- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: BOA Balance Transfer to pay BOA

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BOA Balance Transfer to pay BOA

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BOA Balance Transfer to pay BOA

My DW has about $6k on a 0% BT offer that is expiring soon. The best BT offer she has without getting a new card is with BOA. As we all know, you generally can't BT a balance back to the same CC company, but it seems like it would be possible (if against the rules) using the BT convenience checks to deposit to our bank account and then pay the CC. I'm a little concerned about this verbiage from the offer page:

You may not use this account to make a payment on this or any other credit account or loan product issued by Bank of America, N.A., or its affiliates.

It's not really clear to me whether "Account" refers to the BOA CC account or my bank account so I could launder the money a little by depositing into our daughter's account and transfering back to ours before making the payment. Any experiences doing similar that anyone wants to share or any thoughts in general?

I know that some here frown on rolling over BTs, no lectures please. We're about 2 years into a 4 year plan to be out of debt, and so far have gone from about $80k to under $35k, and don't expect this to be perpetual. A major key to the plan is paying much less interest than we were before, so I'm using a combination of low interest loans and BTs.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

Certainly no lectures to be given; this is not the forum for that! Congrats on the amazing reduction you've already made.

Yes, the rules with every card issuer are that you cannot use a BT to pay off a balance with the same issuer. That said, I've certainly done deposits from BOA accounts' BT offers while doing some shuffling around on BT offers and also making large payments to BOA at the same time, so technically it could have been coming from the BT if they looked at it that way. It's not something that I would risk unless you also have significant other deposits coming in that you could explain how you paid the balance and also significant other payments going out that you could explain where the money went other than the BOA account.

The safer thing would be to deposit it in another checking account with another institution or to use another card as a bridge that has no BT fee and then pay that card off as soon as possible to minimize interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

Don't over complicate things, just don't deposit it into a BOA account.

The disclosure just means you can't write it out to make a payBOA loan directly.

If you wanted to you can just do DD to your outside account from the BT screen itself up to the total CL of the CC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

@Anonymous wrote:Don't over complicate things, just don't deposit it into a BOA account.

The disclosure just means you can't write it out to make a payBOA loan directly.

If you wanted to you can just do DD to your outside account from the BT screen itself up to the total CL of the CC.

Thanks, I'll just go the direct route of deposit to my account and paying from there then.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

@FlaDude wrote:Thanks, I'll just go the direct route of deposit to my account and paying from there then.

Well, if you want to be super-safe, that's not opaque enough! Ideally, deposit to outside bank account 1, transfer to another outside bank account 2, and pay from there. Then BoA receives payment from something unconnected with the BT.

But only if you are sufficiently concerned

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

GL2U

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

I'd also add not to do it too close together, if possible give yourself some breathing room between the deposit of new BT and actually paying off the current BT balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

Thanks for all the feedback. After reading the posts and giving it more thought, we've taken the DD route to our daughter's checking account and will transfer it back to ours to pay the card. We've done it a few weeks before the current 0% offer expires so we can leave a little time between getting the money and paying the card.

I'm not too worried about AA, if they want to balance chase or not offer any future BTs, no big deal. Once we have all of our debt taken care of, we'll probably close this card in any case. DW's FICO 8 scores range from 810 to 841 at this point with 50% util on this card, she might lose a few points in the short term but we're not planning to buy a house or do any other major apps soon.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

IMPORTANT NOTE:

Read the fine print on the balance transfer offer. BoA *sometimes* adds a clause that you can write the check to anything or anyone BUT YOURSELF or AUTHORIZED USER on the account. I called for clarification on this as I was considering the same thing. The CSR informed me that if I write one of these checks to myself it is considered a CASH ADVANCE and you will be charged at the CASH ADVANCE interest rate, on top of the 3% of the check amount.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BOA Balance Transfer to pay BOA

@ChargedUp wrote:Read the fine print on the balance transfer offer. BoA *sometimes* adds a clause that you can write the check to anything or anyone BUT YOURSELF or AUTHORIZED USER on the account. I called for clarification on this as I was considering the same thing. The CSR informed me that if I write one of these checks to myself it is considered a CASH ADVANCE and you will be charged at the CASH ADVANCE interest rate, on top of the 3% of the check amount.

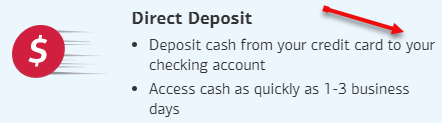

I've used convenience checks and DDs before with BOA and other credit cards and have never seen a case where you had to deposit to someone else's account. Maybe that happens, but in this case it's pretty clear that I don't have to deposit to someone else's account. Here is what the BOA page says (arrow mine):

I certainly expect that the cash advance rate will be charged on any remaining balance after the 14 month 0% promo period ends, but I have no intention of getting to that point. It will be paid off or the remainder rolled over in some fashion if needed.

AoOA: closed: 36 years, open: 25 years; AAoA: 11.8 years

Amex Gold, Amex Green, Amex Blue, Amex ED, Amex Delta Gold, Amex Hilton Surpass, BoA Platinum Plus, Chase Freedom Unlimited, Chase Amazon, Chase CSP, Chase United Explorer, Citi AA Plat, Sync Lowes, Sync JC Penney - total CL 145k

Loans: Chase car loan (35k/6yrs 0.9%)