- myFICO® Forums

- Types of Credit

- Credit Cards

- Barclay's must think there customers are stupid an...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclay's must think there customers are stupid and desperate acting like pay day lenders.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

@MacCreed wrote:You got it exactly right that they are targeting desperate people. beggars can't be choosers.

No. Just no. Not everyone can be as well off as you are apparently but please dont pass judgement on those of us who have been severely affected by Covid 19, the exonomy and life in general.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

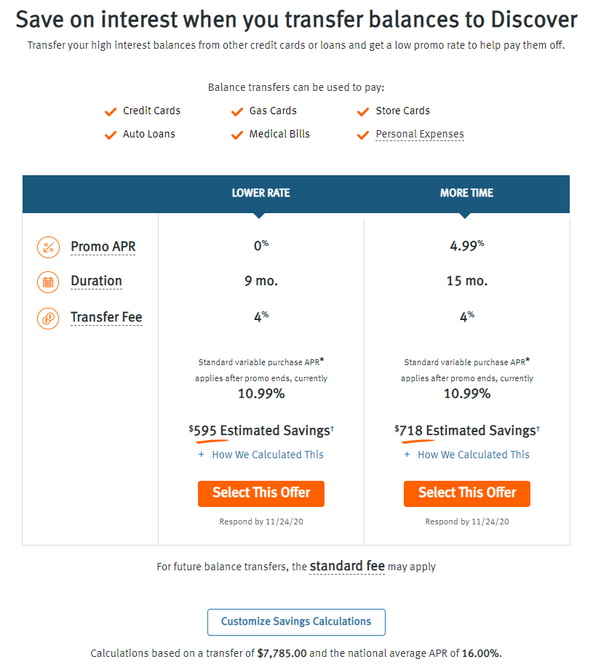

@firefox100 wrote:Ok some you guys sound like you work for the banks, I seen others bash Barclay's for how they do business like starting credit products and year or two later shut them down year or later. No one said anuy thing about that. I think it is better not offer any balance transfers then try to get high intrest rates and put customers in a worse shape. Just for info Discover sent me offer 3 percent for 12 months or no transaction fe with intrest rate of 4.99 percent for 15 months. The 4.99 percent offer is the out standing balance and if you pay it off in couple of months then you pay much less.is 0.4158 percent per month.For example if you took a loan from Discover for 2K you would pay $8.32 for first month and if held the same balance for 9 months you would pay intrest of 75 dollars. You would come out head with Discover because you are only paying intrest on out standing balance.

Theres a difference in bashing for closing an active account or clding while bt is running. To bash over an actual bt offer is not the same.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

@Anonymous wrote:I'm begging to find out what stupid customer is desperate enough to not take the offer.

I get a ton of BT offers of varying lengths. I don't use them but the first thing I check is the fee. I mostly see 4%, sometimes 3%. Barclays seem to be competitive with other lenders during these times. And an added bonus is its direct deposit.

If I got that offer, except at 0%, I would take it (I mean it), even though I don't need or want such an offer, so its actually a very good offer for those who do need it.

this. Lol, whether they close it or cld it after, for many that bt could be huge right now til things get better.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

I"m not quite sure what the fuss specific to BarclayUS is all about here. On the surface the offer in question doesn't appear to be much different than what Discover has been extending and continues to extend.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

First let me say I thank got that I am not hurting and don't need to use my creditcards to meet my daily needs or put food on my table. There are so many others who are hurting at this time from Covid and can't not pay there creditcars or who started using there creditcards to meet there daily need and put food on the table to no fault on them self. In 2008 public bail out the banks and now it is time for the banks to step up and help there customers. I am not saying that investors and stock holders should not get return on there money. You can help your customers and still turn a profit.

The barclay's offer is not good deal at all, Some of you say it is only 4 percent transaction fee, but it is only for nine months and it is up front fee loaded and if you pay it off before the nine months youstill pay the transaction fee and the annual intrest rate could be over 20 percent and if you go over the nine months then intrest rate is much higher. The customer does not win eather way.

The Discover has 2 offers, the first offer is a 3 percent transaction fee for 12 months wich is 3 months longer then the barclay's offer and if you pay the loan off in equal 12 payments then the annual intrest rate equals about 6 percent. The second offer is a 4.99 percent annual intrest rate on the daily balance with no transaction fees and is good for 15 months. If you are going to pay off the loan before 12 months then the 4.99 percent offer is a much better deal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

A 4% front-loaded fee can still be even better than some of the best credit union APRs, such as BECU Visa and NFCU Platinum with APRs in the 6s. It all depends on how long one is planning to carry a balance. Normal BT fees are 3-5%, 4% is very much average. If a person plans to pay off a balance quickly, it usually doesn't make sense to do a BT for that reason. If you have a 17% APR card and plan to pay off a balance over 3-4 months, with the initial grace period depending on how the payments are made it could certainly cost less in interest to leave the balance than to pay a 3-5% fee.

A majority of credit card users carry a balance long term. On average that's been at around 17-18% APR, so for most people balance transfer offers such as this, even if they have a 4% fee for only 9 months, would save most people money.

While your Discover offers match mine, they do vary from person to person. 9 months at 0% with a 5% fee is not uncommon from Discover.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

@firefox100 wrote:

First let me say I thank got that I am not hurting and don't need to use my creditcards to meet my daily needs or put food on my table. There are so many others who are hurting at this time from Covid and can't not pay there creditcars or who started using there creditcards to meet there daily need and put food on the table to no fault on them self. In 2008 public bail out the banks and now it is time for the banks to step up and help there customers. I am not saying that investors and stock holders should not get return on there money. You can help your customers and still turn a profit.

The barclay's offer is not good deal at all, Some of you say it is only 4 percent transaction fee, but it is only for nine months and it is up front fee loaded and if you pay it off before the nine months youstill pay the transaction fee and the annual intrest rate could be over 20 percent and if you go over the nine months then intrest rate is much higher. The customer does not win eather way.

The Discover has 2 offers, the first offer is a 3 percent transaction fee for 12 months wich is 3 months longer then the barclay's offer and if you pay the loan off in equal 12 payments then the annual intrest rate equals about 6 percent. The second offer is a 4.99 percent annual intrest rate on the daily balance with no transaction fees and is good for 15 months. If you are going to pay off the loan before 12 months then the 4.99 percent offer is a much better deal.

If you would have posted 9 months at 6.99% and a 4% transaction fee (or worse), with no option for direct deposit, and comparing those to other issuer offers, I would have kudo'd your post.

The direct deposit option makes it even better than a straight BT offer. Someone may take the offer to buy something (or get work done on their home) where they think they can pay it off in 8 months.

The direct deposit option is an additional perk they are offering that adds risk to the lender.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

eeRe: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

Ok first my Discover offer came with 3 checks which I could deposit into my checking account or make payable to any one. Also I would like to say when some is hurting or desperate they may think clearly or make the best decisions, average person does not understand time value of money and how intrest works.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: eeRe: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

@firefox100 wrote:Ok first my Discover offer came with 3 checks which I could deposit into my checking account or make payable to any one. Also I would like to say when some is hurting or desperate they may think clearly or make the best decisions, average person does not understand time value of money and how intrest works.

Now you're suggesting the average consumer can't also be credit savvy?? Oh brother... 🤐

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: eeRe: Barclay's must think there customers are stupid and desperate acting like pay day lenders.

This thread has run its course