- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CCs and FICOs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CCs and FICOs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CCs and FICOs

Do certain credit cards (VISA/MC/AMEX) look better or worse on your credit report than others? Does FICO score take these into account? Credit cards by certain banks, etc? If so, what credit card characteristics look 'better' on your CR vs credit card characteristics that look 'worse?'

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

A very interesting question:

I was looking at all my reports last night in reference to this. No accounts list the network type of card at all, or make any reference to store account either.

So, if the reports don't say (Visa, AMEX, MC, Discover, or store). How can FICO even use it.

Need an expert here!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

Nope, no difference in Visa/ MC/ Discover/ AmEx.

There has been more weight given to "national" bank cards (BofA, Chase, American Express, Citi, etc.) than to local or credit union bank cards, but I read something recently that indicated that this might no longer be true. Even if it is, it doesn't mean that CC's from local banks or from CU's are bad; it just means that they might have a bit less oomph.

And I really am pretty well convinced now that having a store card doesn't do any magic, as in 4 bank cards plus then you get a store card. That never did make sense to me, but once upon a time, there was something on the Education tab here that implied it. It think what it really is is that a bank card helps, as in 4 store cards and then you get a bank card. There is definitely a scoring factor for "too few bank cards."

Where you might see a difference is in lender approval. There's some convincing anecdotal evidence that having lots of low-limit cards, especially from rebuilder-type banks, can make it tough to break into the higher CL cards, even when your reports and scores are starting to improve. Lenders are chicken, and no one wants to go first. That's a great example for a time to get with a credit union.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

@haulingthescoreup wrote:...... There is definitely a scoring factor for "too few bank cards."

Target and Nordstrom are national banks. Both have store and VISA versions, Can FICO tell the difference, Does FICO count it as a bank card or a store card.

What about my wifes Sears MC from Citi. How is that counted? Store since it is Sears, or bank since it is CITI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

@haulingthescoreup wrote:Nope, no difference in Visa/ MC/ Discover/ AmEx.

There has been more weight given to "national" bank cards (BofA, Chase, American Express, Citi, etc.) than to local or credit union bank cards, but I read something recently that indicated that this might no longer be true. Even if it is, it doesn't mean that CC's from local banks or from CU's are bad; it just means that they might have a bit less oomph."

Is it still true that CCs with CL > 10K count a little higher too for FICO scoring? I notice Capital One considers someone with Excellent credit having another CC with higher than 10k CL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

@Wolf3 wrote:@haulingthescoreup wrote:...... There is definitely a scoring factor for "too few bank cards."Target and Nordstrom are national banks. Both have store and VISA versions, Can FICO tell the difference, Does FICO count it as a bank card or a store card.

What about my wifes Sears MC from Citi. How is that counted? Store since it is Sears, or bank since it is CITI.

There is a code on the data sent by the bank that indicates whether it's a revolving card or a charge (pay every month) card. The term "charge card" gets confusing, because so many store cards used to be charge cards, where you couldn't carry a balance. Now they're pretty much all revolving. Look on your reports to see if it says revolving or open. You might need to look at a full report, directly from the CRA and/or annualcreditreport-dot-com. Even myFICO reports sometimes display details like this oddly. ![]()

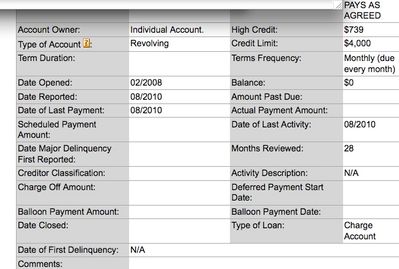

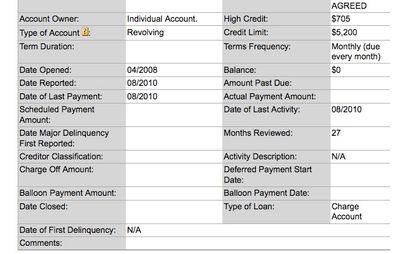

Here are a couple of my store cards, as compared to an AmEx charge card and a bank card, per EQ full report.

Note that the store cards say type of account: revolving and type of loan: charge account. But it also says that they're due every month, which they aren't:

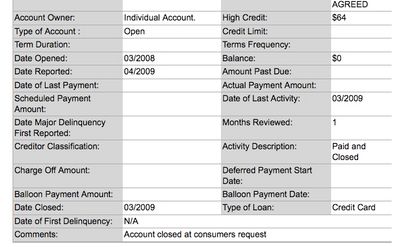

Here's an AmEx Gold (charge) card. Note that it says type of account: open, and type of loan: credit card, but it doesn't say due every month, which it was ![]() :

:

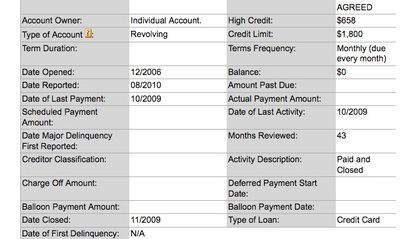

And then here's my closed Citi Sears MC, which is a bank card, not a store card, because of the MC. Note that it says type of account: revolving and type of loan: credit card, and again there's the due every month, which it wasn't:

So, assuming that a card is coded correctly, they can tell if it's a bank card vs a store/ gas card, and they can tell if it's revolving or open (aka "charge.") And I looked at my other cards, and the revolvers say "due every month", except for the AmEx Blue, and they aren't. So what that's all about, I dunno. I do know that the formula pays attention to the revolving vs open designation.

Hope that doesn't confuse anyone even more. ![]()

![]()

eta: I'm thinking that the charge cards don't say "due every month" because they're only due once, when the statement comes out. That seems wonderfully bass-ackwards, but it makes me think of the poster who had a charge-off on a Green card, but didn't show the 30-60-90 bit, presumably because it wasn't due every month. It was just due. ![]()

![]()

![]()

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

@Anonymous wrote:

Is it still true that CCs with CL > 10K count a little higher too for FICO scoring? I notice Capital One considers someone with Excellent credit having another CC with higher than 10k CL.

This was never true for FICO scoring. Lenders can put more weight on this, as in your Cap One example, but not for scoring.

Scoring looks at util, not CL, and 3% on a $100 card is just as good as 3% on a $10K card. In fact, in a way it might be better, because FICO also looks at total of balances, although not nearly as much as it looks at util.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

hauling, your post got me in to review my CR and found out followings:

My Chase Freedom World MC's information is just like hauling's AmEx Gold ... Acct Type as Open Acct / Loan Type as Credit Card / No CL / High Balance Only.

Is this mean the Chase considers a Freedom World MC as charge card? not credit card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

No, it means that you have a CL, but you're allowed to go over it, as long as you pay back the amount over the CL by the due date? next statement?? You need to check your paperwork to see when it would be due. This is from the Mastercard World site:

No pre-set spending limit:World MasterCard has no pre-set spending limit which gives you the benefit of additional spending power should you ever need it. Enjoy the benefit of increased purchasing flexibility as long as you pay in full the amount that exceeds your revolving credit line on your billing statement each month.

What will happen is that it's going to be scored differently from normal revolving credit cards.

Since your World card allows you to go over your CL, and they are not reporting your CL, but they are reporting your highest balance, it means that your util will be higher if any balances report, because now the highest balance is the denominator in the util calculation, instead of the CL being the denominator. The smaller the denominator, the higher the util. (Yikes, 4th-grade arithmetic rears its ugly head!)

I don't know your CL, or course, but as an example, if your CL is $5,000, but your highest balance is $1,000, and you have $500 reported as your balance, that card will be at 50% ($500 / $1,000) instead of 10% ($500 / $5,000) util. In addition, your total util might rise, because now you don't have that $5,000 as part of your total CL. This card is now only adding $1,000 to your total CL.

(These are for-instance numbers, so everyone needs to substitute their own figures.)

For those with very small balances ever reporting, or really high total CL, these card types probably won't affect your util. But for those who have three cards, and they allow balances to post on their statements and then pay them off, if two of their cards go World (MC) or Signature (Visa), they can potentially see some real score damage.

edited for clarification after getting more coffee...

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CCs and FICOs

@haulingthescoreup wrote:No, it means that you have a CL, but you're allowed to go over it, as long as you pay back the amount over the CL by the due date? next statement?? You need to check your paperwork to see when it would be due. This is from the Mastercard World site:

No pre-set spending limit:World MasterCard has no pre-set spending limit which gives you the benefit of additional spending power should you ever need it. Enjoy the benefit of increased purchasing flexibility as long as you pay in full the amount that exceeds your revolving credit line on your billing statement each month.

What will happen is that it's going to be scored differently from normal revolving credit cards.

Since your World card allows you to go over your CL, and they are not reporting your CL, but they are reporting your highest balance, it means that your util will be higher if any balances report, because now the highest balance is the denominator in the util calculation, instead of the CL being the denominator. The smaller the denominator, the higher the util. (Yikes, 4th-grade arithmetic rears its ugly head!)

I don't know your CL, or course, but as an example, if your CL is $5,000, but your highest balance is $1,000, and you have $500 reported as your balance, that card will be at 50% ($500 / $1,000) instead of 10% ($500 / $5,000) util. In addition, your total util might rise, because now you don't have that $5,000 as part of your total CL. This card is now only adding $1,000 to your total CL.

(These are for-instance numbers, so everyone needs to substitute their own figures.)

For those with very small balances ever reporting, or really high total CL, these card types probably won't affect your util. But for those who have three cards, and they allow balances to post on their statements and then pay them off, if two of their cards go World (MC) or Signature (Visa), they can potentially see some real score damage.

edited for clarification after getting more coffee... <<<

Thanks for your help hauling. Now, I remember it. But I am not planning to go over my limit unless it is really ... really ... needed.

My CL on Freedom MC is 9k ... it was 6k and they just gave me an auto 3k CLI ...

The highest balance is $5232, and it used to report between $250 and $1000. But now, I switched to carry the balance between my Freedom VISA and Freedom MC. So it will be $0 balance on this acct from now on.

Yikes! I hope Chase does not change my Freedom VISA to Signature ... cross my fingers ... The highest balance on this cc is $3868 vs 8.6k CL. If it changes to the Signature, I will switch back to MC to carry the balance is sure.

Uhh, I got an idea ... purchase something big like ... a used car up to 8k and let it report, then PIF before the due date with auto loan from Navy Fed. Therefore, I will have high balance of 8k on it. What do you think everyone?