- myFICO® Forums

- Types of Credit

- Credit Cards

- CLI's on RBFCU? When/How?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CLI's on RBFCU? When/How?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLI's on RBFCU? When/How?

@Anonymous wrote:

To clarify, they don't do auto CLIs.

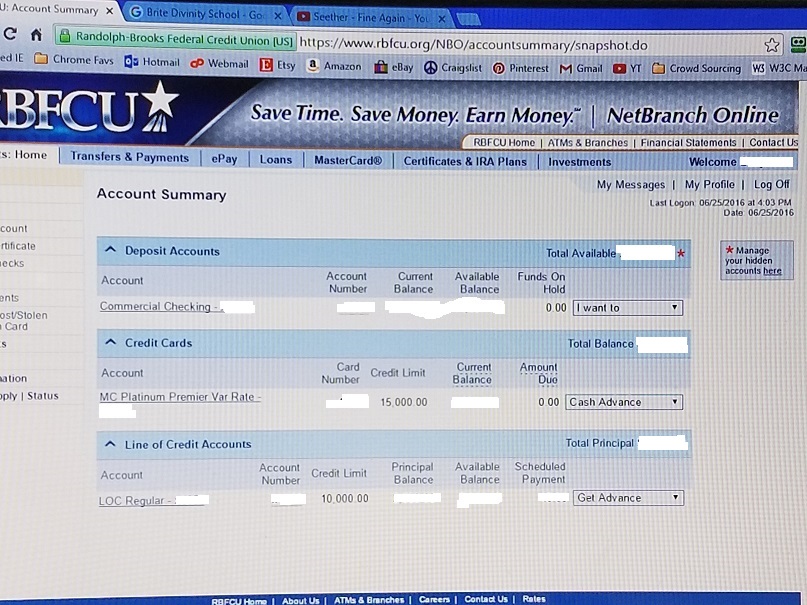

@I knew this going in so when I app'ed in Jan I made sure to aim high ($15K) and was approved with no issues for the premier rate @9.95% (2nd tier rate, score was around 700 then)

I too, have switched and made them my main bank from a different CU and am very happy I did! Great customer service, great rates, eDeposits credited same day! ![]()

Gardening until 2019....at least

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLI's on RBFCU? When/How?

@Anonymous wrote:

To clarify, they don't do auto CLIs.

I was hoping you'd see this post!

Thank ypu for the definitive answer!

I have plenty of other cards/credit, so I'll leave it as is for a while and maybe try in a year or so, if I can refrain from opening new accounts for any appreciable amount of time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLI's on RBFCU? When/How?

FYI RBFCU uses the same pull for 45 days NOT 30 days when you apply for a CC/PLOC.

When you ask for a CLI from RBFCU I would ALWAYS do it in a branch on webcam with a loan CSR rep (not by phone or online) and don't take no for an answer.

I asked for $20K CC and $10K PLOC right away and they countered at $10K on CC and I said talk to the hand. ![]()

CSR went back to the underwriter and got me $15K on CC and approved the $10K PLOC (I won't lie I wimped out and only asked for $10K PLOC when I should've asked for $15K). I would've gotten $20K or $25K on both lines right out of the gate, but when I refi'd my car from RBFCU to ATFCU (did this to make sure FICO didn't credit score r$pe my a$s). But of course, I still lost a soul crushing 56 points off my TU score once my refi'd loan reported as paid off/closed and my new car loan reported which bumped me 3pts off their highest credit tier. ![]() OOOO

OOOO

Thank the credit TU gods I got all 56 pts back plus another 12 pts in the last 50 days and by the end of this month I should be approaching Mr. 800 TU score.

I'm going back to ask them for a CLI around September 30th and asking for $25K CC and $25K PLOC. I found out from CSR the highest credit limits he's ever heard or seen since working there was one guy got both a $40K CC and $25K PLOC. Those are my goals to hit with them in the next 12 months. I'm betting RBFCU's max exposure is like PenFed's and it's at $50K CC/$25K PLOC.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content