- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cap1 showing more BT offers!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap1 showing more BT offers...or not.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@UncleB wrote:

@Anonymous wrote:

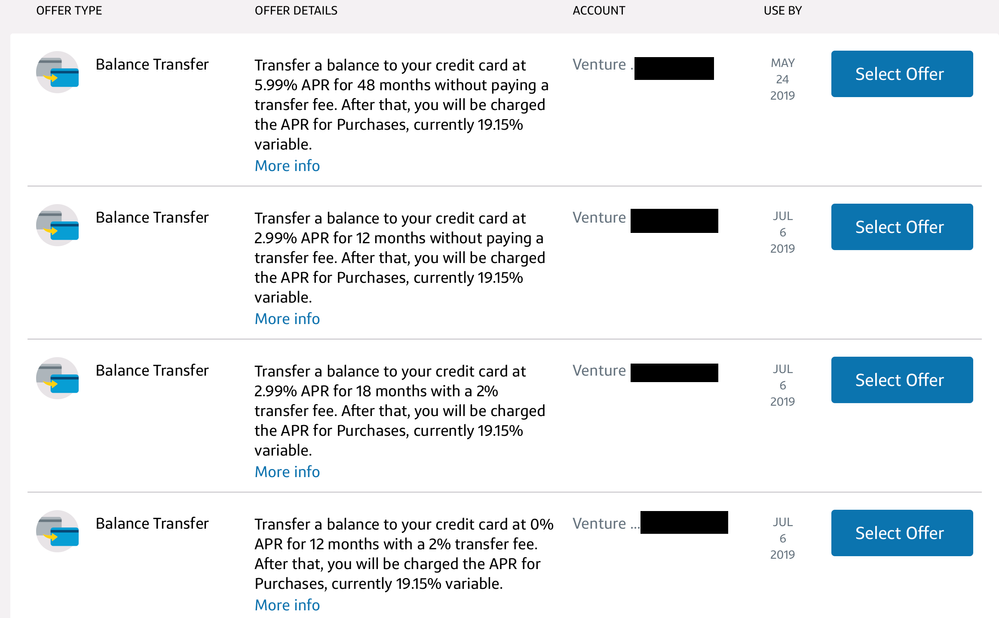

Too funny. I wonder if they'll keep coming until you use one or after awhile they'll get the hintThe offers above are on a card that currently has a balance on a 2% fee/18 month offer I took last August.

It's strange... my other two Capital One cards are older (one quite a bit so) and never have good BT offers. On the other hand, I got this one mainly for the bonus, but it's turned out to be valuable for BTs. ¯\_(ツ)_/¯

Hmmm, interesting. My QS also current has 2% fee/18 month offer that expires in August, the only BT offer on it now is no fee regular APR, which is low for Cap One. 15.15%, but still a big No Thanks. It has a high $20k CL from combining two $10k QS accounts a couple years ago. I always calculate my BTs to come in just under 49% of CL w/fees, learned the hard way to never let any card go to 50% as that's a big ding to your score. I hope I get those BT offers when I pay QS off. Funny thing is I just took a 3%/18 month BT on my Spark One, just barely under 49% of CL. and it has the 2%/12 month & 3%/18 month 0% APR offers on it, not gonna happen.

And BTs are pretty much all I use my QS & Spark cards for anymore, 1.5% reward cards don't cut it anymore.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@pizza1 wrote:Logged in to check my account, and I have 3 more BT offers. They really want me to use my limit I bet, lol...

Be wary. Capital One closed all my accounts one day. They never gave me an answer as to why, they said it was a "back office thing" and they're supposedly not informed as to what goes into "back office" decisions. But it was clear to me that the reason was my using some of their balance transfer offers in a way that was good for me but not profitable for them.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@SouthJamaica wrote:

@pizza1 wrote:Logged in to check my account, and I have 3 more BT offers. They really want me to use my limit I bet, lol...

Be wary. Capital One closed all my accounts one day. They never gave me an answer as to why, they said it was a "back office thing" and they're supposedly not informed as to what goes into "back office" decisions. But it was clear to me that the reason was my using some of their balance transfer offers in a way that was good for me but not profitable for them.

@SouthJamaica , ouch! really?? Thats kinda shady. I'm assummimg you took advantage of one and paying it off well before the end of the BT offer?? All of the offers have some fee or interest rate associated witht it, so they are getting something. Did you have similar offers?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@pizza1 wrote:

@SouthJamaica wrote:

@pizza1 wrote:Logged in to check my account, and I have 3 more BT offers. They really want me to use my limit I bet, lol...

Be wary. Capital One closed all my accounts one day. They never gave me an answer as to why, they said it was a "back office thing" and they're supposedly not informed as to what goes into "back office" decisions. But it was clear to me that the reason was my using some of their balance transfer offers in a way that was good for me but not profitable for them.

@SouthJamaica , ouch! really?? Thats kinda shady. I'm assummimg you took advantage of one and paying it off well before the end of the BT offer?? All of the offers have some fee or interest rate associated witht it, so they are getting something. Did you have similar offers?

The offers had no balance transfer fee, and surprisingly they charged no interest if you paid them back before the next statement cut. So that's what I did. It was nice for me, but produced no money for them. Of course they could have charged me interest and that would have been ok, but instead they closed my accounts.... one of them a checking account I'd had for > 15 years with a different bank that Capital One had acquired.

But they never had the integrity to say why they did it.

In view of Capital One's lack of integrity and professionalism, and refusal to give the reason as they are legally required to do, I would be very wary of accepting "offers" from a lender like that.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

They must like you @pizza1

Transfer a balance to your credit card at 0% APR for 12 months with a 2% transfer fee. After that, you will be charged the APR for Purchases, currently 20.15% variable.

Is the only one I have beyond their usual "Transfer a balance at your current purchase APR!" which, no; I'm a little tempted to see if I can take a chunk off my auto loan but I'm paying that off whenever the market is up or flat anyway and leaving a maxxed out credit card for 12 months would sort of ruin my silly FICO games that I'm playing currently... so doesn't really make a lot of sense financially and would mess up my hobby.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

Still no BT offers for me. It could be that I rarely use my Savor and QS now. I would love an offer for my QS as the card really serves no use besides it’s 15k limit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

they want to see you use some of that close to 50k cl you have on that card and this is their way or trying to get you to do it.. would still personally move your personal loan from penfed to the 48 month at 5.99 as savings would be huge. Sorry had to throw that out here again ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@CreditCuriosity wrote:they want to see you use some of that close to 50k cl you have on that card and this is their way or trying to get you to do it.. would still personally move your personal loan from penfed to the 48 month at 5.99 as savings would be huge. Sorry had to throw that out here again

cant...its expired now. Im super weird about having high revloving debt showing lol...![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

@Anonymous wrote:Still no BT offers for me. It could be that I rarely use my Savor and QS now. I would love an offer for my QS as the card really serves no use besides it’s 15k limit.

Same exact thing taking place on this end as well in well over a year now.

I used it this week for to place spend in the column then same week PIF and back to SD again.

Pitiful that Capital One doesn't cover the whole circle by encouraging more than the status quo they tend to lock theirself into with some accounts.

And then there's that notorious triple pull threat always waiting to dock your CRA's across 3 bureaus. Ugh.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap1 showing more BT offers!

Anyone noticed something odd with their offers?

I had a 2% fee BT offer that disappeared all of sudden.

When Pizza1 posted this, I noticed different BT offers again.

I checked yesterday, and they were all gone except the one to transfer at the full rate (15.xx%).

The only thing that changed is the activity on the card. The offers seemed to be there when I had NO activity. As soon as a made a purchase, the offers disappeared both times. Is that weird or what?

I'm going to pay off the small balance and see if they come back.

ETA: the expiration of the BT offers where end of May for the first one, and the last ones were supposed to expire in July or August, I think.