- myFICO® Forums

- Types of Credit

- Credit Cards

- BoA Closed Both of my Cards!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BoA Closed Both of my Cards!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@Kenny wrote:Exactly. Why do we always go to the base level of not believing what someone has said? There should be no reason they should lie. (Yes, there are trolls in this world, but we shouldn't treat everyone as how we treat the trolls.)

There's obviously background here I'm not familiar with. I guess I'll have to be more careful on how I word things and to be more specific. I left my comment intentionally vague and open ended so other more experienced people could maybe fill in their thoughts on what could cause such a massive point drop. Plus I hate typing.

For what it's worth, OP I BELIEVE YOUR STORY. And I'm sorry it happened to you. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@tcbofade wrote:

@Kenny wrote:

@Anonymous wrote:Yes I did have the cards close to maxed, but I was still in my 0% APR period and was going to make a large chunk of change towards it when the promotion was over. The reason for 100 point drop is clear! They closed my accounts and FICO is viewing them differently somehow. Just not sure how they are scored. I think I read somwhere that it considers them 100% maxed if they are closed. It also probably hit my AAoA as well.

I've read a lot of threads where they won't seem to budge on reopening accounts like this. Part of me wants to call them and let them know I have the cash in the bank to pay, but if they want to be like that, I'll keep my business with NFCU.

People think that just because there is 0% APR on the card the issuer doesn't mind if you max it out and pay only the minimum. Absolutely not.. the contrary they don't want you to do that and it's a sure-fire way to get your accounts closed. If you can get these opened and make some larger payments that's the way to go-- if you can't, then I sincerely hope you've learned a valuable lesson.

Bof A did this to me as well.

I opened a 123 card with zero percent, and put several BT's on it....never hit 80% util on the card, but when they closed it, I called them, and the CSR told me that taking advantage of the zero percent offer caused them to be concerned and they chose to close the account.

They honored my 12 months no interest intro deal, and I paid in full during month eleven...and now have NO relationship with Bank of America and am perfectly OK with that.

Interesting. I also recently opened a 123 card with them and am taking advantage of their 0% apr. I guess I'll have to rethink this option then because I really do like the card.

Were you making only near-minimum payments on it? And did you get to keep your earned rewards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@Anonymous wrote:

@tcbofade wrote:

@Kenny wrote:

@Anonymous wrote:Yes I did have the cards close to maxed, but I was still in my 0% APR period and was going to make a large chunk of change towards it when the promotion was over. The reason for 100 point drop is clear! They closed my accounts and FICO is viewing them differently somehow. Just not sure how they are scored. I think I read somwhere that it considers them 100% maxed if they are closed. It also probably hit my AAoA as well.

I've read a lot of threads where they won't seem to budge on reopening accounts like this. Part of me wants to call them and let them know I have the cash in the bank to pay, but if they want to be like that, I'll keep my business with NFCU.

People think that just because there is 0% APR on the card the issuer doesn't mind if you max it out and pay only the minimum. Absolutely not.. the contrary they don't want you to do that and it's a sure-fire way to get your accounts closed. If you can get these opened and make some larger payments that's the way to go-- if you can't, then I sincerely hope you've learned a valuable lesson.

Bof A did this to me as well.

I opened a 123 card with zero percent, and put several BT's on it....never hit 80% util on the card, but when they closed it, I called them, and the CSR told me that taking advantage of the zero percent offer caused them to be concerned and they chose to close the account.

They honored my 12 months no interest intro deal, and I paid in full during month eleven...and now have NO relationship with Bank of America and am perfectly OK with that.

Interesting. I also recently opened a 123 card with them and am taking advantage of their 0% apr. I guess I'll have to rethink this option then because I really do like the card.

Were you making only near-minimum payments on it? And did you get to keep your earned rewards?

Guilty of the near minimum payments....guess I incorrectly assumed that minimum meant...um.... minimum. Live and learn.

Yes, I got to keep the rewards, but no, I can't redeem them....you've got to aquire $25 worth to redeem them, and I've got $13 or so in rewards that I cannot redeem or add to because they closed the card....and I don't care enough to argue with them about it.

Fico 9: EX 756 03/13/24, EQ 790 02/04/24, TU No idea.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

Now, it means the minimum you must pay to not be in default, but not the minimum you must pay to be considered a good lending prospect, as far as maintaining a relationship with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@tcbofade wrote:Guilty of the near minimum payments....guess I incorrectly assumed that minimum meant...um.... minimum. Live and learn.

Yeah, not intuitive imho. I always thought as long as you're making min payments, you were fine. It's actually how I survived 90% UTIL with two several month stretches of unemployment. Thinking back, I'm surprised banks like Chase, WF, FNBO, etc didn't close my accounts during those times.

My plan was to make near-min payments on my 123 card and use the excess money to pay down my other balances I racked up during stints of unemployment/underemployment, but scratch that now.

Ha. Wrote this before I read Nixon's post above. That explains things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@Kenny wrote:

@Anonymous wrote:Yes I did have the cards close to maxed, but I was still in my 0% APR period and was going to make a large chunk of change towards it when the promotion was over. The reason for 100 point drop is clear! They closed my accounts and FICO is viewing them differently somehow. Just not sure how they are scored. I think I read somwhere that it considers them 100% maxed if they are closed. It also probably hit my AAoA as well.

I've read a lot of threads where they won't seem to budge on reopening accounts like this. Part of me wants to call them and let them know I have the cash in the bank to pay, but if they want to be like that, I'll keep my business with NFCU.

People think that just because there is 0% APR on the card the issuer doesn't mind if you max it out and pay only the minimum. Absolutely not.. the contrary they don't want you to do that and it's a sure-fire way to get your accounts closed. If you can get these opened and make some larger payments that's the way to go-- if you can't, then I sincerely hope you've learned a valuable lesson.

I would add a counter-point to this.

I do not know about BoA, but I did use my Barclays SMMC and kept a real high balance on it. I started doing so before coming to MyFico and knowing about the util mumbo jumbo; but by then I didn't have all the cash to repay the full balance. So this is how the statements looked like:

(Opened late Dec-2013) CL $3k

Jan: $350 Feb: $2.4k Mar: $2.6k Apr: $2.4k May: $2.3k Jun: $2.7k Jul: $2.7k Aug: $2.8k Sep: $2.85k Oct: $0k

Every month (except Feb, when the big charges happened), I purchased some and paid some (anywhere between $100-$300, more than the min payment), but Barclay's didn't do adverse action. Neither did others; well I didn't get CLI but no CLD initiated by banks.

When the Oct statement released, I got a 3k CLI from them. (Others with perfect utilization may have got that in their 6th month)

This story about banks not liking high balance had got me scared; I had opened a thread here about how to pay this Barclay money back. I had thought of all the balance chasing they would do. In the end, common sense and other comm members' advices prevailed. I paid off all the debts; there was no balance chasing, in fact I got some CLIs here and there.

I did something similar with AMEX; only difference was I had paid them to zero once (around 6th month) but other than that they were 80-85% utilization on a $1k limit. I didn't get any of the 3X CLI as others get but I wasn't shut down; I also got an auto-CLI with 80% utilization and then a 3X CLI after 2 weeks when util on that card was 0%.

Same story with Citi; for 4 out of 6 months of 0%, I had 75% and above utilization with them. I had in fact called up the CSR the very first day I got that card - 0% APR was a new concept to me then - and asked if I could charge around $1.8k on a $2k card and keep paying it over 6 months and it'll be okay, and the CSR said that's the concept of 0% APR, so I've been doing that ever since.

Is it a good practice? Maybe not. But does it call the wrath of hell? I don't think so either.

To sum up my experience, just because you're making use of a 0% APR and keeping close to 80-90% of your CL on a particular card doesn't mean you'll get closed. I don't know much about BoA, never used them, maybe they have some different policies. In general, I don't think high utilization == account closures.

My 2 cents.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@Anonymous wrote:

@Kenny wrote:Exactly. Why do we always go to the base level of not believing what someone has said? There should be no reason they should lie. (Yes, there are trolls in this world, but we shouldn't treat everyone as how we treat the trolls.)

There's obviously background here I'm not familiar with. I guess I'll have to be more careful on how I word things and to be more specific. I left my comment intentionally vague and open ended so other more experienced people could maybe fill in their thoughts on what could cause such a massive point drop. Plus I hate typing.

For what it's worth, OP I BELIEVE YOUR STORY. And I'm sorry it happened to you.

I didn't mean for you to be offended by my post. It's just odd seeing at least one post per thread of someone who either says how weird is it that this happened? Did this really happen? Etc. No need for you to be any more careful than we all need to be when posting. Our words are powerful. I understand that and for what it's worth, I apologize if you were offended. It certainly wasn't meant at any one person.

As I've said before.. have profound respect for each poster on this board, and I'd hate for my posts to come across as anything but that. I can definitely commiserate with your hate of typing... I don't love it either. I tend to like shorter posts so that my brain doesn't check out due to boredom.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

I don't understand why some think that 100 point drop for this is inconceivable.

OP sig states 46k limits. With the closure of the 2 cards total limits would drop to 36k. This may have caused overall Util to cross a certain threshold like 50 or 60% plus OP now has atleast 2 cards showing 100% maxed.

I would think that scenario could cause 100 point drop.

OP sorry to hear that this happened. In the interest of helping others to avoid these kind of closures perhaps you could give us more detail.

How long had you been carrying the maxed out balances and making minimum payments?

What was your over ll Util prior to closure? Were you also making min payments on large balances on other cards?

One thing to keep in mind, as much is this sucks it's not a personal thing. banks have algorithms that help them to determine when people might be in trouble finsncially so they can mitigate risk. It's not a personal thing. It's a setback but you can recover the 100 points once you get them paid off and B of. A cards are not the best out there anyways.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

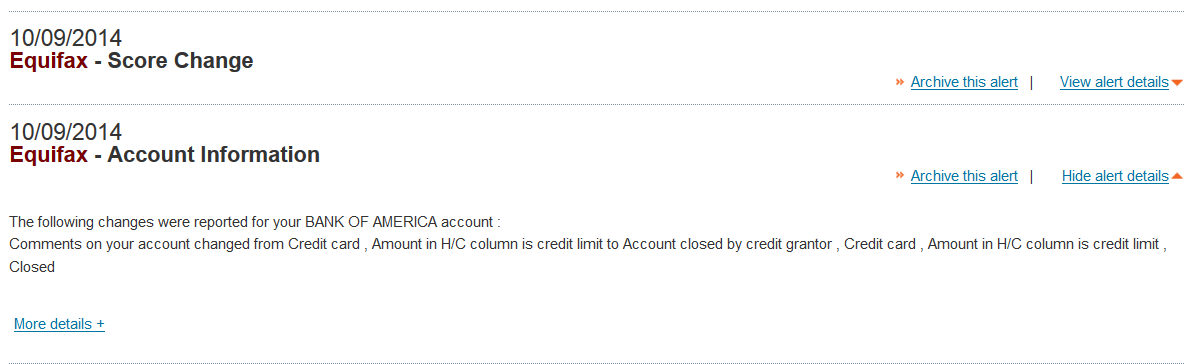

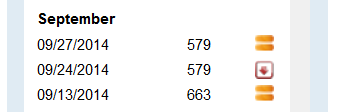

Here's some pudding for ya:

This was taken from Experian as it shows where I was and where I am now.

Exquifax is always the last one to pick up any changes. Now I do see with the math that isn't exactly 100 points, but can you feel my pain? That's one big drop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BoA Closed Both of my Cards!

@Anonymous wrote:

Exquifax is always the last one to pick up any changes. Now I do see with the math that isn't exactly 100 points, but can you feel my pain? That's one big drop.

Brutal, and technically you did NOTHING WRONG. But, for certain credit profiles BTs are the same as cash advances... forbidden fruit offered to tempt you and punish you if you accept.... that's part of the credit game... it IS crazy.![]()