- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Capital One Dispute and it takes the disputed ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Dispute and it takes the disputed amount from the CL

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One Dispute and it takes the disputed amount from the CL

Capital One is my worst card when it comes consumer protection and how it handles disputes. The disputed amount was paid off a while back and I was working with the merchant to make things right and it took over 2 months until I filed a dispute. My account is only used for a cellphone bill or make larger purchases and for me to pay those amts off within the month, as I dont like to leave a balance on the account.

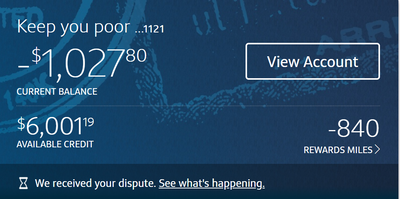

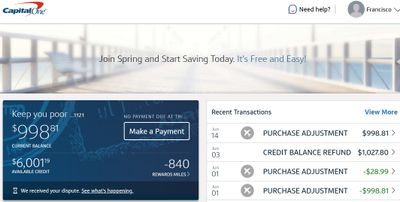

Any other CC company, would not take away the amount from a consumers CL. The balance on my account was $0 with a CL of $7k, after I file the dispute I have a balance of -$1,027.80 and CL of $6,001.19. I called and asked why is my CL at $6,001.19 and Cap 1 rep states, I have a credit and the reason why my CL is to lower the risk away from Cap 1, in case the dispute is doesnt go in my favor. I tell Cap 1, well even though you have issued me a credit, you have not given me that credit in a form a check or back to my bank account? Why not issue the credit and add it to my current CL and not screw with my CL? All others that I have disputed with issue a credit and add to the current CL and never subtract from current CL. Never have I dealt with this crap before...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

This is the very reason why you don't use subprime lenders such as cap1... I would get their sub and go.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

Your credit limit is still $7k. You can charge up to the negative balance without it changing the available credit.

If you had a -$1k balance and a CL of $7k you would actually have a CL of $8k. This only happened because you paid the balance in full and had no other charges.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

Just wanted to say love how you named the account Keep you poor...lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

I'm so sorry to hear that. Thank you for sharing because I have another reason to steer clear of applying for another card with them.

(+102) |

(+102) |  (+106) |

(+106) |  (+151)

(+151)| TU Fico 9: ? | Exp Fico 9: ? | EQ Fico 9: ?| EQ Fico 8 Bankcard: TBA

Initial Goal: Min. 740 w/all CRAs - Met

Interim Goal: 780 w/all CRAs - Met

Current Goal(s): Min. 800 w/all CRAs

Gardening Until: ??/??/202?| Last App: 10/20/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

@GatorGuy wrote:Your credit limit is still $7k. You can charge up to the negative balance without it changing the available credit.

If you had a -$1k balance and a CL of $7k you would actually have a CL of $8k. This only happened because you paid the balance in full and had no other charges.

@GatorGuy I understand but the point I am trying to make, they credited me $1k but take it away from the CL to take away risk from them? The risk is on me if I charge up on the negative balance and they side with the merchant. I am not going to use this card untill the dispute process is over. If they side with me I will just request a refund check and be done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

They should have just not given you a provisional credit at all. Since you already paid it off they had no obligation to credit anything until after the investigation was completed. Instead of doing that they took the credit out of your credit limit which puts you in the situation of not actually receiving a provisional credit and having funky looking accounting too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL

@Anonymous wrote:They should have just not given you a provisional credit at all. Since you already paid it off they had no obligation to credit anything until after the investigation was completed. Instead of doing that they took the credit out of your credit limit which puts you in the situation of not actually receiving a provisional credit and having funky looking accounting too.

Agreed and I just received a check for $1,027 and some cents from Cap 1 in the mail yesterday. I am going to need to cash the check and put into the bank account that makes payments to Cap 1 and just hold this money. I am finding this who process with Cap 1 shady AF. Its almost as if they are going to deny the dispute and I am left with the balances of $1,027 that they removed from my credit line and the check they sent me, will pay for that balance. If they agree with my dispute and side with me, that still leaves a balance of $1,027 on my credit line, they are going to make me whole again and put that Credit line back to $7k. Just shady complete screwed up process with Cap 1 here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Dispute and it takes the disputed amount from the CL (Update)

Go figure as soon I cash the check and I look at my Cap1 balance, they repost the charge. 90 days to investigate and have my rebuttle on what the merchant stated is not happening here. Cap1 is just putting back the charge on my account. By far the worst card I have when it comes to the dispute process, funny how they have not given me my points back for spending and still left me at negative ...