI may look like TD’s Redcard.It's definitely not that awful.

The app is actually pretty good.

Yes Thank You Saeren. So very appreciate you taking the time to provide a true screen shot (and then blurring) this for me.

I agree - its not bad at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@NoMoreE46 wrote:

Thanks so much- it is very decent.

Cheers

The website is actually pretty bad. The app makes up for it though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

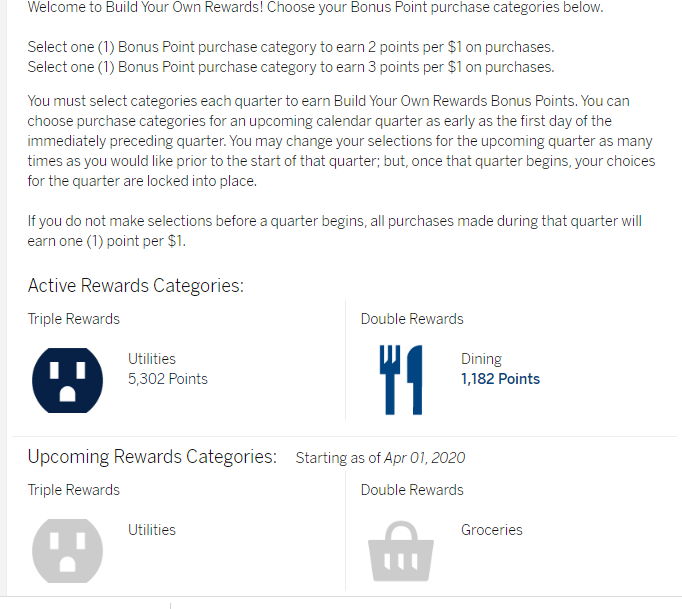

I love the Rewards Center. The Build Your Own Rewards is simple and straightforward and I like how the points are broken per purchase

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@UncleB wrote:Rewards are redeemed as a statement credit in $25 increments, and they also have a 'Real Time Rewards' feature that allows you to use points to 'erase' a purchase of any amount (even less than $25).

Thanks for posting this. I wasn't aware you could do any kind of redemption before amassing at least $25 in points/cash back. This makes my BBVA card a lot more appealing to me now. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA ClearPoints question

@Anonymous wrote:

@KLEXH25 wrote:

@JNA1 wrote:

The purchase eraser isn’t really much different than statement except you can target a specific purchase to to use cash back to pay. Let’s say you say to yourself “When I save up $100 in cash back, I’m gonna buy myself a $100 pair of sunglasses.” When you reach that $100 in cashback, you can buy the glasses, and pull up that purchase and pay for it with the cashback you earned. It’s a great card though. The the 2X and 3X and categories are very broad!

They regularly offer 4X offers on groceries, restaurants, etc. We earned 6X points on restaurants for all of January. https://ficoforums.myfico.com/t5/Credit-Cards/BBVA-4X-Points-at-Restaurants-in-January-Offer/td-p/5851794That's awesome! But if you don't know what the bonuses will be, and you've already chosen your categories, it's sort of like a lottery then? I have most categories covered with my other cards, but it'd definitely be nice to earn a little more once in a while. I was curious about the Utilities category and what would be covered. Any categories that cover cell phones and/or cable bills?

Utilities covers cell and cable. That's what I use mine for.

As to the purchase eraser question, it's really only used if you want to use your points before you hit the $25 redemption threshold but you can use points to cover exact dollar amount purchases (so you have to have points to cover the entire purchase) and it just gets removed from your points balance, it doesn't cost you anything more than a statement credit, it's just a hack that allows you to pay off that burger without waiting to hit $25.

Also the bonus offers are stacking offers so if you get a 4X offer, it's 5X if it's not the category you selected, 6X if it's a 2X, or 7X if it's the 3X. They are usually pretty awesome unless you have a rotator with the same category that month but since BBVA offers are generally for a month and tend to have high caps on spend, they can put a decent chunk of points in your account.

That's awesome to know!! Thanks