- myFICO® Forums

- Types of Credit

- Credit Cards

- Barclays Uber Visa Refresh

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclays Uber Visa Refresh

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@SEAlifer wrote:Well shoot! This isn't a goal card of mine anymore! Losing the travel rewards and changing from cash back to Uber cash? What the heck even is Uber Cash?! I think they're going to regret this change a lot.

The fact you had to ask what Uber cash is, but Uber card is your goal card...that's the reason why they are changing rewards structure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@Anonymous wrote:this is hell. i spent 9 months building up my credit enough to app for the card and soon as i get it, they nerf it dead. i only got to make 2 purchases on it. they don't have any other good cards to pc over to either.

Sigh, this is very unfair to you. I remember when you were approved for this card. It seems like they should warn applicants if these changes are gonna take place near the time of application. It feels dishonest to me.

On another note, I had a Barclay's Reward card that they sold to another lender without warning. It happened to a lot of us, so I closed that card and transferred it's limit to the Uber, now this. I guess it's permanent SD for me!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Uber Visa Rewards Change...no more "cash" rewards.

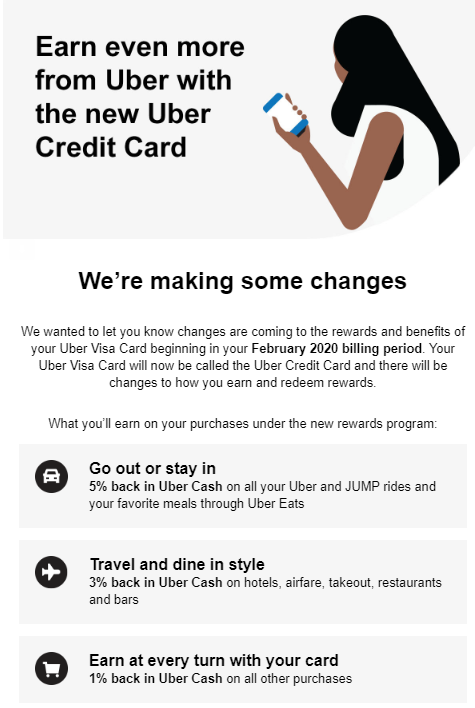

Just received an email from Barclays...they're changing the rewards on the Uber Visa. I've included the text and a screenshot below:

We’re making some changes | ||||||||

We wanted to let you know changes are coming to the rewards and benefits of your Uber Visa Card beginning in your May 2020 billing period. Your Uber Visa Card will now be called the Uber Credit Card and there will be changes to how you earn and redeem rewards. | ||||||||

What you’ll earn on your purchases under the new rewards program: | ||||||||

| ||||||||

| ||||||||

| ||||||||

Here is what’s different: | ||||||||

| ||||||||

+Until your next account anniversary date, you will continue to receive a $50 statement credit for online subscription services after you spend $5,000 or more on your card. After your next account anniversary date, this benefit will no longer be available. | ||||||||

Redemption updates | ||||||||

When you earn rewards with your Uber Credit Card, starting with your billing period in May 2020, they’ll come in the form of Uber Cash. You can redeem for Uber rides, Uber Eats, or rides with JUMP bikes and scooters. Uber Cash never expires. | ||||||||

Up until 24 hours before your product changes, you can continue to redeem your points for gift cards or statement credits as well as Uber Cash. When your product changes, any unredeemed points will be converted to Uber Cash. | ||||||||

Other changes you should know about | ||||||||

A valuable new cardmember benefit, Roadside Dispatch, will be added to your account effective November 1, 2019. This benefit is a pay-per-use roadside assistance program that provides you with added security and convenience wherever your travels take you. | ||||||||

If you have already set up your total monthly wireless bill to be charged to your Uber Credit Card, you may continue using your cell phone protection benefit without interruption. As of November 1, 2019, there will be changes to the insurance provider and to the maximum coverage levels and deductible amounts. | ||||||||

The following Visa benefits will no longer be available after November 1, 2019: Purchase Assurance, Price Protection and Satisfaction Guarantee. You can still submit claims for purchases made prior to November 1, 2019 through the time periods described in your current Guide to Benefits. | ||||||||

View the Guide to Benefits effective 11/1/19, for a full explanation of your updated coverages and details regarding specific time limits, eligibility and documentation requirements. |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Honestly I'm not surprised. They want people who have this card to be actual Uber users, not people maximizing rewards, so it makes sense. Plus, Barclay's is never shy to nerf a card, and they have discontinued many products. Their lineup keeps shrinking and they keep changing things. Who knows, the card may change lenders at some point, but I think the rewards will remain locked to Uber.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Rewards Change!

May sounds better than Feb.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Uber Visa Rewards Change!

Yes, mine is Feb as well. Pity!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Looks like the e-mail blast is going out to current card holders w/ the transition between Feb - May 2020

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

Just thinking about cell phone insurance again as I will probably switch from this card. I saw the recent thread, but just want to check that the consensus is that Citi DC WEMC DOESN'T have it, correct?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

I was thinking about it last night when I had a feeling that sooner or later the Uber card is getting nerfed, I was right. Time to cancel the card by end of the year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclays Uber Visa Refresh

@longtimelurker wrote:Just thinking about cell phone insurance again as I will probably switch from this card.

I'm pretty sure most prime cards offer it.... I posted a link in the thread you're referring to though. If you have a high end phone it's a bit of a moot point as it only covers up to $600 and is a secondary coverage. You HO/renters polciies usually have deductibles that negate the benefit of filing a claim vs just buying a new phone yourself.