- myFICO® Forums

- Types of Credit

- Credit Cards

- Best bank for adding kids as AU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best bank for adding kids as AU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

I know Cap1 backdates to the original start opening date.

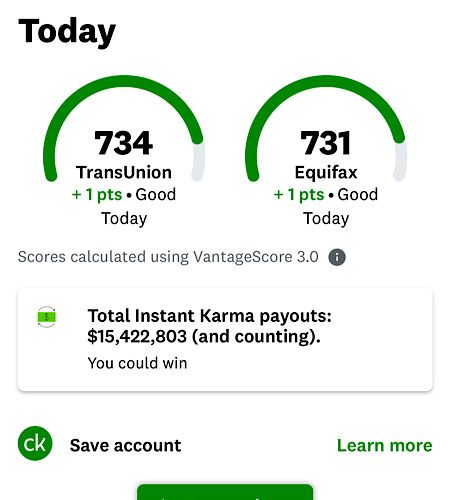

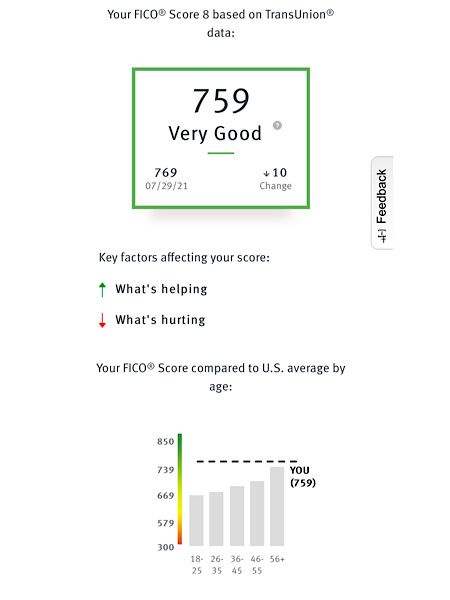

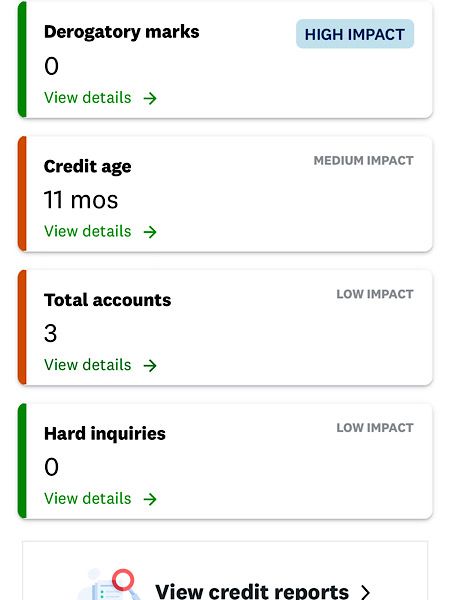

I added my 18 y/o stepson a year ago. I had the Cap1 card open for 10 years. When he checked his credit score a month ago on his 18th bday he had a 755 across the board and 10 years of history. He apped for the Navy Fed AmEx and got a $7k starting limit and $1k on an Apple card. He's working on Chase and AmEx next year.

My 11 y/o daughter is also an AU so she'll have 20 years of history on her 18th.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

I do have to say despite AMEX not letting AUs inherit the credit history of the primary they're probably the best bank for adding children and controlling their cards like assigning limits as low as $200-300 with ability to increase it via website and have it reflect shortly. They also give primary power to lock the card. And since it's a different card number from the primary as well there's no need to replace all cards on the account if it is ever lost or stolen

Just a shame they don't give account history to AUs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

@Anonymous wrote:

@Wavester64 wrote:

@Anonymous wrote:All,

I am going to add my child as a AU to one of my cards so they can start building a credit history. The question is which card should I add them to. Options are:

Chase

Amex

Citi

cap one

Discover

I am going to hold onto the card and only give them access when they want to go to 7-11 or walmart ect. so there is no outragous spend. Which bank do you think I should use?? I was thinking chase but at this point I cant decide. Thoughts....

I know this doesn't answer your question, but I get advertisements all the time from CHASE for Children for, I believe it's called CHASE "First Banking" where they get their own debit card that you can monitor. Something you might want to consider.

Intresting.... I looked into it and apprently you have to have a checking account with Chase already to start one of these accounts. Currently I only have a Chase CC but its something I am to keep in the back of my head down the road as I have several chase branches in the area. Thanks for the tip.

On this topic, you may want to check out "Money" from Capital One. That's what I use for my DD. The advantage it has over Chase First is both Apple Pay, and mobile check deposits. When Chase First came out, I was going to switch her over due to Chase being my primary FI, but after researching a bit more I found it was lacking where Cap1 had the edge. Once she turns 13, she will qualify for their student checking which seems to be pretty much an unrestricted checking account as an adult would have, it just requires a co-signer. Sorry to veer off of the AU topic, just wanted to throw my experience with that out there.

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

To add for anyone reading this: I just talked to Navy Federal CU and was told by the credit card department that they have no minimum age for adding an AU to a credit card. Which is kinda amazing considering they won't let a minor have a checking account until age 14, lol. I wanted to check because I couldn't find a straight answer on the web (mostly saw age 10 up to 16).

BK 7 DC 7/9/19

FICO 8 on 01/31/2023 ~~ EQ: 693, TU: 677, EX: 678

NFCU CLOC $1,000

Apple Card 4,500

Williams Sonoma $1,250

NFCU CashRewards $2,500

NFCU Flagship $12,100

Navy Federal Platinum $25,000

PenFed Pathfinder $12,500

Kemba CU Platinum $3,500

Amazon Store Card (Synchrony) $1500

Paypal Credit $850

Capital One QS $2,000

Capital One Spark $2,000

Overstock Store Card $2,150

AAoA: EQ - 7y9mo, TU - 7y8mo, EX - 5yr7mo (as of 01/31/2023); INQ are 2 EQ, 6 TU, and 5 EX.

New Auto Loan with NFCU (May 2022): 32k for 3.49%/60 months

My DPs: as of January 2023, I am full-time employed, 55k/year, 2 federal consolidated loans plus 3 new student loans, had perfect payment history with 0 derogs until 90 day lates prior to filing BK in March 2019.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

@simplynoir wrote:I do have to say despite AMEX not letting AUs inherit the credit history of the primary they're probably the best bank for adding children and controlling their cards like assigning limits as low as $200-300 with ability to increase it via website and have it reflect shortly. They also give primary power to lock the card. And since it's a different card number from the primary as well there's no need to replace all cards on the account if it is ever lost or stolen

Just a shame they don't give account history to AUs

I have to admit, I have never read this before.

So say I were to have an AU for my Amex BCP: Other than the indivdual being able to use my card that I am responsible for, they gain no other benefit? I am assuming then if such is the case, Amex would not have a need to ask for the AU's SS #?

Does this also apply to Amex Business Cards as well? (in this case it wouldn't be AU, it would be employees).

Potential Future Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

@Wavester64 wrote:

@simplynoir wrote:I do have to say despite AMEX not letting AUs inherit the credit history of the primary they're probably the best bank for adding children and controlling their cards like assigning limits as low as $200-300 with ability to increase it via website and have it reflect shortly. They also give primary power to lock the card. And since it's a different card number from the primary as well there's no need to replace all cards on the account if it is ever lost or stolen

Just a shame they don't give account history to AUs

I have to admit, I have never read this before.

So say I were to have an AU for my Amex BCP: Other than the indivdual being able to use my card that I am responsible for, they gain no other benefit? I am assuming then if such is the case, Amex would not have a need to ask for the AU's SS #? @Wavester64 The SS# is primarily used to verify identity in addition to cross-checking internal databases + accurate reporting of the individual's CRA information. The backdate reporting "benefit" ceased around this time in 2015.

Does this also apply to Amex Business Cards as well? (in this case it wouldn't be AU, it would be employees). Correct. No backdate reporting on D&B and/or SBFE.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

I think Discover and if there's ever an issue, the customer service is great; at least that's my experience.

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

I added my 13 year old aughter to all my CC's, Chase, Barclay, Amex, Citi, and Cap 1. On her 18th B-day she applied for an unsecured Barclay card and was approved for an 8000 CC limit. Her credit score was 813, she just recently applied for an Amex card at 19 and was approved with a 6000 CC limit, her score was 800. So start building their credit early by adding them as AU's to all your cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

will add my kids once they're 1 day old

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best bank for adding kids as AU

As others have said, AMEX starts history as soon they turn 18, but Cap 1 back dates to when they were added as an AU. Since, I could control the limit on the AMEX, we let DD carry the AMEX with a low limit, and we SD'd her Cap 1 QS card.

That said, her being added on our cards almost 2 years ago, along with her Disco It card (that she got approved for 3 days after she turned 18) has given her an excellent score for a 18 year, a 3 month old! I've now done the same thing for my son.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards: