- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Best Credit Card for your Experience (no trave...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Credit Card for your Experience (no travel) annnnnnnd GO!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

Citi costco visa. I shop heavily at costco, plus 4% back on gas. I know you said no travel, but it does give 3% back on travel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

@longtimelurker wrote:

@redpat wrote:Give me travel cards or give me death......Live a little and see the country and world!!

Scary! So you apply for a travel card and get:

Dear redpat, after much consideration we cannot approve your application for our card, and so we have decided to give you death. Thank you for your understanding.

Hope you can recon!

Lol! LT, I survived......Got-’em!

Like any good attorney would say “Before you ask a question, you better know the answer/reply.” Same goes for applying for credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

LOLOLOLOL all ya'll are funny XD. I love reading these and some of these cards I haven't heard of before so they are helping a lot. ![]() Some points are being made also I haven't considered too so this is why I love hearing personal opinions.

Some points are being made also I haven't considered too so this is why I love hearing personal opinions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

Since travel cards are not allowed, I'm gonna have to go with BCP because grocery is my biggest spend. Second would be the Gold because of dining, but general spend goes to CFU. I do have to mention my CU Card as well, as somone else commented that you can take up to your full CL for cash advance w/o the associated fees. Just standard rate, wich is lowest of all my cards. It has helped several times when I've needed to cover expenses between paychecks. I also have to nominate Discover for being a great card the frist year, and then being available for BTs afterward. Especially for being my highest CL, and for all the other reasons already mentioned above. The only hitch with their rotating categories, is that I'm usually on a BT offer. lol But before I got all these new cards with perks, Discover did get most of my spend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

@Anonymous wrote:

@Anonymous wrote:

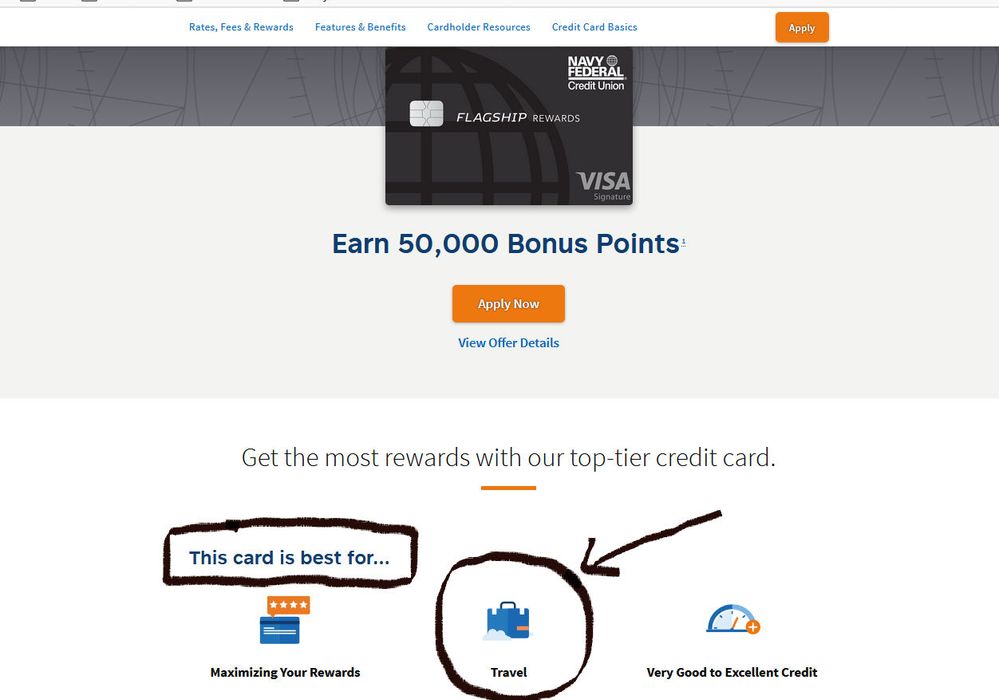

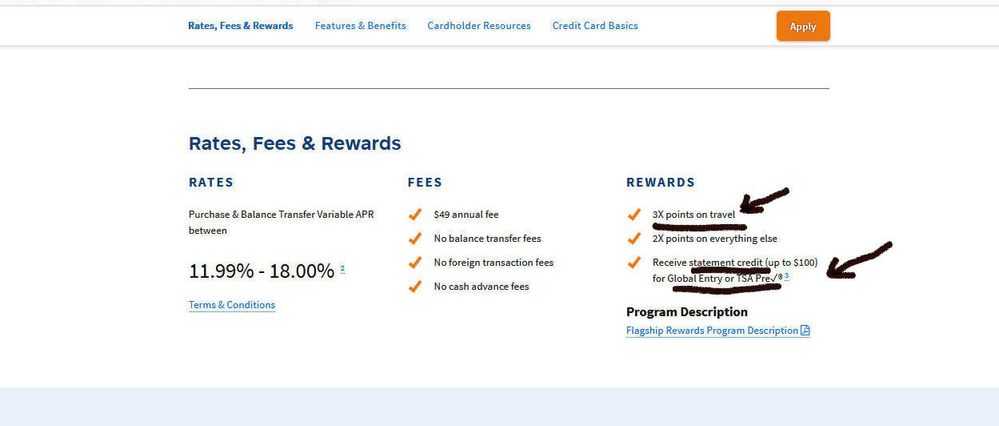

Since you said no travel cards I would have to say NFCU Flagship. $500 cash sign up bonus. At least 2 percent on everything and tons of benefits.That's a travel card. The only thing that makes it worth the AF is the possibility to make it back through 3% on travel and credit for global entry. There are plenty of cards with no AF and no $50 minimum cash back redemption that earn 2%.

Nope. It is a cash back card. There is no fee the first year. Keep the card a year and cancel or downgrade to another card. No other 2 percent card comes with a $500 sign up bonus. Even if you kept the card 5 years you would come out a head of any 2 percent back card as none of them come with even a $250 sign up bonus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

@Anonymous wrote:

@Aim_High wrote:

@Anonymous wrote:

Since you said no travel cards I would have to say NFCU Flagship. $500 cash sign up bonus. At least 2 percent on everything and tons of benefits.That's a travel card. The only thing that makes it worth the AF is the possibility to make it back through 3% on travel and credit for global entry. There are plenty of cards with no AF and no $50 minimum cash back redemption that earn 2%.

Yes, it's a travel card. But that seems a little harsh and hasty a review of the Flagship card. Pardon my off-topic diversion. I don't have it but have considered it. I think it can be a great card depending on what else is in someone's wallet. For someone who can get qualify for membership in NFCU, who doesn't want a high-priced travel card but wants to save rewards for travel, who doesn't yet have a 3%+ travel card and/or a 2%+ all-purpose card, it's certainly a worthy contender.

First off, it has a 50K point ($500 SUB) that effectively pays the annual fee for more than 10 years if you keep it! (Regardless of all other benefits you get from the card.)

Yes, it has $49 AF but for someone who uses that Global Entry credit you mentioned, the effective AF is actually $24 ($100 credit every 4 years = $49-25.)

For that $24, you get a lot of other Visa Signature "value" items you neglected to mention that are sometimes not available in sub-$50 AF cards including basic travel protections like secondary rental car CDW, Accidental Death & Dismemberment travel insurance ($250K), Lost Luggage Reimbursement, plus also Purchase protection, Extended Warranty coverage, Cell phone protection, Visa Signature Concierge, Roadside Assistance Dispatch, and Emergency Travel Assistance hotline. For someone who can use those things, it easily pays the other $24 in AF for being able to decline CDW, cancel cell phone insurance plans, or file claims for purchase protection or extended warranty coverage. Some other no-AF Visa Signature cards may have some of those benefits but there are probably few that have all.

Also, no FTF's, no BT fees, and even no Cash Advance fees! That can really add up if you ever do BT's alone.

And what other rewards cards have APRs as low as 11.99%? That is exceptional for a card that also pays 2-3%. (PenFed Power Cash is 11.74% and no FTF ... but they also have 3% BT and 5% Cash Advance fees.)

There are only a handful of cards that give 3% or more back on travel in CASH at a penny-a-point with either no-AF or that low an AF. My Citi Costco does, but Costco membership is required. WF Propel and Barclays UBER do, but they don't offer a base of 2% on anything, so it's more cards to carry with less-favorable terms. That appears to me to be one of the strong suits of this card: the ability to consolidate in one place all the cash back awards for future travel usage. Someone can combine their 2% and 3% cashback categories and allow it accumulate for major travel purchases like vacations, hotel stays, airfare, rental cars.

NFCU also advertises "Member Deals" for shopping redemptions that can amplify reward points value. The website shows an example of up to 5% bonus on top of the 2% base earning, so points could be worth effectively 7% for shopping with the Flagship, if you chose to redeem them that way. I believe the CITI DC is the only card that allows something similar, since they just began allowing conversion of DC to TY points.

Navy FCU is known for generous approvals, generous SLs, generous CLIs, and good customer service. All this really counts. From what I've read, I've rather deal with NFCU for customer service issues more than any of the well-known national 2% card products, including Synchrony (PayPal), Citi (DC), Elan Financial Service (Fidelity), Alliant CU (Visa Signature), or even PenFed (Power Cash), which is also on my radar. I've read some pretty negative reviews on all of those from some customers.

Yeah, the $50 minimum redemption is high, and that turns me off in some ways. But as I said, I think it's intended to be a program where rewards are allowed to accumulate for major travel redemption. If you don't spend enough to accumulate rewards quickly enough or travel often enough, it's not such a good card for you. Also, depending on what else is in your wallet, the overlaps may make the AF an unnecessary expense. But for the right consumer, it's a highly competitive product to those $89 and higher-AF travel cards.

It's still a card that works best with travel. I don't refute all of the benefits the card has but if you don't travel, it's not anywhere near as good as a flat 2% with no AF. The SUB is great and does indeed cover the AF for a long time but that doesn't change the fact that you're still going to get hit with that $49 every year you have the card, long after the SUB is spent.

If you want Siggy benefits, get a cashRewards VISA. If you get a $5K+ SL, it's automatically a VS and if you don't get a $5K SL but get there with CLIs, a quick call will see it upgraded. Sure, it's 1.5% instead of 2X points but no minimum redemption and no AF and the APR can go even lower than the Flagship at 11.65%.

If you don't take advantage of 3X categories or the Global Entry credit, it's $9800 of spend to break even on the Flagship AF vs the cashRewards.

It is not a travel card. I am not sure why you keep repeating the same thing over and over again. It has travel benefits but isn't a travel card. It is a straight up cash back card. And you are wrong with your math. The Cash Rewards doesn't have a $500 sign up bonus. There is no way that the Cash Rewards could be as good as the Flagship if you meet the sign up bonus.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Credit Card for your Experience (no travel) annnnnnnd GO!

@Anonymous wrote:

@Anonymous wrote:

@Aim_High wrote:

@Anonymous wrote:

Since you said no travel cards I would have to say NFCU Flagship. $500 cash sign up bonus. At least 2 percent on everything and tons of benefits.

That's a travel card....Yes, it's a travel card. But that seems a little harsh and hasty a review of the Flagship card ...

It is not a travel card. I am not sure why you keep repeating the same thing over and over again. It has travel benefits but isn't a travel card. It is a straight up cash back card. And you are wrong with your math. The Cash Rewards doesn't have a $500 sign up bonus. There is no way that the Cash Rewards could be as good as the Flagship if you meet the sign up bonus.

First, I'm not sure why you are criticizing my post because I defended your original posting and the NFCU Flagship card. ![]()

@Saeren and I weren't saying the same thing over and over again; we were discussing the Flagship and Cash Rewards cards.

Nobody said the Cash Rewards had a $500 SUB. I said the Flagship had a $500 SUB. (Reread my posting.)

So, what exactly is a "travel card"??? Travel cards come in many shapes and forms. Travel-oriented cards don't have to pay in points or miles. Sometimes they do pay in cash. For that matter, I can "cash" points in from almost ANY card, from AMEX Platinum to Chase Sapphire Reserve to CITI Prestige, and use the cash for anything I want, but does that make those cards not "travel cards" if I don't spend it for travel?? Of course not. They are still premium cards at premium fees clearly aimed at the premium travel market. And their best use and primary purpose is for travel redemption.

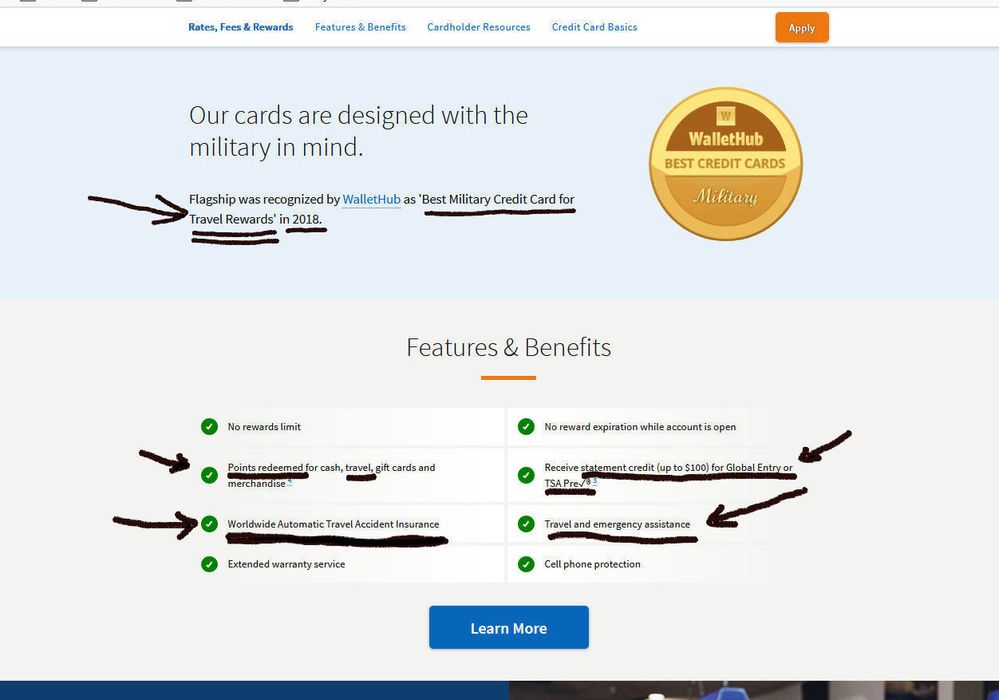

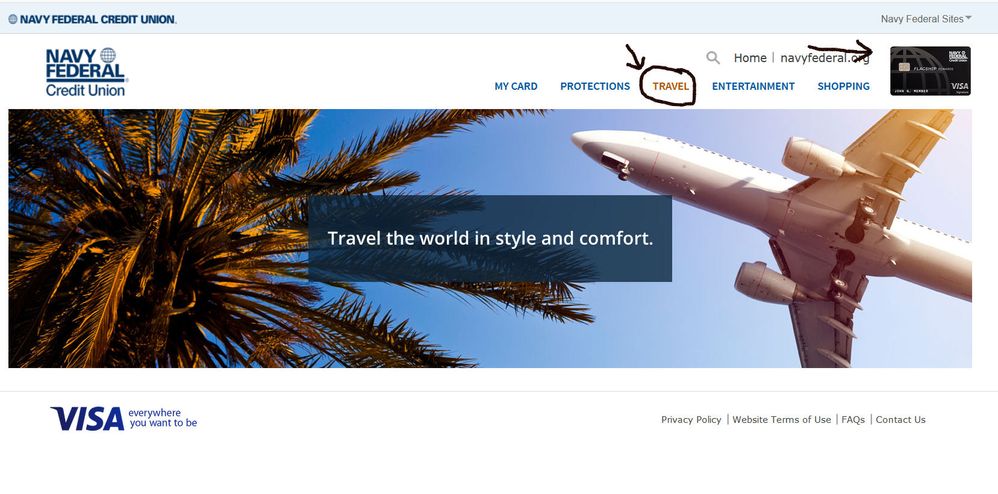

Travel cards don't have to have only certain travel benefits but not others. Cards can be "travel cards" but also good for other purposes. Particularly at the lower end of the travel card spectrum, cards do tend to be more flexible to be used for travel or cash. Cards like the Wells Fargo "Propel" card, the Capital One Venture/Venture One, the Bank of America Travel Rewards card, the Discover IT MILES card, the Chase Sapphire Preferred, and BB&T Spectrum Travel Rewards card are all clearly aimed at the lower end of the travel card market even though they can be used for cash redemption also. They typically either have no fees or charge $99 or less for some lesser travel benefits than the high-fee premium travel cards. So yes, the NFCU Flagship card is absolutely certainly marketed for people who are interested in travel. Otherwise, it wouldn't be so clearly spelled out on their advertising and website. No simple cash-back card gives you reimbursement for TSA Global Entry. That's a sure giveaway. You won't see that on a Citi DC, PayPal MC, Fidelity Visa, or PenFed PowerCash. (See below).

Sure, you can use the Flagship cash for other things. But that doesn't change the marketing segment the card is aimed for.

Cards that aren't competing in the travel market don't:

* offer a premium 3% cash back on travel spending

* reimburse for TSA Global Entry

* promote point redemption for airline travel, hotels,

rental cars, vacation packages, cruises, tours, and attractions

(See Full Program Description)

* say they are "best for travel" in advertising

* promote their travel accident insurance

* promote their travel and emergency assistance hotline

Moreover, cards that aren't designed for travel rewards are not nominated by

Wallet Hub as "Best Military Credit Card for TRAVEL Rewards"

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.