- myFICO® Forums

- Types of Credit

- Credit Cards

- Cap 1/Best Buy reporting closed on Experian due to...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap 1/Best Buy reporting closed on Experian due to Citibank transition

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

Cap 1 will no longer be able to or have the legal right to update your CR's. the question is whether or not you will have the original open dates.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

@Ron1 wrote:

@mnavas wrote:

@Ron1 wrote:

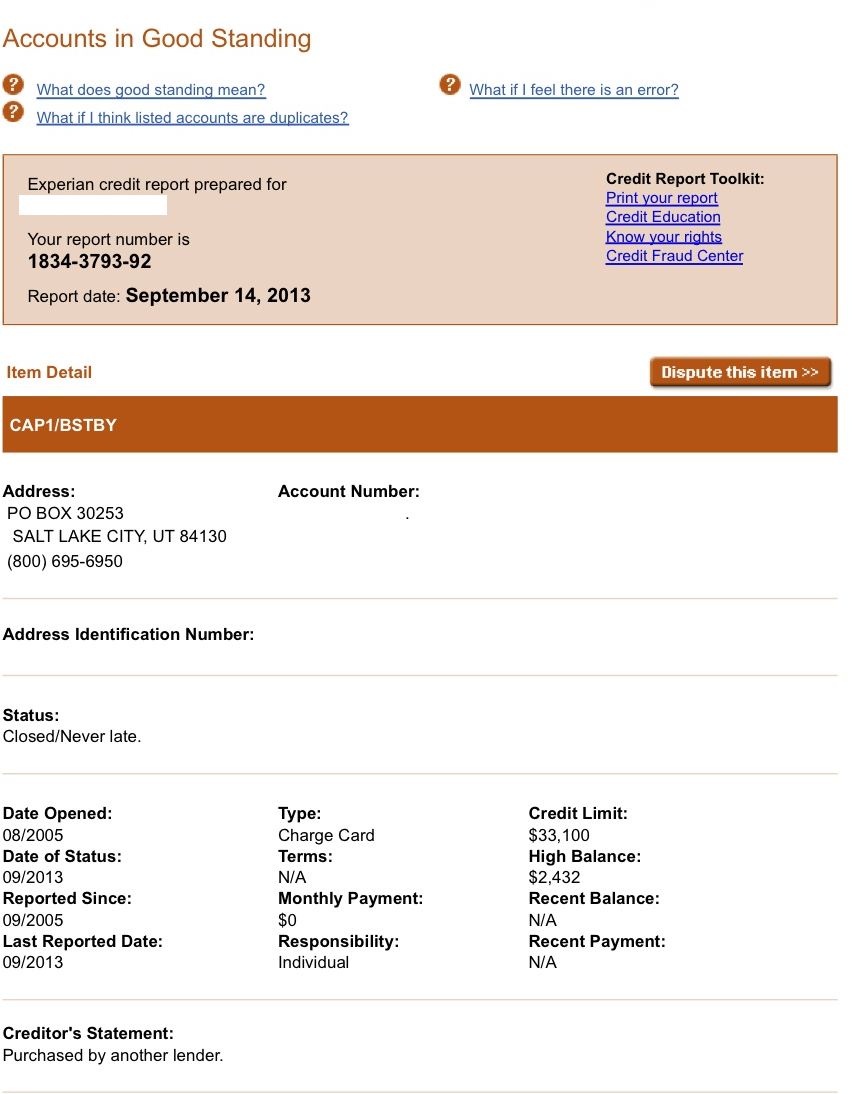

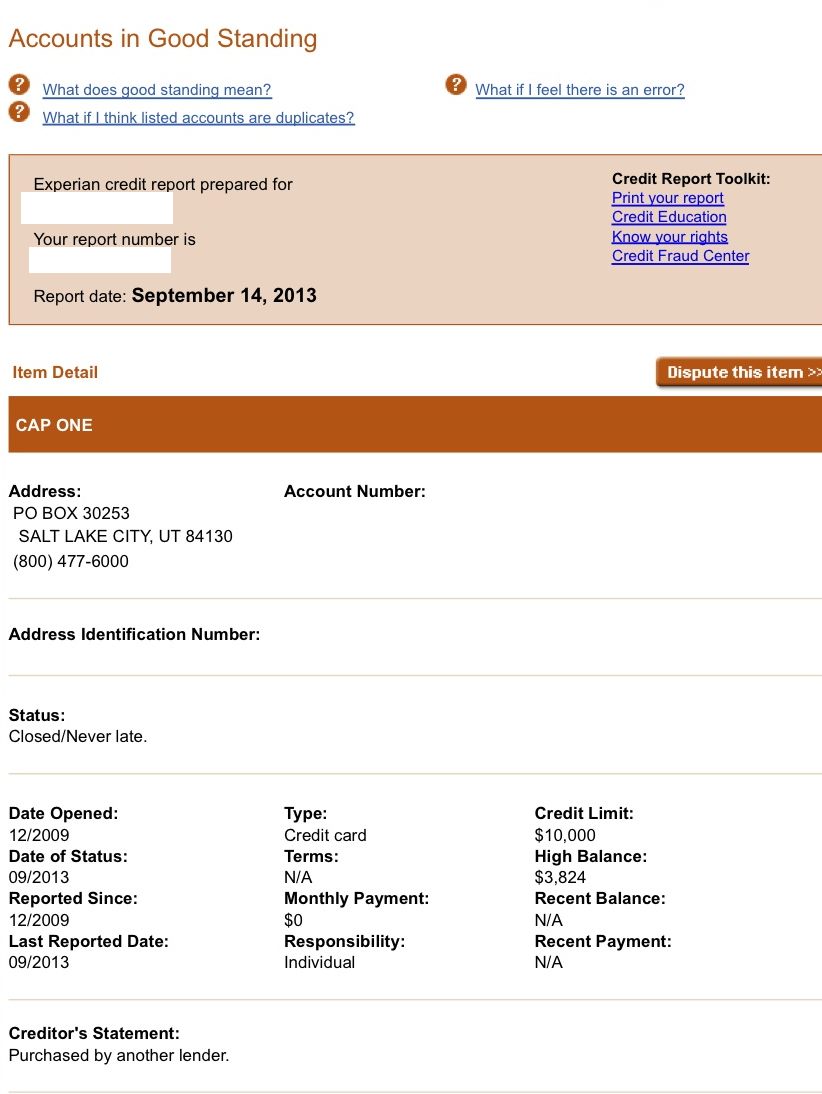

@mnavas wrote:My mom was checking her EXP report today and found out her Cap 1/Best buy appears as closed . It also says that the account was purchased by another lender.

I never thought they were going to close that Cap1/BBY tradeline. I thought that account was going to remain the same and that they were only going to change the lender's name. I guess another tradeline will pop up on her report (s) in the coming days (her account its active, same limit)

Cap1 closed your mom's account because they transferred it to Citi. I don't think your mom's account was closed. Tried to register your mom's account with Citi. I think the account is still open.

link:

http://www.bestbuy.accountonline.com

Ron.

Yeah the account is still open she registered her account on the Citi's website, The part that generates a little concern for her is the fact she will get another tradeline and like 09Lexie says this new account will ding her AAoA

I guess everyone who had a Cap 1/BBY is going to have this issue.,,,

I think Citi will report the orignial account open date. I don't think they will report the account as new. They might issue a new account number.

Ron.

Yeah i think so too but even if they report the original opening date. Her account is pretty new (10/2012) so this will drop her AAoA a little bit anywway. It might be a good thing for some people who have had this Cap1/BBY account open for a long period of time....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

@09Lexie wrote:

Lets think this through..BestBuy doesn't hold the financing Cap 1 did and have transferred the accounts to Citi. Your future payments will be sent to Citi, CLIs will be granted by Citi, etc.

Cap 1 will no longer be able to or have the legal right to update your CR's. the question is whether or not you will have the original open dates.

+1. Citi is your current issuer/lender of BBY card and RZMC.

Ron.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

@mnavas wrote:

@Ron1 wrote:

@mnavas wrote:

@Ron1 wrote:

@mnavas wrote:My mom was checking her EXP report today and found out her Cap 1/Best buy appears as closed . It also says that the account was purchased by another lender.

I never thought they were going to close that Cap1/BBY tradeline. I thought that account was going to remain the same and that they were only going to change the lender's name. I guess another tradeline will pop up on her report (s) in the coming days (her account its active, same limit)

Cap1 closed your mom's account because they transferred it to Citi. I don't think your mom's account was closed. Tried to register your mom's account with Citi. I think the account is still open.

link:

http://www.bestbuy.accountonline.com

Ron.

Yeah the account is still open she registered her account on the Citi's website, The part that generates a little concern for her is the fact she will get another tradeline and like 09Lexie says this new account will ding her AAoA

I guess everyone who had a Cap 1/BBY is going to have this issue.,,,

I think Citi will report the orignial account open date. I don't think they will report the account as new. They might issue a new account number.

Ron.

Yeah i think so too but even if they report the original opening date. Her account is pretty new (10/2012) so this will drop her AAoA a little bit anywway. It might be a good thing for some people who have had this Cap1/BBY account open for a long period of time....

I think it will drop until Citi report. I have had BBY card for almost ten years. It will hurt my AAOA when Cap1 reports. ![]()

Ron.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

@09Lexie wrote:

Lets think this through..BestBuy doesn't hold the financing Cap 1 did and have transferred the accounts to Citi. Your future payments will be sent to Citi, CLIs will be granted by Citi, etc.

Cap 1 will no longer be able to or have the legal right to update your CR's. the question is whether or not you will have the original open dates.

+1+1=2 ![]()

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

Citi gave me a CLI ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

I just checked my Experian report. Cap1 reported both of my BBY card and BBY RZMC as closed and transferred to Citi.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

Experian lists it as "transfered to another lender or claim purchased", and my FAKO PLUS score dropped 20 points. I hope my FICO scores aren't going to see a similar drop, or I am going to be very angry. The new TL should report in a few days for me. It is going to pull down my AAoA a little, even if it uses the old date. If it uses the new date, I am going to be very, very pissed off, and will request them to remove the account completely.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

I checked my reports on USAA and my Cap1 Best Buy card also is reporting as closed on experian, transferred to a new lender. No FAKO score change on USAA. No report yet from Citi showing up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap 1/Best Buy reporting closed on Experian due to Citibank transition

Be interesting to see how it ends up. The way it is occurring right now is definitely going to cause some problems for some people in some cases. Obviously, Capital One knows the right way of moving accounts which is essentially to change the lender on the account, or delete the old entry and dup entry with new lender. It is pretty much always handled this way. Capital One handled it correctly for the BB card and other HSBC cards. So either Citibank is requesting it done this way or Capital One is trying to stick it to Citibank or it is just temporary and it will be down correctly.

My recommendation is that you guys call Citibank (not Capital One) to complain now. They can fix this if they want. BTW, I can see why Citibank might want to do it this way vs. the way it was handled in the past. Have the old account as Capital One. New account as Citibank with original open date or new open date of BB card. With original open date of BB card on new account, they could argue it was fair (which isn't really true). As for the reason, it makes it easier for Citibank to handle past disputes. You call up and want to ask for 30 day lates to be removed from 1 year ago, then you need to call Capital One vs. Citibank. Saves Citibank the hassle of dealing with these complaints.