- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Barclays CLD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclays CLD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

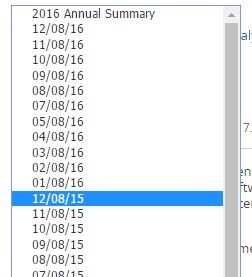

@elim wrote:Just looked at my 16' summary and I see I only run about $200/mo through their card. I'll probably be next.

It's in your "statements"

There are many low-spend Barclaycard accounts that don't get CLDs, so long as they get some spend every few months. Did you use it lightly throughout 2016? Or occasionally early on in the year, and not at all for the last few months?

My barely-used Arrival has an $8k CL and I spent about $400 on it in 2016 (the online PIN has been occasionally useful in travel). Importantly, I haven't gone more than about 90 days between transactions.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

@wasCB14 wrote:

@elim wrote:Just looked at my 16' summary and I see I only run about $200/mo through their card. I'll probably be next.

It's in your "statements"

There are many low-spend Barclaycard accounts that don't get CLDs, so long as they get some spend every few months. Did you use it lightly throughout 2016? Or occasionally early on in the year, and not at all for the last few months?

My barely-used Arrival has an $8k CL and I spent about $400 on it in 2016 (the online PIN has been occasionally useful in travel). Importantly, I haven't gone more than about 90 days between transactions.

That's about right, I grab it every few months and use it for few hundred. I actually just cut a $900 statement and I'm going to leave like $20 on it and pay interest for a day.

@Anonymous utilization will be 10k heavy in like 3 days (taxes/med) so i'll let ya know, lol. 13k total @ 0% won't be paid off for 3 months. I just had surgery and am taking the winter off.

Last year I wrote some 2k checks and deposited in my account for a month and they didn't CLD. strange. but, haven't had an auto CLI in 2 year, lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

No 15' summary, seems rare to have one on an MC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

Wow. They are a super jealous company lol I closed my barclaycard a little while ago and it was my only card with them. Honestly, I would never apply for any of their cards except for the ring. You made a good decision. I would be super upset if they decreased my credit limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

Either way I think it is sh;//y they treat their customers this way, especially ones that never have done anything wrong in the slightest.

Still is making me angry thinking about it. I don't care that I am "losing" a card because it is my choice. I could easily keep it open and maybe in 6 mo get it back. But it is the principle of it.

Guess I'll wait and see what the letter and the message center reply says.

Thx all for the posts. Nice to know this is not very rare and that I did the right thing by closing it. Eff em.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

It will be interesting to see what Barclays does to my Sallie Mae account after the change over March 1.

I almost max'ed all 5 % categories for the whole year in 2016 on Sallie Mae - 2016 spend = $14,335 .

Almost $700 in cash back for 2016. My activity will go to $0 starting March 1, but I'm not closing the

account. I'll let them do it.

I haven't had the slightest negative with Barclays up until the Sallie Mae cancellation. I would have rated

Barclays as the best bank to do credit card business with. If they had a single card with any appeal ro me,

I would continue to do business with them. I don't have any hard feelings over Sallie Mae, but I sure will miss it.

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

850 FICO8 since 2015, Thanks MyFICO - 5+ years since last HP

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

I get so frustrated for these folks who try the best they can to please them only to have to go through this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

I don't have Barclays because I always hear terrible things about them on the forums, also hear terrible things about them from people in real life, and am not especially interested in any of their products. Definitely though, what stands out to me is that most CC companies seem to have both people that love and hate them. You may hear a lot of people annoyed with Chase for instance, but you'll hear a lot of good comments too. With Barclays, all I ever hear is how awful they are. At best I'll hear people say something like, 'they're okay' or 'I haven't personally had a problem' but I never come across 'Ra! Ra! Barclays!' type people like I see with other companies.

So yeah, I wouldn't sweat it if I were you. It probably is the other approvals. From what I hear, Barclays very much wants to be your only/main card...which seems like such an unattainable goal considering their lukewarm products. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

I can't wait till they open today cuz I have been fuming all night and decided that I am not even going to let them reconsider. I'm going to call and close ASAP. It was a $2k limit. My last 3 approvals, US Bank, Chase, and Amex total $10k. Don't need them. Rewards and APR suck. Only thing that makes me sad is I wanted that Apple Card. Not cuz it's a great card but cuz I am an apple junkie. Just wanted it for some reason. Oh well. ...... C'est la vie Barclays.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays CLD

DJ, sorry to hear this. It does suck especially when you are doing all the right things such as paying on time etc. If it was over a year or such of not using card i could jind of understand in that they want you to use it but its just plain ridiculous to do so just because you have other creditors

I know you will hear we are small % of general poulation but when a lot of those small percentage of people are getting cld for ridiculous reasons well obviously somethings up. Be glad this happened in the beginning of your relationship not many years in. Me personally, id tell Barclays to pour themselves into a cup of tea and jump ship