- myFICO® Forums

- Types of Credit

- Credit Cards

- Best for cash back?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best for cash back?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best for cash back?

So far, I have

Cap1 Quicksilver one 1.5% cash back for all

amex blue cash everyday 3% supermarkets, 2% gas, 1.0 cash for all

store cards I don't care about

(update)

had an app spree, Now for gardening as you guys call it...

Amex simply cash plus business 5% cell phone , 3% for...gas? I get to choose my second category and it's 50k each/combined not too bad

Amex blue cash everyday 3% supermarkets (instacart), 2% gas

Marvel 3% dining, entertainment, movies, online streaming...pretty much everything

Cap1 Quicksilver one 1.5% cash back whatever else

macys, home depot, store cards I don't care about but have no AF and decrease my utilization

I think this is a pretty decent lineup... I think I can use every single card every month without TRYING to do anything. I am pretty sure I can link amex to speedpass and autopay for cell phone, link all of them to samsungpay (just in case) and carry marvel and QS1 for day to day things.

(update)

My goal is to get the maximum rewards (cash in, cash out) and maximum perks (cell phone protections, warranty extension, etc) per dollar spent in every major category I spend with the least amount of cards, while having no AF. I hope to convert the QS1 to a QS with no AF.

The majority of my yearly spend (in order) is on restaurants, cell phone (business), bar/club (not so much, but it's there), gas, and travel. However, when I travel, I don't normally spend all my money on the hotel and airfare. I like getting out and seeing the sights, see local culture (more restaurants, bars and clubs, tours, etc) So, I don't think "travel" is really the big ticket item, it's stuff to do.

After somewhat extensive research (my GF is annoyed how much time I spend reading the forums)...I've tried to find a good place to figure out the conversion from points to dollars, but in general, I think cash back cards seem to do best for me. I'm open to points if they really work though.

I have my eyes on cap1 Spark business, amex simplycash plus business (actual business), and Sams club credit.

Keeping my credit worthiness to the side, as I'm talking about goals rather than immediate results, is this a good "lineup" for my spending? Anything I should add or replace? I've heard good things about the chase cards. the business card offers protection on your cell phone, which is a plus..but also sounded like the neudered it a bit much to be useful...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

It's hard to give you a concrete answer without spend category percentages and other fun math details. A couple thoughts though. One is that an AF should not be an automatic deal breaker. The catch is to do the "break even" math to see how much you have to spend to overcome the AF versus a comparable non-AF product. Another thought is that (although there are exceptions) travel rewards are often more generous than flat out cash back rewards.

- If dining is a high spend category for you and an AF is a deal breaker, Capital One Premier Dining Rewards will give you 3% cash on dining and 2% on groceries with no AF.

- Citi Double Cash will give you 2% on everything and should be on your short list based on what you're saying, also no AF. Same with Fidelity.

- Alliant does 3% cash back in the first year, 2.5% thereafter, but it has a $59 AF. You'll need to spend $11,800 or more per year to make the AF worthwhile versus a 2% no AF card.

You have to do a lot of math to see if points are good for you. A lot is going to come down to the % of your spend on travel every year. Travel stuff can code more widely than you think too. Uber and taxi rides, some hotel restaurants, etc. I once took a helicopter tour of the Grand Canyon that actually coded as "other travel" on my Venture.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

Discover It

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

If you are eligible for USAA you can get 2.5 percent back if you open a checking account with direct deposit.

Truthfully if you want to maximize your money back just sign up for a new card every month or so get the sign up bonus and move on to the next one. That is what I have been doing. The percent back is very minor amount of money compared to sign up bonuses.

For example Barclay Arrival Plus gives you 500 dollars to reimburse any type of travel. Hotel Room, Airplane, Car rental, bus, whatever they will reimburse you. But you have to spend 3k to get it with 2 times points that gives you 560 dollars right there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

@Anonymous wrote:Truthfully if you want to maximize your money back just sign up for a new card every month or so get the sign up bonus and move on to the next one. That is what I have been doing. The percent back is very minor amount of money compared to sign up bonuses.

Sure, if you want to rip your AAoAs to shreds and cost yourself as much as 125 points of FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

@Skymogul wrote:

@Anonymous wrote:Truthfully if you want to maximize your money back just sign up for a new card every month or so get the sign up bonus and move on to the next one. That is what I have been doing. The percent back is very minor amount of money compared to sign up bonuses.

Sure, if you want to rip your AAoAs to shreds and cost yourself as much as 125 points of FICO.

My score keeps going up so this isn't true. And I alternate between my wife and me. She has gotten 3 new cards this year and a new car and her score weent from 808 to 804.

I have gotten 15 cards this year and my scores were 527, 527, 529 in January. Now they are 708, 710, and 659. So it seems like it has really hurt me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

@Skymogul wrote:

@Anonymous wrote:Truthfully if you want to maximize your money back just sign up for a new card every month or so get the sign up bonus and move on to the next one. That is what I have been doing. The percent back is very minor amount of money compared to sign up bonuses.

Sure, if you want to rip your AAoAs to shreds and cost yourself as much as 125 points of FICO.

That's a bit exteme. FICO will not go down that much. I did this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

@Anonymous wrote:I have gotten 15 cards this year and my scores were 527, 527, 529 in January. Now they are 708, 710, and 659. So it seems like it has really hurt me.

If you look at a componetized score like myFICO offers, you would see that a significant chunk of that last 140-191 points of version 8 is inquiries and AAoA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best for cash back?

@Skymogul wrote:

@Anonymous wrote:I have gotten 15 cards this year and my scores were 527, 527, 529 in January. Now they are 708, 710, and 659. So it seems like it has really hurt me.

If you look at a componetized score like myFICO offers, you would see that a significant chunk of that last 140 points of version 8 is inquiries and AAoA.

I am quite aware of my Fico 8 score. I am sure if you have had one credit card as your only account and it is 18 months old and you go out and get 20 cards in one month it might do what you are saying. But if you get a new card every two months you probably would be fine even in that case. If you got 6 new cards a year that is only 6 inquiries in 12 months that would never hurt your score to any extant. And there are plenty of ways to get cards without inquiries. The most inquiries I have on a report are 8 and 4 of those are NFCU.

The only caveat I would say is get your Chase Saphire Preffered and Chase Southwest first because of the 5/24 rule.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

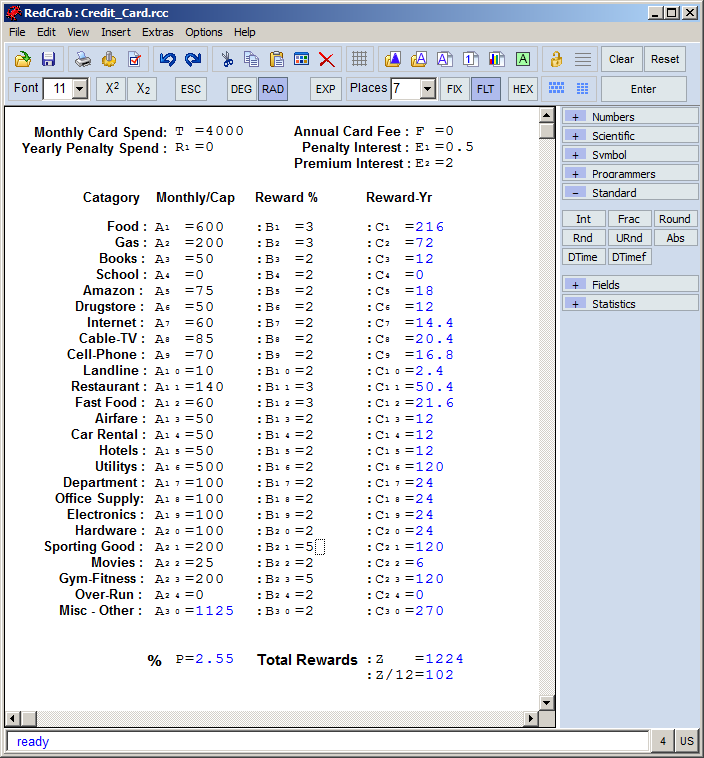

Re: Best for cash back?

There are a lot of good cashback cards, What will work best for you

depend on where and how much you spend, and how many cards you want

to manage. Your credit profile determines which cards you can reasonably expect

to get. I always recommend that someone enter real spend history for

between 12 and 18 months and put the numbers into a spreadsheet or

programmable calculator. This is a little work but will let you know where your

spend is and which card or cards will be the best. NO one here can know what

is best for you and with out real numbers in each cashback category you will

also only be guessing instead of knowing.

Here is an "example only" of spend in cashback category's and cashback for 3 cards.

The spend numbers should be averages for a minimum of 12 months not you last months

spend . You can change the cash back rewards for different cards and see real numbers

for long term rewards.

Citi Double cash + Bank West Cash Back + US-Bank Cash Back