- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: BBVA/PNC CLI data points & other transition ti...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BBVA/PNC CLI data points & other transition tips

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

@JNA1 wrote:

@chuckwood wrote:

@Duriel wrote:Has anyone called to product change from the awful points card yet? I am looking to do so soon.

I had to call and then they sent me to the branch becuase my BBVA username did not work. I was told over the phone and then by the branch manager that PNC will not convert any accounts to different products.

Man, that sucks. So far, not only is this card a horrible rewards card, it is opted out of the Purchase Payback offers (which are actually really good on my Cash Rewards card) and you can't opt-in for them, and there isn't even any promotional balance transfer offers (my Cash Rewards card aways has a 0% for 13 month offer with a 3% fee.

The bad part is that mine is a $25K CL and DW's is a $10K CL. I took a HP in December to get my BBVA card from $15,300 to $25K, so I'm not giving that up. I'm going to put a $1.99 recurring Apple charge on mine and let it pad my utilization.

It's just disappointing all the way around how this transition has been...

I am in the same boat. Mine is at $25K also so I really don't want to close it but I am still debating it. I did recieve a letter today that was dated October 1st saying I would have to register with PNC that my User ID would not port. So we will see what happens when the dust settles.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

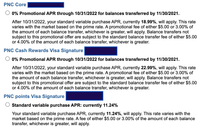

@CreditCuriosity wrote:BT fees for my PNC cards are as follows... Nothing is free on BT fees usually unless NFCU or a few other CU's or possibly a new card sign-up no BT fee.

I have the points card and also have the standard rate with fees for the BT "offer". Since you got a 0% offer for the other 2 cards, I'm wondering if they don't offer BT promos for the points card.

By the way, does it annoy anyone else that the word "points" in the card name isn't capitalized? LOL. It also bothered me that the "A" in BBVA was intentionally misaligned. 😁

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

@cr101 wrote:

@CreditCuriosity wrote:BT fees for my PNC cards are as follows... Nothing is free on BT fees usually unless NFCU or a few other CU's or possibly a new card sign-up no BT fee.

I have the points card and also have the standard rate with fees for the BT "offer". Since you got a 0% offer for the other 2 cards, I'm wondering if they don't offer BT promos for the points card.

By the way, does it annoy anyone else that the word "points" in the card name isn't capitalized? LOL. It also bothered me that the "A" in BBVA was intentionally misaligned. 😁

To be fair, being worth less 1/4 of cent each, I'm not sure points deserved to be capitalized! 😂😂🤷♂️

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

@cr101 wrote:

@ocheosa wrote:

@chuckwood wrote:

@Duriel wrote:Has anyone called to product change from the awful points card yet? I am looking to do so soon.

I had to call and then they sent me to the branch becuase my BBVA username did not work. I was told over the phone and then by the branch manager that PNC will not convert any accounts to different products.

I was told the same this morning from their sales dept, no combinations either. The only option is to apply for a new card and close the points card. She was happy to report you could redeem the points for gift cards. She said they have lots of gift card choices. Her example, you can purchase a $50 gift card for 45 points. I didn't bother to go look was too disappointed. She also said they run BT offers on the points card, didn't say how ofen but yeah, Sucks!

I wish! She left off some zeroes. LOL. You can't even get a $5 Sam's Club card with 45 points.

2,689 points = $5 Sam's card

23,155 points = $50 Sam's card

Now, the BT offer sounds nice as long as there's no BT fee. I already have cards that offer BT offers, but the fee is too much to make it worth my while.

Too bad reps are confirming that we can't switch products. If they're lucky, most customers won't care about these things. It would be awful for them if they bought a customer base and lost a big chunk of them bc the customers didn't like the CCs. 🤣

Thanks for clarifying the GC program. I am not at all surprised, what a garbage card. I already have BT cards. Will concentrate on growing the cash rewards and probably just close the points cards when I come out of the garden to app for elan. Oh well, c'est la vie.

TCL $678.5K: Personal $562.5K, Business $116K.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

@cr101 wrote:

@ocheosa wrote:

@chuckwood wrote:

@Duriel wrote:Has anyone called to product change from the awful points card yet? I am looking to do so soon.

I had to call and then they sent me to the branch becuase my BBVA username did not work. I was told over the phone and then by the branch manager that PNC will not convert any accounts to different products.

I was told the same this morning from their sales dept, no combinations either. The only option is to apply for a new card and close the points card. She was happy to report you could redeem the points for gift cards. She said they have lots of gift card choices. Her example, you can purchase a $50 gift card for 45 points. I didn't bother to go look was too disappointed. She also said they run BT offers on the points card, didn't say how ofen but yeah, Sucks!

I wish! She left off some zeroes. LOL. You can't even get a $5 Sam's Club card with 45 points.

2,689 points = $5 Sam's card

23,155 points = $50 Sam's card

Now, the BT offer sounds nice as long as there's no BT fee. I already have cards that offer BT offers, but the fee is too much to make it worth my while.

Too bad reps are confirming that we can't switch products. If they're lucky, most customers won't care about these things. It would be awful for them if they bought a customer base and lost a big chunk of them bc the customers didn't like the CCs. 🤣

Something tells me the majority of folks who got stuck ended up with the "points" card will be just fine with it, not knowing they can do better elsewhere.

The folks who will close the card because of the points value (or rather, lack thereof) won't be missed since PNC wouldn't make much money from us anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

@atst2000 wrote:@cr101 Thank you for posting this.

I amongst millions of other sorry saps, have been migrated to this abysmal banking institution.

I banked with them 10 years ago (not by choice) when they bought out National City.

Here's an important note for PNC checking:if your coming from BBVA, you will be charged checking fees if you don't have a minimum balance of $500.

Also they migrated me to the PNC points card. Don't be fooled by the 4% earning rate. The points are worth less that a quarter a penny!

Meaning, if you want a $100 cash , you need 50,000 points LOL!

So long BBVA, it was nice knowing ya...

My sentiments exactly! I too was converted to Points card. October 7, I redeemed all my rewards and paid off the balance. Cest la vie!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

Well .....

Good bye Clearpoints![]() , welcome _________ points

, welcome _________ points![]() ..worthless POC.

..worthless POC.

Since,, I was already a PNC customer. all my stuff migrated over with no issues![]()

Now to close that checking account and SD that worthless PNC points card.

In my mind I am thinking 'WHAT A DISASTER" ...eom

Feel like calling PNC and say; "WHAT ARE YOU THINKING HERE" ???? ..end of rant!..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

Yes, we are PNC customers and are there for the business banking. There is not much value in their personal checking account and the DW's converted "points card" is useless. We keep $501.00 in the personal checking to prevent the monthly fee but do not use it. The ACH system is bogus, I could physically walk the money faster in some cases.

Right after they converted her card to a worthless points card, they sent a preapproval for a CB. FUBAR I say!

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

The rep told me that I should be able to request a CLI since there wasn't a notation that I couldn't. But, I ultimately couldn't request a CLI because my card is not activated. So, we'll at least have to wait until we activate our new cards. That could be the reason that we're getting errors for the online CLI request.

She said that it's a SP and there's a 6-month wait between CLI, even if I'm declined. 😮 I hope that she was wrong about the wait between denials. Anyone have any data points on that?

Also, you apparently have to call the CC department, not the main PNC number.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BBVA/PNC CLI data points & other transition tips

I texted them about a PC about a month ago and again yesterday into today (yes took that long) and I don't think they are going to budge on this unless something changes. Maybe they don't realize just how awful their points card is. I plan to let them know. I left an honest review of the card on WalletHub and I'm going to leave more reviews on a bunch of similar sites. All I have to do is cut a paste the truth. My plan for my card which has a $10K limit and is just shy of 2 years old is to close it. I have more than enough available credit to not miss it. I'm just going to wait a month or two to see if they get enough flack to change their PC policy and if not the cc, checking and savings accounts will all be closed together. If anyone else wants to try to help them see the light please post your honest reviews all over the place too.