- myFICO® Forums

- Types of Credit

- Credit Cards

- Capital One CLI questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One CLI questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

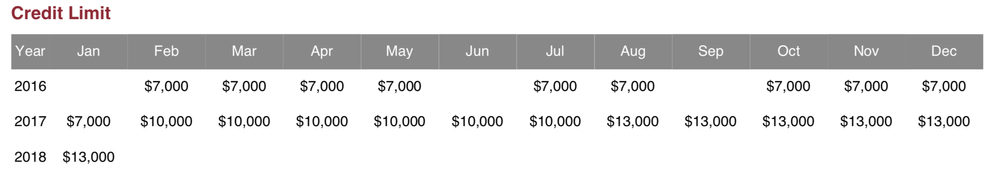

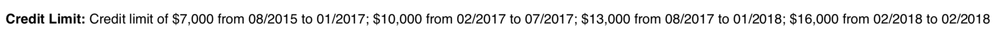

Here's a screen capture from my Equifax report pulled in Feb 2018:

And from my Transunion report, also from Feb 2018:

I'm not seeing any limit history on my Feb 2018 Experian report. But the Feb 2017 report has lines like this: Between Feb 2015 and Dec 2016, your credit limit/high balance was $7,000. I'm not sure how to interpret that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

Agreed that CCCs can see your credit limit history when looking at your CR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

I have considered the Uber and am still considering it. It's very difficult to pass up that SUB though, since I can easily hit it in a month. If Barclay would PC my Apple Rewards to an Uber I'd do it in a heartbeat and stay in the garden. But, they won't PC...

I've been considering getting both and then downgrading the Savor to Savor One before the AF hits.

The only reluctance I have with the Uber card is Barclays. They don't seem to give out big SLs under the best of circumstances and clearly don't love my profile. I only got a $1500 SL for my Apple Rewards card and the recon was declined. I had a $5K purchase planned for it. So, at the end of the day I got an HP and a new account to go right into the sock drawer. Can you tell I'm bitter? I ended up putting the charge on my QS

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

@HeavenOhio

Well, that's pretty definitive then......a well-answered question. To follow up, do you know what effect those have on approval consideration for new CC's or on SL for those CC's? This would be very helpful info.

Sock Drawered

On Deck: No Plans Currently

On Deck: No Plans Currently

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

@HeavenOhio wrote:Here's a screen capture from my Equifax report pulled in Feb 2018:

And from my Transunion report, also from Feb 2018:

I'm not seeing any limit history on my Feb 2018 Experian report. But the Feb 2017 report has lines like this: Between Feb 2015 and Dec 2016, your credit limit/high balance was $7,000. I'm not sure how to interpret that.

Lol I feel so blind right now. I totally never noticed those fields on mine! I guess my eyes were always darting for DOFD and removal dates.

Although I just looked and my SSFCU and NFCU accounts have them but they’re only reported occasionally. Discover doesn’t report it at all. Capital One reports it every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

@Taurus22 wrote:@HeavenOhio

Well, that's pretty definitive then......a well-answered question. To follow up, do you know what effect those have on approval consideration for new CC's or on SL for those CC's? This would be very helpful info.

I think escalating credit limits may very well be looked at by institutions like PenFed with it's "pyramiding debt." And I think the fact that I increased my limits from 10.5k to 53k in five months might have had to do with them giving me a 6.2k CLI rather than the 7k I requested. ![]()

@Anonymous, your limit is "reported" every month. It has to be in order to determine your utilization. How the bureaus opt to keep this information around is another story, though.

For the banks that only showed limits "occasionally," is it possible that those limits coincided with CLIs?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

I will have to wait for my next annual report before I can say for sure that CLIs caused Disco to report my limit since I didn’t get one from Disco until December and I pulled the report before my bill cycled in January. Same with NFCU and my cashRewards which only shows the original $3000 in September but at least shows something unlike Disco.

SSFCU has very sporadic reporting of the same $5000 limit I started with.

Capital One reported limits every month except for one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

Is it possible that you had balances of zero during the months where the limits don't appear?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI questions

@HeavenOhio wrote:Is it possible that you had balances of zero during the months where the limits don't appear?

For SSFCU, yes because it was pretty much SD after SUB but NFCU and Disco, no. Disco has been used every single month since I got it and it was my AZEO reporter as well.