- myFICO® Forums

- Types of Credit

- Credit Cards

- Capital One QS1 - Credit Lines Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One QS1 - Credit Lines Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

Moral of my story is that you can get one of their MC's up to that range. I'm hoping for a WMC when I combine in my $3k QS1 (that was my starting limit on that one).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

@Anonymous wrote:

his point is that the QS1 won't get as high as the QS. he wasn't trying to be negative.

Yeah, I know that QS1 is a lower tier card... I'm just curious if people out there who do have the QS1 hit a cap on CLI or whether it's possible to get a big jump. Ideally, I would love to see them increase my $1500 QS1 to $3500 or $4500 in my next increase due Oct 14. I've only seen on person specifically mention going from $1k to $2k and then from $2k to $6k on the QS1... my entire goal will be to combine it with a prime card just as soon as I can get approved for one.. which is probably realistic in 2014 based on the score jumps I expect in the next 60 days.

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

They won't reward you, believe me. I have 2 cards with them $750 and $2000 both QS1 (one was originally Orchard) and could NEVER get more than a few hundred dollar CLI if any at all. However, I have the Venture with $20k limit and QS with $10k. Yet if I ask for a CLI on either of the first 2, no go![]() I stopped trying to figure their logic out.

I stopped trying to figure their logic out.

Last app 09/21/2021. Gardening Goal Oct 2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

How do

@dallasareaguy wrote:

Once the line hit $1500, I have been using that card like a mad man... running $17,000 through the card and constantly paying PIF 2-3 times monthly.

I'm new with this credit thing. How do you run $17K on a $1,500 credit limit line? Obviously no one pointed this out. Perhaps I'll learn something here today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

@Anonymous wrote:How do

@dallasareaguy wrote:

Once the line hit $1500, I have been using that card like a mad man... running $17,000 through the card and constantly paying PIF 2-3 times monthly.

I'm new with this credit thing. How do you run $17K on a $1,500 credit limit line? Obviously no one pointed this out. Perhaps I'll learn something here today.

I pay my car payment, all groceries (family of 5) .. all gas.... utility bills... etc.. I'm averaging about 3-4k a month in charges. My limit was raised to 1500 in April... so about 14k has run through since April. I pay the balance off at least once a week.. sometimes as often as twice a week... but at least 2-3 times per month.. I have a capital one branch two blocks from my house... so 50% of the time I make cash payments.. the other.... via ACH. I have received $255 in cash back rewards to date... which is $17,000 in charges at 1.5%.. that is via 11 months... my anniversary is October 14th (1 year)

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

@Anonymous wrote:How do

@dallasareaguy wrote:

Once the line hit $1500, I have been using that card like a mad man... running $17,000 through the card and constantly paying PIF 2-3 times monthly.

I'm new with this credit thing. How do you run $17K on a $1,500 credit limit line? Obviously no one pointed this out. Perhaps I'll learn something here today.

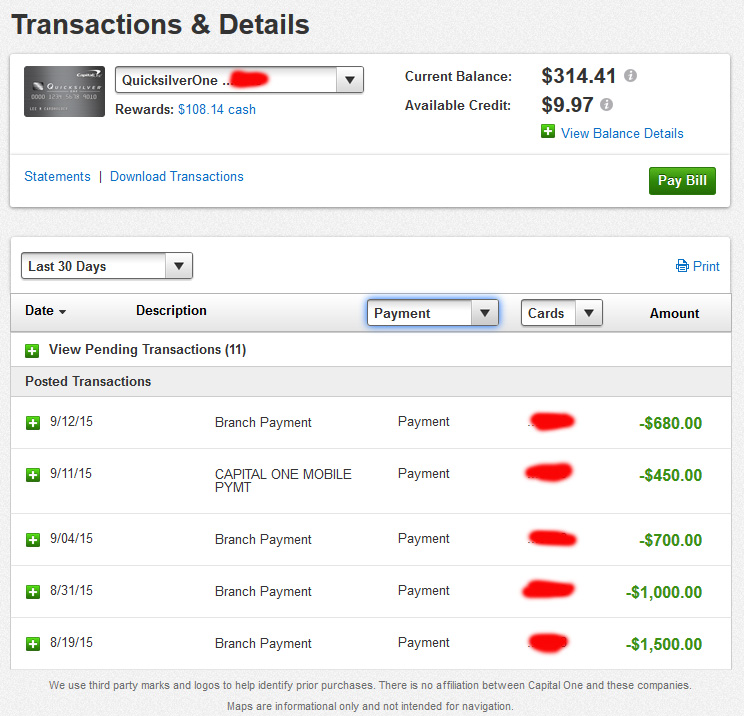

So here is an example... of my snapshot today.. I just made a $1200 deposit tonight because I've used all my credit, but here is my last 30 days deposits. When I get low.. I add more.. basically use this card for everything to pile up rewards. I had one cashout thus far for $147.. now I have 108 in rewards.

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

Well if you are in my shoes and can't get a card currently better than QS1... why wouldnt I put basically every living charge I can possibly put through on that card... the 1.5% cashback isn't as amazing as AMEX, Discover and some of the better prime cards.. but I look at it as free money I'm throwing away if I don't run every little thing through that card. I book all my kids athletics, trips, hotels, everything through that card... if they would give me $3500-$4500 limit I just wouldnt have to pay the card off multiple times a month.. I could just PIF on statement due date ![]()

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One QS1 - Credit Lines Question

What I meant is, As long as it remains a QS One, it will remain in that lower end category. Get it product changed to a Quicksilver and give it a go.