- myFICO® Forums

- Types of Credit

- Credit Cards

- Best rewards card for the credit-averse

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best rewards card for the credit-averse

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best rewards card for the credit-averse

And the more I think it through, I can just keep a card saved on the Amazon account, so basically this question has turned into "what's the best grocery card?" which I'm sure has been answered a million times.

I just want her to have only one card to carry and use since I think she'll be willing to go along with that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best rewards card for the credit-averse

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best rewards card for the credit-averse

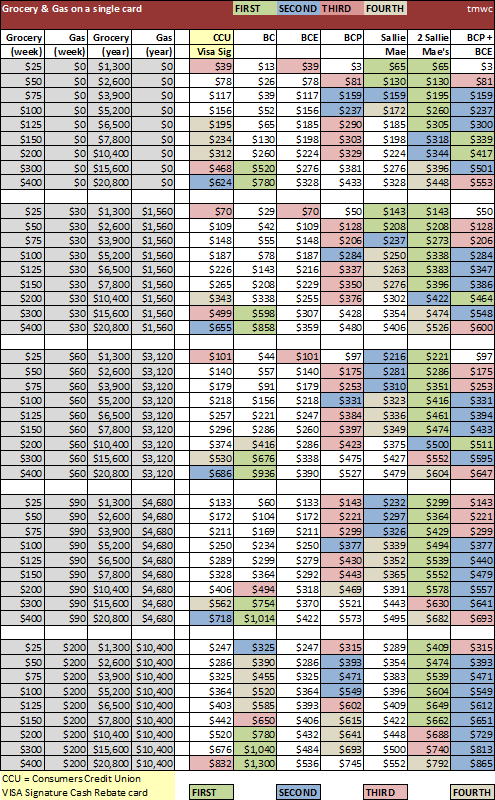

I don't agree with the above chart. If you have $300 in groceries per month, you have $250*0.05% + $50*.01% = $13 in rewards per month, which equates to $156 per year. For the Amex card, you get 6% back on the entire $300 per month, which gives $216 per year. However, you also have a $75 annual fee, which means that you're left with $141 per year. The catch is that you have a lot of variance in your spending, and the results change dramatically depending on how much you spend. If you're close to $300 most months, the math will hold up. If you're oscillating between $500 and $250, we may need to recompute.

Overall, Sallie Mae is probably the better option for your wife. As a perk, you get a 5% gas card and 5% off on Amazon.