- myFICO® Forums

- Types of Credit

- Credit Cards

- Best way to pay down my Cap 1 credit card; possibl...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best way to pay down my Cap 1 credit card; possible balance transfer option?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best way to pay down my Cap 1 credit card; possible balance transfer option?

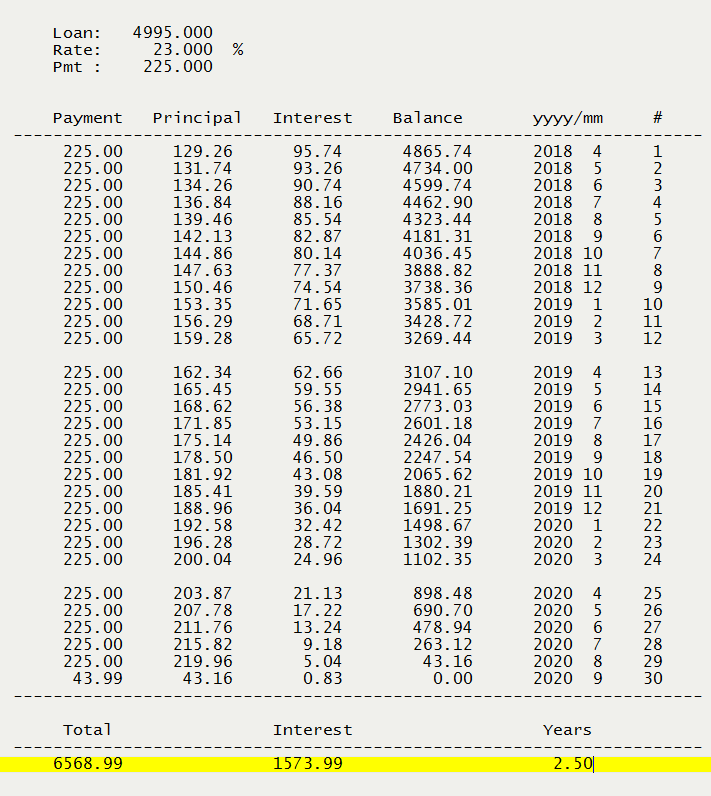

I have a Cap 1 credit card in great standing but it's currently sitting at $4995 balance on a $6800 limit. I've always paid at least the minimum on it and for the past 6 months or so have been paying even more in hopes of slowly cutting it down. I have one other Cap 1 card with a way lower limit (just using it for the avail credit) but both have high APR's (around 23% I believe).

I haven't been using said card now for any purchases either. I asked back in January for a limit increase and was denied due to overall credit picture, also I think I'm at the top of their limit anyways (anyone know)?

I've recently gotten some preapproved offers from CITI for a balance transfer card and I'm tempted to try it out, tho I doubt I'd get approved for the full amount. I'd even take any type of offer they'd give me.

Current scores are all hovering around the 640 range, so not great but not horrid either.

What would be my best moves?

Also, I was even thinking about trying to get a couple lines of credit from my credit union and bank if that might help at least lower the APR.

I don't have a TON of extra $$$ to throw monthly at this bad boy but I currently the payment is around $150 and i've done from $50 to $150 extra every month, depending on what i can afford.

Any and all advice welcomed!!! What way(s) would help increase my scores the quickest?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

First recommendation is to set up a budget so no new debt is created. You might try YNAB.

Your utilization is high and at that interest rate it will be difficult to pay off. It may be worth getting another card to do a balance transfer to save on interest.

You are paying around $95 a month just in interest on the $5,000 you owe. If you had a zero % option for a year you would save around $1,100 in interest.

If the credit union/bank would lend you money as a personal loan this would be another possibility. Provided the interest rate is lower it would save you money. That plus the fact that FICO treats a personal loan more favorably than credit card debt that is over 50% utilized.

Good luck and let us know how things go.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

1) Don't worry about scores at this time focus on the best way to pay card off.

2) If you get a zero interest now, you will save 1,570 dollars and be able to pay it off in 2 years. I would try for $1,500. If a no-go this time the hard pull will fall off by the time you get to under 50% when you could try again. With your high utilization it might be difficult to get a zero interest card now, however if you can put 225 per/month in payments, in 1 year you will be under 50% utilization.

3) Another good option would be a loan with better terms from your CU. Be careful and don't put new spend on the card if you take a loan to pay it off.

4) At the rate you are paying it will cost you a little money (1500), and take some time (2.5yr), but you will be OK.

5) Every month as you pay, they lower the minimum due, "Do not lower you payments". Keep paying the 200-250 it will save you a lot of money and time.

** Good Luck, remember you are not alone many on this board have been where you are ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

I hate to say this but IMO, I seriously doubt you will be approved for a $5k

SL BT card. Even if you were, you'd max out the card.

One thing you can try is to call Cap1 and ask if your account has any special offers offers available. Maybe you can get a 7 month temporary APR reduction. Wont be much but it will help.

Cap1 bills show you how much you have to pay to pay your account off in three years. That should be your new minimum amount payment. Paying the regular minimum due now will take you 12+ years to PIF

You best chance for a decent approval would be NFCU. Amex wont be helpful for you. At best, youd get a $500 or $1000 SL and be stuck in a starter card

Good luck

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

CITI is notorious for low starting limits...

Cap 1 venture,,,,BT offers, i believe.,They started me at 5,000 . When citi was 1,000.

I believe they do BT's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best way to pay down my Cap 1 credit card; possible balance transfer option?

UPDATE;

Things are getting better score-wise little by little. The Cap 1 card I inquired about is still around $4400 with a $6800 limit.

Going to ask next month for a CLI but am not holding my breath.

The 2nd Cap 1 card I have just increased my limit of $750 to $2750(!) which has helped LOADS. That already cuts my utilization down to around 36% at this time.

I am still researching balance transfer cards at the moment and waiting until it seems like a good time to apply. I don't know what my best choices are though overall. I suppose some of it factors on the initial limits they wanna give me IF i end up getting approved. I'm looking at an AE and or Chase card with 0% transfers for 15-18 months. I went to both websites and used their pre-approval and they came back with the cards I was looking at (not sure if that means I'll ACTUALLY get approved though).

If I get approved do I want to use all of my limit though? Won't that really hurt my overall utilization? Also, if you have a 0% balance transfer for so many months, is there a minimum amount you need to pay like with a regular card?

Also, I was going to look into getting a line of credit from my bank or credit union - even though the APR would not be 0%, probably closer to 10% if I had to guess. Wouldn't that look good on my overall credit profile since I currently only have a car loan, student loans and credit cards?

Any and all info you guys can share would be MUCH appreciated! I just want to pay down/off my big CC balance the fastest/cheapest way possible without lowering my scores too much.

Current scores as of today (I do expect them to go up next month a little more)

TU: 713

EX: 663

EQ: 683