- myFICO® Forums

- Types of Credit

- Credit Cards

- Balance Transfers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Balance Transfers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@wasCB14 wrote:

@Brian_Earl_Spilner wrote:

@K-in-Boston wrote:After doing them repeatedly for 13 years with Bank of America it has proved disastrous. They raised my credit lines to $99,900. AU had the same thing happen to her.

More recently in the past 4 years, PenFed, NFCU, Discover, US Bank, Comenity, Citi, and Chase all had the same disastrous results. Doing BTs resulted in them increasing credit lines, sometimes automatically.

Edit: To be serious for a moment, the key is that BTs are fine as long as you are not just making minimum or near-minimum payments every month and your debt is not escalating as a result (pyramiding debt). Also the most lenders taking BT offers away is very much YMMV. I still have a lot of them available to me, and there are many cards that still offer them for new cardholders.

It was just a random question. Was thinking of charging some stuff on my amex and BT to NFCU to show some use because I don't have a use for it in the immediate future. That led to me remembering amex taking away SUBs for BT abuse, but nobody has said what that abuse is. That led to me wondering what abuse is and whether or not other lenders track that you're not actually paying your cards, but BTing the balance to another card. Which led to me making the thread.

And, you're profile is not typical. While it may be YMMV, based on what I'm reading everywhere, most people have had BT offers dry up on them and needing to apply for new cards to get them.

The only arguable BT abuse I've heard of was with Barclays Ring years ago, where people would BT sums in for a 1% cash bonus, and then almost immediately pay it off. A $50 or $100 bonus offset by maybe $1 of interest.

Otherwise, I don't see how it could be abused. Either the issuer allows a BT on a no-fee, 0% intro promo (wouldn't mind getting one of those)...or the issuer earns a BT fee and/or interest.

🤷♂️ It's listed as a reason for losing SUBs with amex. I don't see how you can abuse it other than constantly BTing your balances out. And, I still don't see how it matters as long as they're getting paid

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Brian_Earl_Spilner wrote:

@wasCB14 wrote:

@Brian_Earl_Spilner wrote:

@K-in-Boston wrote:After doing them repeatedly for 13 years with Bank of America it has proved disastrous. They raised my credit lines to $99,900. AU had the same thing happen to her.

More recently in the past 4 years, PenFed, NFCU, Discover, US Bank, Comenity, Citi, and Chase all had the same disastrous results. Doing BTs resulted in them increasing credit lines, sometimes automatically.

Edit: To be serious for a moment, the key is that BTs are fine as long as you are not just making minimum or near-minimum payments every month and your debt is not escalating as a result (pyramiding debt). Also the most lenders taking BT offers away is very much YMMV. I still have a lot of them available to me, and there are many cards that still offer them for new cardholders.

It was just a random question. Was thinking of charging some stuff on my amex and BT to NFCU to show some use because I don't have a use for it in the immediate future. That led to me remembering amex taking away SUBs for BT abuse, but nobody has said what that abuse is. That led to me wondering what abuse is and whether or not other lenders track that you're not actually paying your cards, but BTing the balance to another card. Which led to me making the thread.

And, you're profile is not typical. While it may be YMMV, based on what I'm reading everywhere, most people have had BT offers dry up on them and needing to apply for new cards to get them.

The only arguable BT abuse I've heard of was with Barclays Ring years ago, where people would BT sums in for a 1% cash bonus, and then almost immediately pay it off. A $50 or $100 bonus offset by maybe $1 of interest.

Otherwise, I don't see how it could be abused. Either the issuer allows a BT on a no-fee, 0% intro promo (wouldn't mind getting one of those)...or the issuer earns a BT fee and/or interest.

🤷♂️ It's listed as a reason for losing SUBs with amex. I don't see how you can abuse it other than constantly BTing your balances out. And, I still don't see how it matters as long as they're getting paid

For the AMEX reason for losing SUBs the only real way I can see that being an issue is if the balance is taken out immediately after SUB is attained to another card and it happens a lot. Doing it once I would like to think they would be okay with since they got the swipes and it got paid; maybe if the card sees little to no use after it might raise a flag but that's about it. But that's all profile dependent and how when AMEX softpulls your reports they interpret it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

I dont think there is any danger in BTs, as long as other balances are not continously escalating, but that's a whole another problem.

As far as is sky falling, yes it is for some. For many nothing will drastically change, but for others, current situation may hasten the inevitable.

Declaring that sky is falling is a fallacy, because its blaming current economy for financial issues that most likely started long time ago.

At the same time, claiming that nothing out of the ordinary is happening can be filed under denial. If I want to keep all my cards as they are now, wishful "Nothing is different" might help me sleep better, but a lender might have a different opinion.

A little bit extra caution has never hurt anyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@simplynoir wrote:

@Brian_Earl_Spilner wrote:

@wasCB14 wrote:The only arguable BT abuse I've heard of was with Barclays Ring years ago, where people would BT sums in for a 1% cash bonus, and then almost immediately pay it off. A $50 or $100 bonus offset by maybe $1 of interest.

Otherwise, I don't see how it could be abused. Either the issuer allows a BT on a no-fee, 0% intro promo (wouldn't mind getting one of those)...or the issuer earns a BT fee and/or interest.

🤷♂️ It's listed as a reason for losing SUBs with amex. I don't see how you can abuse it other than constantly BTing your balances out. And, I still don't see how it matters as long as they're getting paid

For the AMEX reason for losing SUBs the only real way I can see that being an issue is if the balance is taken out immediately after SUB is attained to another card and it happens a lot. Doing it once I would like to think they would be okay with since they got the swipes and it got paid; maybe if the card sees little to no use after it might raise a flag but that's about it. But that's all profile dependent and how when AMEX softpulls your reports they interpret it

Why would Amex care whether they're being paid by a BT or a checking account transfer, so long as it's legitimate and not MS/stolen/laundered? I can see the risk of AA and closure/CLD if they think someone can't pay the bills...but why clawback the SUB?

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

Meh. As @kilroy8 mentioned, DW and I are still doing the BT shuffle and we've had no AA on any of our accounts related to balance transfers.

Barclay is an odd duck and we all know it. The Macy's closure was unexpected, but the card hadn't been used in years.

Navy, PenFed, Citi, Chase, and Discover have been very good to us.

BofA and I ain't friends...never have been. ![]()

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Brian_Earl_Spilner wrote:Hello.

Just got my new NFCU Platinum, and although I don't need to BT anything, it got me thinking.

Do you guys and gals think there are any negative effects behind the curtains by using them? Like, do most lenders keep track of your BTs and how often. I know amex does. Wouldn't it be risky behavior to always be BTing your balances? I would think that if you do it too often, it would raise flags. In addition, I doubt they like having their 0% BT offers being taken advantage of often. The fact that most lenders have removed those offers in the current economic state shows they don't want to be the ones left holding the bag.

Just some random thoughts.

From my experience, it's not the initial BT transfer that to me has a negative affect. Its the ongoing balance on your card that lenders do not like, even though its a 0% APR. To me, that doesn't seem fair. They offer it, I am taking advantage of it, yet I am being penalized for it.

Potential Future Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@K-in-Boston wrote:After doing them repeatedly for 13 years with Bank of America it has proved disastrous. They raised my credit lines to $99,900. AU had the same thing happen to her.

More recently in the past 4 years, PenFed, NFCU, Discover, US Bank, Comenity, Citi, and Chase all had the same disastrous results. Doing BTs resulted in them increasing credit lines, sometimes automatically.

![]() Good stuff!

Good stuff!

Potential Future Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Brian_Earl_Spilner wrote:It was just a random question. Was thinking of charging some stuff on my amex and BT to NFCU to show some use because I don't have a use for it in the immediate future. That led to me remembering amex taking away SUBs for BT abuse, but nobody has said what that abuse is. That led to me wondering what abuse is and whether or not other lenders track that you're not actually paying your cards, but BTing the balance to another card. Which led to me making the thread.

I have often done this to both satisfy Amex spend as well as usage on other cards, though i only do this if I can get 0% BT's. Or even 1.99% because I generally pay it off well in advance of the promo period. I honestly have too many cards to get constant usage usage on them, so i have to come up with creative ways to use them all .lol

I know some will likely eyeroll at this, but when you have low limit cards you have to more to boost total CL's and to help out UT at times.

I think that as long as there is notable progress on paying those BT's back, rater than letting them stack up. There shouldn't be a problem in using them often.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Wavester64 wrote:

@Brian_Earl_Spilner wrote:

Just some random thoughts.

From my experience, it's not the initial BT transfer that to me has a negative affect. Its the ongoing balance on your card that lenders do not like, even though its a 0% APR. To me, that doesn't seem fair. They offer it, I am taking advantage of it, yet I am being penalized for it.

This was my exact argument with Barclays.

Did absolutely no good, and they have since raised the credit line on the card almost to what the original credit line was.

...it sits in the sock drawer unused until they close it.

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Balance Transfers

@Brian_Earl_Spilner I did the Balance Transfer shuffle with some large five-figure debts for many years until I could pay them off. Sometimes when I rolled balances over, I got individual utilization up to 90% or more. I knew that wasn't good for my credit score but I also knew I needed to do it to be able to stay ahead of the rapidly-accruing interest charges. You do what you have to do. I didn't see any AA from my lenders over that as long as I was paying on time. I got BT offers from Chase, Bank of America, Discover, Capital One, and FNBO, if I'm not mistaken. And like @K-in-Boston posted, I think it may have led to higher credit lines. After it was all paid down, my Chase, BofA, and Discover lines have grown to some of my highest.

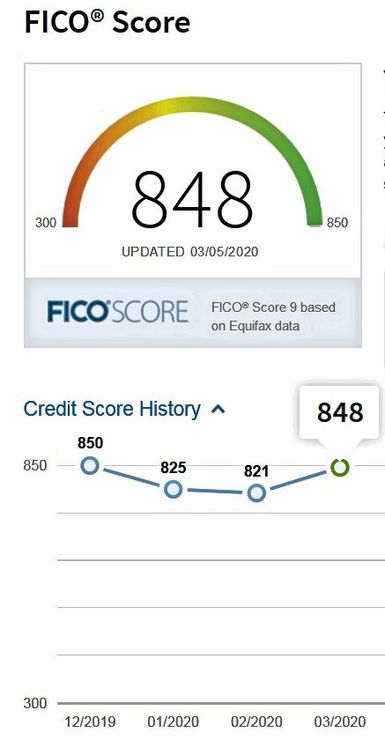

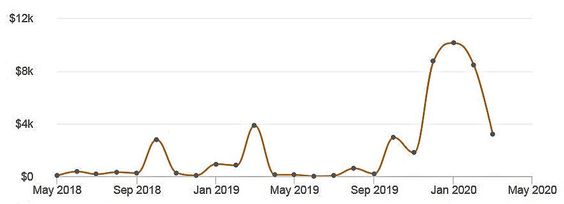

I recently took out a huge 98% utilization BT with Navy FCU that I didn't really need when I opened my Platinum card. I got the card for emergency use due to the low APR and frequent BT offers I had heard about. Since there were no rewards and I wanted to break in the card, I ran it up with BT's from my other cards instead of with new purchases. High balance was $9800 on a $10K line. But it was 0% interest and no BT fees, so it was free money. Then I made large payments over about three months to pay it off and build payment history. Navy rewarded me with an $8K CLI at four months, so it may have helped. No other lenders flinched, my scores dropped substantially but then rebounded right back as I paid it down. I thought it was interesting so I've shared these depictions on a couple of BT threads before. (See graphics below.)

Credit score during and after the BT:

Posted card utilization by month:

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.