- myFICO® Forums

- Types of Credit

- Credit Cards

- Balance Tranfer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Tranfer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Balance Tranfer

Hello! Two cards: 1 has a 6k limit with $4,400 on it (a bal transfer) and another has a 12.5k limit with $4,500 on it (also a bal transfer). I have an opportunity with the larger limit card to do a balance transfer for the full amount of the first card. The first card has to be paid by July of 2016, but if I transfer it I have until Mar. 2017 to pay off the 8k (which I can do). The question is: Is it better to have a 0 balance on the 6k card but have a 72% usage on the other card (with 0 interest). Sorry it's confusing. Also, I have 8 cards total and there is basically no balance on any of the other ones, so my credit is very good. No other cards are ofering a 0 balance transfer so I can spread them out more. Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

ttt

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

Can you shorten your response?.....ha!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

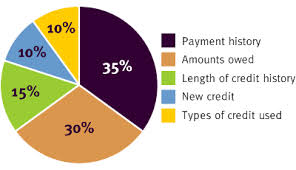

No, it is not good to have 0 balance on one card and then 72% on another card. It impacts your report negatively. But if you are not planning on buying anything where your report will be pulled or applying for a new card then you should be fine. Here is how your scores are calculated..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

@Anonymous wrote:Can you shorten your response?.....ha!

TTT is to the top. He was bumping up your thread so others would see it and respond.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

@Anonymous wrote:Hello! Two cards: 1 has a 6k limit with $4,400 on it (a bal transfer) and another has a 12.5k limit with $4,500 on it (also a bal transfer). I have an opportunity with the larger limit card to do a balance transfer for the full amount of the first card. The first card has to be paid by July of 2016, but if I transfer it I have until Mar. 2017 to pay off the 8k (which I can do). The question is: Is it better to have a 0 balance on the 6k card but have a 72% usage on the other card (with 0 interest). Sorry it's confusing. Also, I have 8 cards total and there is basically no balance on any of the other ones, so my credit is very good. No other cards are ofering a 0 balance transfer so I can spread them out more. Thanks in advance!

So you currently have

4400/6000 = 73%

4500/12500 = 36%

and you are concidering go to

0/6000 = 0

8900/12500 = 71%

seams to me you would lower your max utilization on a single card by doing the transfer, unless I am missing something?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

@Anonymous wrote:Hello! Two cards: 1 has a 6k limit with $4,400 on it (a bal transfer) and another has a 12.5k limit with $4,500 on it (also a bal transfer). I have an opportunity with the larger limit card to do a balance transfer for the full amount of the first card. The first card has to be paid by July of 2016, but if I transfer it I have until Mar. 2017 to pay off the 8k (which I can do). The question is: Is it better to have a 0 balance on the 6k card but have a 72% usage on the other card (with 0 interest). Sorry it's confusing. Also, I have 8 cards total and there is basically no balance on any of the other ones, so my credit is very good. No other cards are ofering a 0 balance transfer so I can spread them out more. Thanks in advance!

I would not transfer the promo BT off the $6k card, because you already paid a fee to get it there. You have until July 2016, 10 months, to continue to enjoy a low or 0% APR. Keep the funds there. If you BT now, you would be paying a fee for, really, only the time period between August 2016 and March 2017, so only getting 8 months of benefit, you don't get the 18 months benefit.

The card with the $12,500 limit probably has routine, monthly BT offers. Every card that I use which has BT offers, whether it is BofA, US Bank or Discover, always has BT offers, so don't just jump at the first one that comes along.

The other reason is, since the $12,500 card is also on a BT offer, that probably has a different end date than March 2017, and so you would end up when that expired with two tiers of balances, with different BT expiration dates, so paying regular interest on the current balance on the card, and the promo rate on what you are thinking of moving to it. Unwinding these types of two-tier APR situations is not impossible, but it's a hassle and you don't want to jump into that fire.

Your score already reflects the high utilization, but cash money savings on the current BT offers always beats any FICO considerations. Your FICO will come back as you pay down these balances, and you will pay them down faster if you just leave them where they are, and concentrate payments to them.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

Thanks for your responses. I will now look out for the TTT.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Tranfer

@Anonymous wrote:The first card has to be paid by July of 2016, but if I transfer it I have until Mar. 2017 to pay off the 8k (which I can do). The question is: Is it better to have a 0 balance on the 6k card but have a 72% usage on the other card (with 0 interest).

How long would it take you to get it down to 50%? 30%? Short term high utilization generally isn't an issue but prolonged high utilization can get one into trouble.