- myFICO® Forums

- Types of Credit

- Credit Cards

- Being charged interest on a 0% APR card. TRUIST. ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Being charged interest on a 0% APR card. TRUIST. What are my options?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

@longtimelurker wrote:

@markbeiser wrote:They have my BoA checking account info because it is the accout I use to pay my Truist CC bill with. I don't have checking or savings with Truist.

OK, they charged you a fee when they shouldn't have, they "forgot" or misinterpreted a 0% APR, but this stretches my belief! I doubt if a bank has a program "if you pay from this account (maybe even once) we can start an autopay on it" Are you sure you never possibly authorized this by clicking in the wrong place or something?

There is no autopay or recurring payment scheduled on their web site, nor have I ever clicked anything that would schedule them, and the CS agent I spoke with on the phone couldn't find a reason why it was doing the ACH payments for the statement balance on the 18th of each month.

They have not charged me any fees, that was what they did to the OP, it is just impossible for me to take advantage of the 12 month 0% APR period, because they keep hitting my payment account for the statement balance every month.

From my experience, and reports of others experiences, I'm getting the impression that the merger of the 2 banks that became Truist has resulted in a bit of a clown show.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

To say the least Truist is not all that consumer friendly. I had the Travel Spectrum card from BB&T with an $89 annual fee. Atfer the merger it was converted to a Truist Travel Spectrum card with the same fee. Truist offers a travel card with the same lousy perks but no annual fee. Upon calling all I was told is to cancel my current card and apply for their travel card. Fat chance of that happening. Not a good FI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

@markbeiser wrote:

@longtimelurker wrote:

@markbeiser wrote:They have my BoA checking account info because it is the accout I use to pay my Truist CC bill with. I don't have checking or savings with Truist.

OK, they charged you a fee when they shouldn't have, they "forgot" or misinterpreted a 0% APR, but this stretches my belief! I doubt if a bank has a program "if you pay from this account (maybe even once) we can start an autopay on it" Are you sure you never possibly authorized this by clicking in the wrong place or something?

There is no autopay or recurring payment scheduled on their web site, nor have I ever clicked anything that would schedule them, and the CS agent I spoke with on the phone couldn't find a reason why it was doing the ACH payments for the statement balance on the 18th of each month.

They have not charged me any fees, that was what they did to the OP, it is just impossible for me to take advantage of the 12 month 0% APR period, because they keep hitting my payment account for the statement balance every month.

From my experience, and reports of others experiences, I'm getting the impression that the merger of the 2 banks that became Truist has resulted in a bit of a clown show.

Perhaps try deleting your bank account info and re-adding it?

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

@markbeiser wrote:

@longtimelurker wrote:

@markbeiser wrote:They have my BoA checking account info because it is the accout I use to pay my Truist CC bill with. I don't have checking or savings with Truist.

OK, they charged you a fee when they shouldn't have, they "forgot" or misinterpreted a 0% APR, but this stretches my belief! I doubt if a bank has a program "if you pay from this account (maybe even once) we can start an autopay on it" Are you sure you never possibly authorized this by clicking in the wrong place or something?

There is no autopay or recurring payment scheduled on their web site, nor have I ever clicked anything that would schedule them, and the CS agent I spoke with on the phone couldn't find a reason why it was doing the ACH payments for the statement balance on the 18th of each month.

They have not charged me any fees, that was what they did to the OP, it is just impossible for me to take advantage of the 12 month 0% APR period, because they keep hitting my payment account for the statement balance every month.

From my experience, and reports of others experiences, I'm getting the impression that the merger of the 2 banks that became Truist has resulted in a bit of a clown show.

Sorry, didn't see you weren't the OP. Glad it's not one person getting ALL the pain!

Now, not a lawyer, but I suspect that taking money from an external bank account unauthorized is a very big no no. After all, you might not want to PIF, or use a different account one month etc. So if you don't get pretty quick satisfaction from the review, certainly a complaint to CFPB, or see a lawyer and sue them for Lots of Money (TM)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

@longtimelurker wrote:

@markbeiser wrote:

@longtimelurker wrote:

@markbeiser wrote:They have my BoA checking account info because it is the accout I use to pay my Truist CC bill with. I don't have checking or savings with Truist.

OK, they charged you a fee when they shouldn't have, they "forgot" or misinterpreted a 0% APR, but this stretches my belief! I doubt if a bank has a program "if you pay from this account (maybe even once) we can start an autopay on it" Are you sure you never possibly authorized this by clicking in the wrong place or something?

There is no autopay or recurring payment scheduled on their web site, nor have I ever clicked anything that would schedule them, and the CS agent I spoke with on the phone couldn't find a reason why it was doing the ACH payments for the statement balance on the 18th of each month.

They have not charged me any fees, that was what they did to the OP, it is just impossible for me to take advantage of the 12 month 0% APR period, because they keep hitting my payment account for the statement balance every month.

From my experience, and reports of others experiences, I'm getting the impression that the merger of the 2 banks that became Truist has resulted in a bit of a clown show.Sorry, didn't see you weren't the OP. Glad it's not one person getting ALL the pain!

Now, not a lawyer, but I suspect that taking money from an external bank account unauthorized is a very big no no. After all, you might not want to PIF, or use a different account one month etc. So if you don't get pretty quick satisfaction from the review, certainly a complaint to CFPB, or see a lawyer and sue them for Lots of Money (TM)

They did offer to refund the payment when I called them about it last month, and turned it over to be investigated, but have not heard back.

Today is the 18th, so I'll see what happens.

The destiny of both of my Truist cards is the sock drawer, so I'm not overly concerned about them fixing anything.

At least the screwup isn't with the "Future" card I'm using the intro 0% APR balance trasfer on.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

I see two different disclosures for the Enjoy Cash card on their website depending on where you click. One says 0%, and the other doesn't.

If you signed up and it said 0% on the documents that they sent with your card, then I would think that they have to honor that, but I'm not a lawyer. ![]() The rep trying to explain how 12 months of 0% meant anything other than what everyone here knows that means was probably just trying to come up with something to get you off the phone.

The rep trying to explain how 12 months of 0% meant anything other than what everyone here knows that means was probably just trying to come up with something to get you off the phone.

Someone accidentally classifying the card as their annual fee card does sound like the most logical explanation, and hopefully they just switch it without a fuss and remove the interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

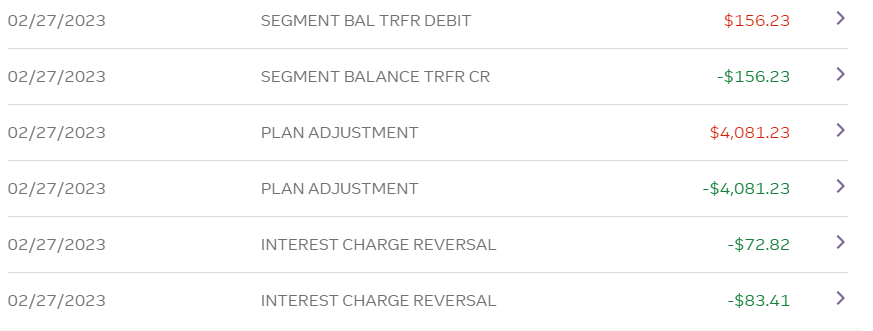

Okay I have some updates. Since making this post, I went on vacation and was looking closely at my truist account to see if there was any update. To my dissapointment. I was once again charged interest. I called while being outisde the country and they agreed with me (which means the first lady had no idea what she was talking about) and said they would escalate again. Waited another week, and to no avail. Super frustrated I made a claim with the CFPB, and then I called again. This time I let my frustrations be known, and told them to contact supervisor and find out was going on. Spent about an hour on the phone with another lady who made sure to forward the message to all the people that can help with these issue. Waited a couple days, and today I logged on to see that they FINALLY refunded all fees. They did a lot of stuff. I see a lot of transactions they made (I'll post a picture) but at least the issue is resolved for now. I will pay the amount slowly, and once its pais, I'm not using the card ever again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

Thanks for the update.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

Truist didn't hit me for the statement balance on the 18th, so I guess they solved whatever the issue was for me too.

The card is saved from the sock drawer, for now...

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Being charged interest on a 0% APR card. TRUIST. What are my options?

Truist (formerly BB&T in my case) is a stupid bank. I got a cashier's check from them one day to close a savings account. I went to deposit it in Bank of America. BOA said they would have to place a hold on the available funds because nowhere on the check did it say cashier's check. I hadn't even noticed it. Turned out ok, but how can the check not say "cashier's? Never heard of that crap before.