- myFICO® Forums

- Types of Credit

- Credit Cards

- Calling all Alliant credit union members who have ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Calling all Alliant credit union members who have a checking/savings acct & a credit card with them

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

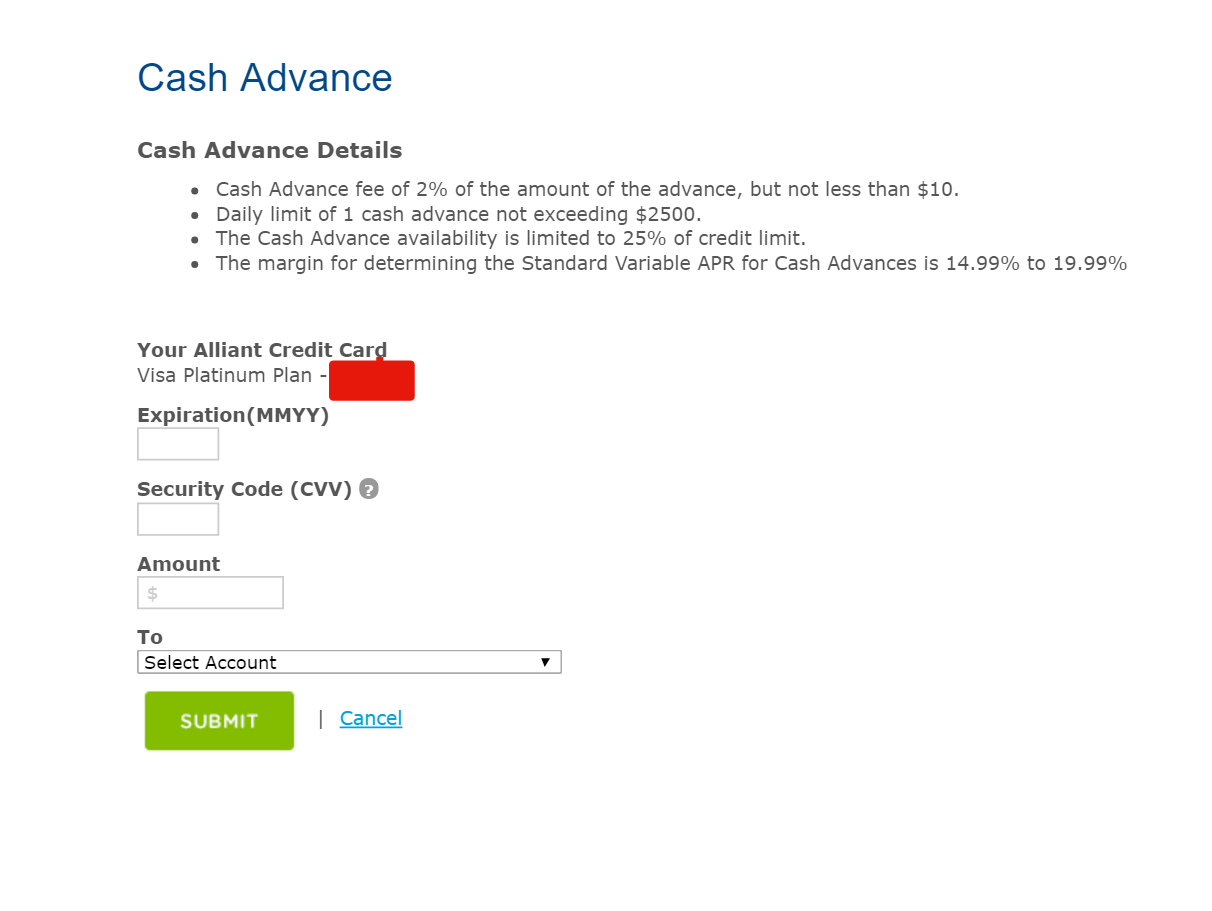

Never fear on MF when you ask a question you get as many yes's and no's from members, but screenshots trump all BS on the forum.

Member giving inaccurate wrong information.

Member giving correct info and PROVING his statements with screenshots. Screenshots are your friend and always use them when you answer or ask questions.

Screenshots are the TRUTH! ![]()

Thanks so much @Mikelo22 for providing the Alliant back office screenshot and the great intel.

Now we have actual verifiable proof that Alliant will allow a person up to 25% of your credit limit in a cash advance (non-ATM) and they set limits of up to $2,500 per day whereas NFCU I believe is 50% of your credit card limit and I know PenFed, RBFCU and Unify allow the full 100% of your credit limits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

They aren't a credit union, but USAA will also let you get a cash advance for up to $2500 deposited into your USAA checking account, for no fee.

Note that interest does start accruing immediately, though.

Edited to add: While I have taken advantage of this a couple of times, I paid it back quickly (once by doing a no-fee BT to NFCU), and the amounts were $1k and $1.5k. I honestly wouldn't recommend maxing out the credit line routinely, as that has caused issues for other people with some banks.

One thread that comes to mind is a person who got all their Capital One accounts shut down because he repeatedly did cash advances to one of his cards for a family member. Even though he paid it back quickly, the repetition got him flagged for money laundering, and Capital One simply closed all of his accounts rather than deal with that possibility.

http://ficoforums.myfico.com/t5/Credit-Cards/Capital-One-Just-Closed-All-4-of-My-Cards/td-p/4362242

Just my 2¢. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

@UB

But you must be military affiliated/family otherwise USAA won't allow you access to their credit or insurance products. They'll allow to open a savings account and maybe a checking account but that's all. Unless they've drastically changed that policy.

Unlike with NFCU or PenFed there are no loops holes for people like me that have no living military people in their immediate family or household to get into USAA.

P.S USAA Bank is a bank NOT a credit union. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

@Anonymous wrote:@Anonymous

But you must be military affiliated/family otherwise USAA won't allow you access to their credit or insurance products. They'll allow to open a savings account and maybe a checking account but that's all. Unless they've drastically changed that policy.

Unlike with NFCU or PenFed there are no loops holes for people like me that have no living military people in their immediate family or household to get into USAA.

P.S USAA Bank is a bank NOT a credit union.

I got in with USAA back when their banking products were available to everybody.

And you're exactly right about them being a bank... thus my disclaimer at the beginning of my post. ![]()

I only mention it here since they seem to be an outlier when it comes to banks who allow no-fee cash advances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

I am trying to juggle way too much at the witching hour by reading and replying to posts while reading emails while watching an episode of Sons of Anarchy on Netflix.

Sadly, banking and insurance products are off limits now to outsiders like myself with USAA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

@Anonymous wrote:

Mea Culpa man.

I am trying to juggle way too much at the witching hour by reading and replying to posts while reading emails while watching an episode of Sons of Anarchy on Netflix.

Sadly, banking and insurance products are off limits now to outsiders like myself with USAA.

No problem my friend, it happens! ![]()

I'm hoping at some point USAA will change their criteria for membership; at the moment I'm locked out from their insurance as well until my father purchases an insurance policy with them. Unfortunately, it doesn't look like that's going to happen any time soon. USAA does have a history of 'adjusting' their criteria for membership, though, so there's hope for us yet!

Back on topic, be sure to check out the link I put at the bottom of my post (I edited the post to add it). It's an interesting turn of events that could happen if a bank gets the wrong idea about cash advances, especially if they are frequent and PIF often. That thread is specific to Capital One, but I would imagine under similar circumstances other lenders might behave similarly. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

Like I said before on posts there is a HUGE night and day difference in how lenders look at and code cash transactions if someone is randomly hitting up ATM's for cash advances constantly (I don't and wouldn't ever do that) and a credit union that you already have a checking and/or savings account with that has a built-in cash advance back office transfer feature that they provide you on a credit card to transfer funds to an internal account that you have with them. See the BIG difference?

Do that and you're good to go as long as you pay it back in full in a timely matter of say 1-3 months or at least most of it in a short time period of that length.

That is why I am so hell bent on finding as many of these little credit union credit card cash gems as possibe because regular credit cards (AMEX, Chase, Cap1, BOA, WF, Discover, etc.) are completely useless to me for what I'm trying to accomplish.

Trust me it's all part of the plan. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

@Anonymous wrote:Like I said before on posts there is a HUGE night and day difference in how lenders look at and code cash transactions if someone is randomly hitting up ATM's for cash advances constantly (I don't and wouldn't ever do that) and a credit union that you already have a checking and/or savings account with that has a built-in cash advance back office transfer feature that they provide you on a credit card to transfer funds to an internal account that you have with them. See the BIG difference?

Do that and you're good to go as long as you pay it back in full in a timely matter of say 1-3 months or at least most of it in a short time period of that length.

That is why I am so hell bent on finding as many of these little credit union credit card cash gems as possibe because regular credit cards (AMEX, Chase, Cap1, BOA, WF, Discover, etc.) are completely useless to me for what I'm trying to accomplish.

Trust me it's all part of the plan.

I'm not arguing with you... and I do see the difference (you don't have to convince me... LOL).

I just hope the banks/CUs will 'see' things the way you and I do. ![]()

I've found that what is considered completely acceptable at one bank/CU can sometimes set off alarms at others, and many times there's no way to know in advance (since that would defeat the purpose).

It sounds like in any case you will have (or already have) relationships with multiple banks/credit unions, so if one of them were to have an issue you would still be OK.

Hopefully other folks on here will know of other CUs (or banks?) that have the specific features you're looking for. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Calling all Alliant credit union members who have a checking/savings acct & a credit card wi

I never thought you were arguing with me.

Arguing with someone on the internet is like trying to win an argument with a concrete wall that you're banging your head against as hard as you can.

They do I've been doing it for awhile and it's not some weird thing it's just a different way then what most people use credit cards for.