- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

Hello,

Im looking for any advice anyone may have on my situation.

I did a post last week livid because Cap1 would not give me a CLI, even though I have been a good customer since 2009. My current CL with them is $1500 with a balance of $1463. I then requested an APR deduction, was denied for that as well and am now waiting on the upgrade to my Quicksilver card.

I have been in the garden for about a year and my plan was to pay down my CAP1 balance to 50% at the beginning of the year. Then do and app/bt for the Chase Freedom once my scores jumped.

Well in the last couple of months Chase Slate kept sending me offers. So I was so pissed with Cap1 I pulled the trigger tonite. Did the online app with the CAP1 balance transfer and was approved on the spot for 3K.

Now my goal is to obtain prime cards with good CL's and APRS.

I currently have the following;

Home Depot with 3K limit, 1200 avail credit

Orchard/Cap1-800 limit, 403 avail credit

TJ Maxx-1600 limit, 800 avail credit

Discover-4700 limit, 1500 avail credit

My credit scores are as follows;

Equifax-683

TU-661

Experian-666

With all of the above being said and a plan to pay down my Discover and Home Depot in the near future.

Should I start an AP spree tonite and apply for another prime BT card and just get rid of the low CL Orchard card?

This way I can be rid of CAP1 for good. The only drawback here is that my Orchard card has a 12.99 APR.

Or should I pay off 500 bucks on my Chase Slate immediatly and then transfer my $400 balance from the Orchard card to pay off with Chase at a 0% interest rate?

Then with either or both of the above mentioned, im on the fence about closing both Cap1 accounts.

Any and all suggestions would be appreciated.

Thanks

As Of 8/2013: Equifax=683, Experian=666, TransUnion=661

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

If you got Chase Slate for $3k, I would transfer ANYTHING up to the limit that you are not getting 0% on... So BT Cap1, HSBC, TJMax (HORRIBLE INTEREST!), and part of HD or Discover if they are not 0%.

Then I would contact EO for Cap1 and ask for CLI on both the Cap1 and HSBC and AF removal/refund and PC to quicksilver on the cap1.... if you are happy with what they come back to you with then keep, if they don't really move or do anything for you, then close them!

either way take advantage of both 0% and no BT fee of the slate for the max you can!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

Hint: Through the roof!

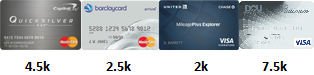

In My Wallet: Amex BCP (12/12) $50,000, Chase Freedom (12/12) $16,500, Cap1 Quicksilver (6/12) $14,000, Barclaycard Rewards (5/13) $10,500, Citi Prestige (4/16) $30,000

Last App: June 27, 2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

Thank you both!

I just went on the Citi site and was denied for the Simplicity. So I think my short lived app spree is complete ![]()

Im goin to try for a CLI with chase and try to get HD and/or TJ Maxx transfered over so I can benefit fully from the 0% APR.

Hopefully I can be paid down by March and see a nice bump. Then at that point I will apply for another prime.

Im still on the fence about closing the CAP1/Orchard card though, what do you guys thing about that?

As Of 8/2013: Equifax=683, Experian=666, TransUnion=661

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

@qt33 wrote:Thank you both!

I just went on the Citi site and was denied for the Simplicity. So I think my short lived app spree is complete

Im goin to try for a CLI with chase and try to get HD and/or TJ Maxx transfered over so I can benefit fully from the 0% APR.

Hopefully I can be paid down by March and see a nice bump. Then at that point I will apply for another prime.

Im still on the fence about closing the CAP1/Orchard card though, what do you guys thing about that?

Congrats on the approval! And yeah, when you finally get a denial it is the sign to stop apping and garden the new tradelines!...![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

depending on how many inqs u have on ur CR u may want to ask them if they are going to use the HP from the app or if they are going to HP again

Starting Score: 620 Current Score: 709 Goal Score: 720

Gardening from 9/28/2013. Target: March 2014

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

@SPRES

Thanks, very good point I didnt think of..... I dont want anymore HP's being as though I got 2 already tnite.

As Of 8/2013: Equifax=683, Experian=666, TransUnion=661

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

@qt33 wrote:Thank you both!

I just went on the Citi site and was denied for the Simplicity. So I think my short lived app spree is complete

Im goin to try for a CLI with chase and try to get HD and/or TJ Maxx transfered over so I can benefit fully from the 0% APR.

Hopefully I can be paid down by March and see a nice bump. Then at that point I will apply for another prime.

Im still on the fence about closing the CAP1/Orchard card though, what do you guys thing about that?

Congrats

Now head on back to the garden for support and to set your plan in motion

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

@myjourney-thanks and im on my way ![]()

As Of 8/2013: Equifax=683, Experian=666, TransUnion=661

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CHASE SLATE ONLINE INSTANT APPROVAL QUESTION

@qt33 wrote:Hello,

Im looking for any advice anyone may have on my situation.

I did a post last week livid because Cap1 would not give me a CLI, even though I have been a good customer since 2009. My current CL with them is $1500 with a balance of $1463. I then requested an APR deduction, was denied for that as well and am now waiting on the upgrade to my Quicksilver card.

I have been in the garden for about a year and my plan was to pay down my CAP1 balance to 50% at the beginning of the year. Then do and app/bt for the Chase Freedom once my scores jumped.

Well in the last couple of months Chase Slate kept sending me offers. So I was so pissed with Cap1 I pulled the trigger tonite. Did the online app with the CAP1 balance transfer and was approved on the spot for 3K.

Now my goal is to obtain prime cards with good CL's and APRS.

I currently have the following;

Home Depot with 3K limit, 1200 avail credit

Orchard/Cap1-800 limit, 403 avail credit

TJ Maxx-1600 limit, 800 avail credit

Discover-4700 limit, 1500 avail credit

My credit scores are as follows;

Equifax-683

TU-661

Experian-666

With all of the above being said and a plan to pay down my Discover and Home Depot in the near future.

Should I start an AP spree tonite and apply for another prime BT card and just get rid of the low CL Orchard card?

This way I can be rid of CAP1 for good. The only drawback here is that my Orchard card has a 12.99 APR.

Or should I pay off 500 bucks on my Chase Slate immediatly and then transfer my $400 balance from the Orchard card to pay off with Chase at a 0% interest rate?

Then with either or both of the above mentioned, im on the fence about closing both Cap1 accounts.

Any and all suggestions would be appreciated.

Thanks

What does the rest of your profile look like? AAoA? Baddies, etc? I ask because I have had scores similar to yours. Other factors would determine whether or not another lender would approve you. I know that you applied for the Citi and were denied, but imo, that doesn't say much. Although I have 2 Citi Simplicity, they haven't been a lender that's favored my credit profile. They originally gave me a Simplicity with a $1500 limit. I applied for another card (not Simplicity) and they gave me another Simplicity with a $500 limit. A few months later, they CLD me and now I have two Simplicities at $500 ea. No CLI although other lenders such as Chase, Amex, B of A, Barclay's and others have given me more credit to start with, despite my imperfect profile. So being denied from Citi isn't saying much IMHO. However, your utilization may be hurting you. Once I paid down my utilization, I was able to get more credit and with better terms.

Anyhow, I wouldn't do a full on app spree just yet. See what you can fix in your profile (the utilization of course) and once you make the changes and they report, you should be able to get more of what you want. The problem of applying for credit when you need it, such as for BT's because of high util and such is that it is harder to get approved. You are at 50% or more util on your cards which doesn't look good. In my experience, even having 26 cards and carrying high balances over 50% util on 4 or 5 drops the score and scares lenders away. The advice I read about keeping low util on each card as well as overall has helped me and works.

This is just based off my experiences with scores similar to yours. Good luck.