- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CSR updates coming 10/5?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

CSR updates coming 10/5?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@iced wrote:United isn't doing itself any favors to compete with Delta, but it's still doing better than lolAmerican and SW isn't even in the discussion. The question I'm walking away with here is why would someone who's flying with enough frequency to almost certainly be at least MP Gold (and well on their way to lifetime Gold) ever choose to board a SW aircraft unless the routing necessitates it? I'd be stuffing those extra UR points back into UA and/or throwing them at *A partners long before I'd ever waste them on domestic tickets with SW.

I bolded the answer to your question ![]()

I live in northern CA, and when I fly to southern CA it doesn't make any sense to fly United, as they are almost always 2-leg routes and cost twice as much. Southwest flies from my home airport to every other CA airport in 1 leg, for much cheaper.

That's the only time I fly SW. When I fly out-of-state I use United.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@iced wrote:

If I could choose between 120,000 UR and no SkyClub or 80,000 MR with SkyClub each year for $550, I'm going to take the 120,000 UR. Yes, I hear the gold card crew chiming in to say to use it for dining, but then my fees go up, plus I can counter that with a CFU and now push my total UR spend even higher while still holding at $550.

I'm only moderately interested in getting the Amex Gold once my next "SUB lifetime" begins. I probably wouldn't use the dining credit naturally most months, and my existing cards cover me pretty well as far as airfare extras.

But CFU is nothing amazing IMO as off-category cards go. I'd sooner use my BBP or 2.625% PR.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@Loquat wrote:If the CSR is to play in the same sandbox as the Amex Platinum then Chase is going to have to do better than DoorDash and Lyft especially since they increased the annual fee to $550.

Folks can justify the Amex Platinum even without big multiplier by way of lounge access, customer service, a much better array of card offerings, willingness to retain a customer by way of incentives to stay, Amex Offers, etc.

Chase brings very little to the table outside the card itself. Travel protection meant something until Amex started to offer it. There's little to no outsized value to be had with the Sapphire product. The multipliers are lagging even behind the likes of Citi and even the CapOne Venture offers 5x when booking through their portal.

In my opinion, since there's no outsized value to be had unless transferring to partners and even their selection of transfer partners aren't all that exciting. There's an argument that could be made that one would do better with the Wells Fargo Propel over the CSP and possibly the CSR. The Propel has no AF, cell phone protection, access to Amex Offers, and the Earn More Mall usually has 400+ offers on any given day.

The CSP/CSR is stale and if Chase thinks that customers are going to continue to hold the CSR just for the 50% uplift via their travel portal (which is usually more expensive than booking direct due to the inflated cost) they may be in for a rude awakening. Shy of any sort of substantial change, my CSR is gone; it's not worth $550 to me in its current form.

Especially with the recent Freedom card changes along with other industry evolution, I agree that the CSR is due for a welcome refresh. However, IMO your review of it is overly harsh, @Loquat. While holding both the AMEX Platinum and CSR may not work for many people, the CSR is sometimes the better choice.

AMEX Platinum is better for some particular customers and travel patterns, namely frequent flyers. It shines for high rewards when purchasing airfare, the best airport lounge access, the best network of travel partners, and even stepped up their game to compete better with CSR by adding some travel protections this year.

For travelers such as myself, whose travel spending may not revolve entirely around airports, the Chase Sapphire Reserve is a far superior card, even in its' present form. The Chase travel definition to earn 3% or travel credits is much more broad. Merchants in the travel category include:

- airlines,

- hotels,

- motels,

- timeshares,

- car rental agencies,

- cruise lines,

- travel agencies,

- discount travel sites,

- campgrounds

... and operators of:

- passenger trains,

- buses,

- taxis,

- limousines,

- ferries,

- toll bridges and highways and

- parking lots and garages.

As usual, AMEX Platinum's travel credits are narrowly focused with $200 for airline FEE reimbursements (on one preselected airline) and $200 for UBER. Neither one works for a lot of people. Meanwhile, the CSR's $300 credit is much easier to redeem and is automatically-applied with any purchases in the above categories.

While AMEX has the better transfer partners, Chase has a good network and points for both are worth up to 2 ccp when transferred.

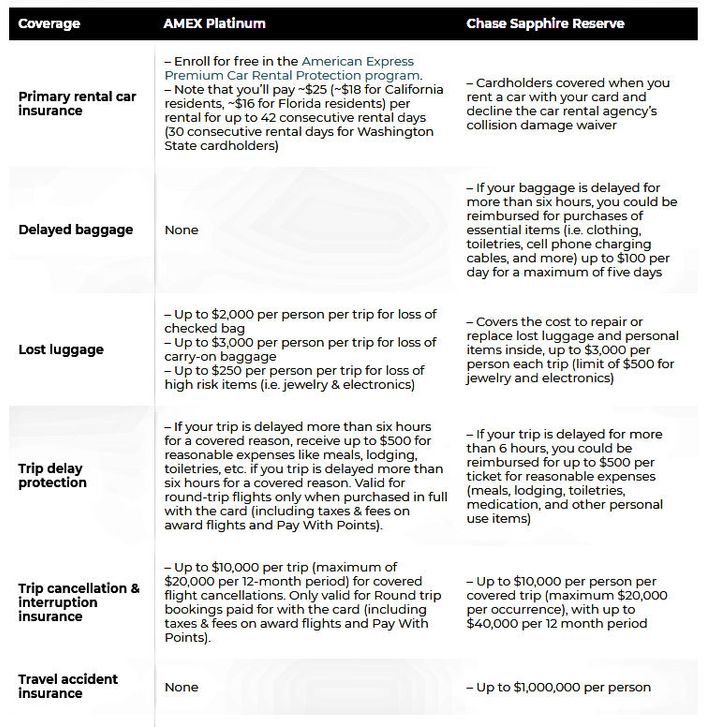

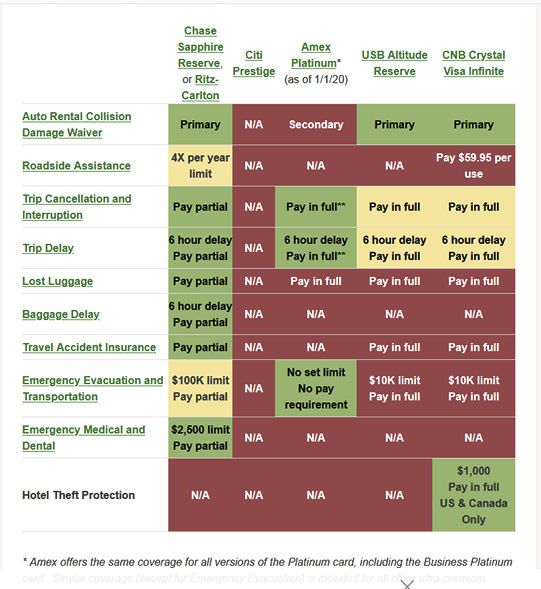

Chase still has the best travel protections, hands-down. Sure, AMEX added some this year but they also eliminated coverages still offered by CSR. In the travel protections, CSR has:

- Primary Rental Car CDW (Collision Damage Waiver) coverage included with your annual fee. It's available from AMEX for an additional fee on a rental-by-rental basis

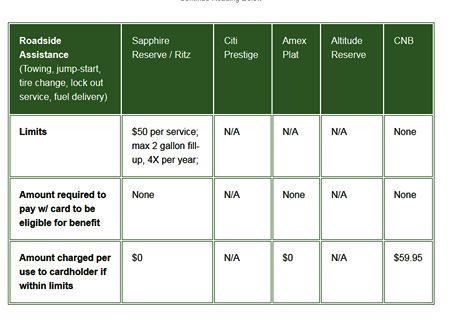

- Roadside Assistance coverage is included, which provides not only Dispatch but pays the first $50 up to 4x per year which is the equivalent of a basic AAA plan. In my state when I priced it, that coverage would cost about $55 per year. AMEX deleted that coverage this year.

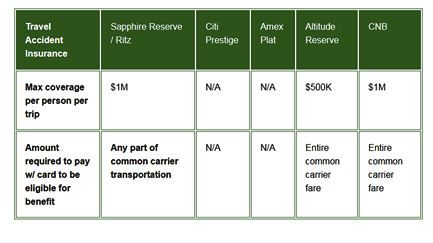

- AD&D (Accidental Death and Dismemberment) coverage for up to $1 Million. AMEX deleted that coverage this year.

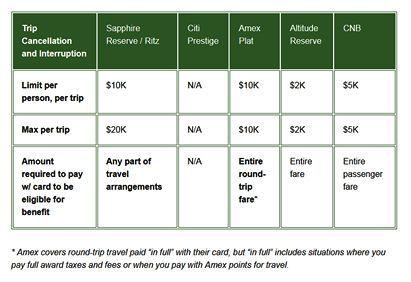

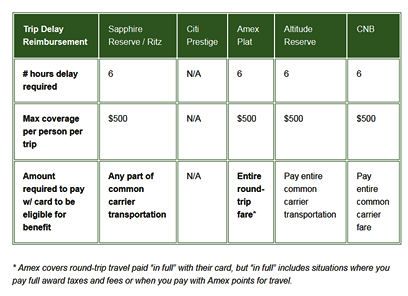

- Trip Delay and Trip Cancellation insurance on all tickets, either one way or roundtrip. AMEX Platinum added Trip Delay and Trip Cancellation insurance this year but it requires purchase of a round trip with your Platinum card to qualify for coverage.

- Higher Trip Cancellation coverages than AMEX Platinum. CSR covers $10K per person, $20K per trip, $40K annually. AMEX covers $10K per trip, $20K annually.

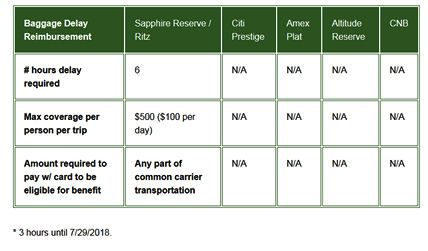

- CSR has Baggage Delay Insurance. Platinum has none.

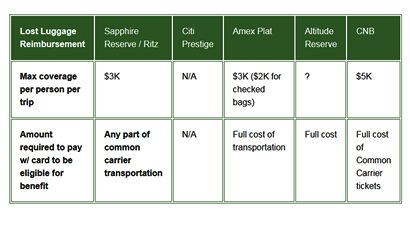

- CSR has superior Lost Baggage insurance that covers checked bags at up to $3K (vs $2K for AMEX) and up to $500 for high value items (vs $250 for AMEX.)

My Verdict: If you already have both an AMEX Platinum and CSR and your travel is focused on flying, CSR may not be as good of a value for you unless you place high value on the superior travel protections offered by Chase. For other people who do not focus their travel spend on airfare and who do not want to carry BOTH cards, the CSR may still be the superior overall pick.

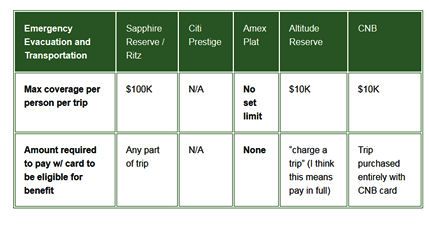

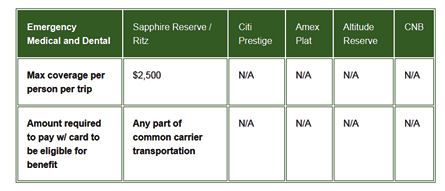

For more comparions on travel protections between the premium cards, here are some charts I found online with excellent summaries.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

I suppose Citi should rename Premier to N/A Travel Rewards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

Also, I think you set a new record for charts in a single post.

UFS peeps might wanna up their game.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@wasCB14 wrote:I'm only moderately interested in getting the Amex Gold once my next "SUB lifetime" begins. I probably wouldn't use the dining credit naturally most months, and my existing cards cover me pretty well as far as airfare extras.

But CFU is nothing amazing IMO as off-category cards go. I'd sooner use my BBP or 2.625% PR.

The point I was going for was that the comparison tends to fall down to 3x dining/3x travel CSR@$550 vs. 5x airfare/4x dining Platinum+Gold@$800. I'm merely pointing out I'd rather have the 3x dining/travel and 1.5x others for $550 than pay an extra $250 for 2x more airfare and 1x more dining, though I also get that people whose travel patterns heavily favor MR partners and/or airfare spending will close that gap easier.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@Remedios wrote:Also, I think you set a new record for charts in a single post.

UFC peeps might wanna up their game.

Isn't there some sort of special My Fico banner for that? ![]()

I want a medal or a certificate!

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

For hikers and the like (people who aren't going to always be in major cities or at developed beach resorts) Platinum's no-purchase-necessary uncapped medical evacuation/transportation perk is quite nice.

CSR has $100k, but it's not hard to exceed that if you need a helicopter.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CSR updates coming 10/5?

@Aim_High wrote:

@Remedios wrote:Also, I think you set a new record for charts in a single post.

UFC peeps might wanna up their game.

Isn't there some sort of special My Fico banner for that?

I want a medal or a certificate!

One thing you touched on was non-airport travel with the CSR, and that's a good point. I'm not sure how Amex/Citi fare in the non-typical travel bookings category, but the UR travel portal (which is basically Expedia) has got an amazing variety of stuff you can book on points. For example, I can rent someone's private vacation cabin in Tahoe for a weekend on points. Or kayak rentals, mountain bike rentals, lift tickets, etc. All kinds of stuff. Maybe the other cards can do those things too, I'm not sure. But I like that Chase can do that to book things besides the standard hotel/car/airfare.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content