- myFICO® Forums

- Types of Credit

- Credit Cards

- Capital One Quicksilver slashing benefits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Quicksilver slashing benefits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

Same thing with my Secured MC. Which is weird, because I didn't even knew that card has those benefits. Also on the Cap1 benefits guide page (https://www.capitalone.com/credit-cards/benefits-guide), it list all types of accounts (WEMC, Visa Sig) but no Platinum MC (only business platinum), so I thought that they didn't offer anything in the first place. Also have a QS1, and also didn't knew it had this type of benefits.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@Hex wrote:I don't think it's Cap1 just catching up. They nerfed EVERYTHING. I don't think

this will apply to QS cards that were obtained for "excellent credit" but it will apply to the other QS's and PC'd Platinum/QS1's. The loss of the rental insurance is probably the worst thing. Many people get their first cards to have for car rentals. I don't use my PC'd QS much. I have other cards with benefits so it doesn't effect me but this is horrible for builders.

If you have collision on your regular auto insurance, then that will cover any incidents with rental cards. Now, if you don't own a car and have auto insurance, well, that's another issue.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@crednub Interesting . . . I didn't know that and hadn't heard it . . . good information -and- thanks for posting!

Current FICO 8 Score in 06/2021: EQ-796, TU-806, EX-812

Goal FICO 8 Score in 06/2022: EQ-825, TU-850, EX-850

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@designated_knitter wrote:

@Hex wrote:I don't think it's Cap1 just catching up. They nerfed EVERYTHING. I don't think

this will apply to QS cards that were obtained for "excellent credit" but it will apply to the other QS's and PC'd Platinum/QS1's. The loss of the rental insurance is probably the worst thing. Many people get their first cards to have for car rentals. I don't use my PC'd QS much. I have other cards with benefits so it doesn't effect me but this is horrible for builders.

If you have collision on your regular auto insurance, then that will cover any incidents with rental cards. Now, if you don't own a car and have auto insurance, well, that's another issue.

Its been a while since I read the fine print on what the World and World Elite coverage for rental cars, but if I recall correctly, even if you have auto insurance (I do), it comes in handy as it will then cover your policy's deductible (which in my case is $500). I'll need to reread the fine print. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@designated_knitter wrote:

@Hex wrote:I don't think it's Cap1 just catching up. They nerfed EVERYTHING. I don't think

this will apply to QS cards that were obtained for "excellent credit" but it will apply to the other QS's and PC'd Platinum/QS1's. The loss of the rental insurance is probably the worst thing. Many people get their first cards to have for car rentals. I don't use my PC'd QS much. I have other cards with benefits so it doesn't effect me but this is horrible for builders.

If you have collision on your regular auto insurance, then that will cover any incidents with rental cards. Now, if you don't own a car and have auto insurance, well, that's another issue.

I am an insurance adjuster and that isn't correct. If you damage a rental car they will bill you for "loss of use", "admin fee" and "diminished value". Your auto insurance will only cover the cost to repair the car, not these other bogus charges that I just listed which rental companies try to gouge you on. In fact they often send those charges to a debt collector called Purco which will harass you for those charges. The rental car coverage on a credit card covers those bogus charges so it is a very important benefit to have. If you have a credit card with that coverage always use that card when you rent a car!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@crednub wrote:If it is only the Platinum Quicksilvers, at least on the MC side, that are being effected then I guess I'll have another question to ask myself...

For a while now I've had recurring charges on those two cards just to make sure they didn't get closed for inactivity solely because I liked having backup cards with the benefits since most of my other cards have already had their benefits slashed. It was really just a matter of time until Capital One caught up and maybe it is time to let these starter cards wither away.

I do find it interesting that at least one person on reddit says they got a similar notice for their QS Visa. I wonder if it is also a lower-tiered Visa, similar to the Platinum MC, but I'm not as familiar with Visa's tiers as I am with MC. Was there ever a starter CapOne Visa that could PC to a QS Visa?

Specific to the bolded piece, Capital One has had several tiers (or flavors) for the Quicksilver card. They have been issued as QS Platinum MC, World MC, World Elite MC, Visa Platinum and Visa Signature. There were even some that migrated from HSBC which transitioned to either QS Platinum MC or V depening on the former product type.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@crednub wrote:If it is only the Platinum Quicksilvers, at least on the MC side, that are being effected then I guess I'll have another question to ask myself...

For a while now I've had recurring charges on those two cards just to make sure they didn't get closed for inactivity solely because I liked having backup cards with the benefits since most of my other cards have already had their benefits slashed. It was really just a matter of time until Capital One caught up and maybe it is time to let these starter cards wither away.

I do find it interesting that at least one person on reddit says they got a similar notice for their QS Visa. I wonder if it is also a lower-tiered Visa, similar to the Platinum MC, but I'm not as familiar with Visa's tiers as I am with MC. Was there ever a starter CapOne Visa that could PC to a QS Visa?

So, my bucketed, credit-steps, Plat PC'd to QS, did not get this notice with my May statement that just cut today. I checked all 15 of my statements and found no notice of this, yet. I am sure it will come, but not quite yet for me.

I will be sad if this ends, as I found it quite useful, even though I have full coverage via my own insurance. Any claims likely increase premiums, so it is nice to have it included with a CC.

My luck, they will tell me in my Sept or October statement 😆

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@designated_knitter wrote:

@Hex wrote:I don't think it's Cap1 just catching up. They nerfed EVERYTHING. I don't think

this will apply to QS cards that were obtained for "excellent credit" but it will apply to the other QS's and PC'd Platinum/QS1's. The loss of the rental insurance is probably the worst thing. Many people get their first cards to have for car rentals. I don't use my PC'd QS much. I have other cards with benefits so it doesn't effect me but this is horrible for builders.

If you have collision on your regular auto insurance, then that will cover any incidents with rental cards. Now, if you don't own a car and have auto insurance, well, that's another issue.

Not to mention some people only carry required/liabilty coverage (*raises hand*). I just bought a new to me vehicle, so I switched over to full coverage now, but my last car wasn't worth the collision coverage (recently I checked value and was about $100 bucks - salavged title, old, high milage, undesirable) and comprehensive wasn't even an option. So having rental coverage through a CC is really handy and like you mnetioned, some people do not even need to own a car and rent as needed, so they have no car ins, anyway.

Heck, when I started working in NH, insurance was not required at all and when I picked up the rental they refused to even look at my insurance card. When I brought my own vehicle, coverage was not required.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

As stated before, benefits have been disappearing for awhile. That includes CU cards as well.

Cap One is just following the trend. The problem for them, it's just making their offerings even more lackluster.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Quicksilver slashing benefits

@rgd51 wrote:

@designated_knitter wrote:

@Hex wrote: ... The loss of the rental insurance is probably the worst thing. Many people get their first cards to have for car rentals ...If you have collision on your regular auto insurance, then that will cover any incidents with rental cards. Now, if you don't own a car and have auto insurance, well, that's another issue.

I am an insurance adjuster and that isn't correct. If you damage a rental car they will bill you for "loss of use", "admin fee" and "diminished value". Your auto insurance will only cover the cost to repair the car, not these other bogus charges that I just listed which rental companies try to gouge you on. In fact they often send those charges to a debt collector called Purco which will harass you for those charges. The rental car coverage on a credit card covers those bogus charges so it is a very important benefit to have. If you have a credit card with that coverage always use that card when you rent a car!

@Anonymous wrote:

Not to mention some people only carry required/liabilty coverage (*raises hand*). I just bought a new to me vehicle, so I switched over to full coverage now, but my last car wasn't worth the collision coverage (recently I checked value and was about $100 bucks - salavged title, old, high milage, undesirable) and comprehensive wasn't even an option. So having rental coverage through a CC is really handy and like you mnetioned, some people do not even need to own a car and rent as needed, so they have no car ins, anyway.Heck, when I started working in NH, insurance was not required at all and when I picked up the rental they refused to even look at my insurance card. When I brought my own vehicle, coverage was not required.

Agreed that assuming your car insurance will always cover a rental car might lead to some unpleasant surprises. ![]() Exactly what is covered and the overall implications can be complicated.

Exactly what is covered and the overall implications can be complicated.

- First, make sure your policy doesn't have an exclusion for rental car coverage. Don't just assume. Especially if you have a discounted policy, this might be one insurance cost that is being passed back to you.

- While your personal car insurance may cover a rental car for US-domestic rentals, it often won't apply if you rent internationally. Also, some credit card coverages may be limited for international rentals. A specialized policy or purchasing a CDW may be needed.

- Your personal car insurance may normally cover a domestic rental car ... but only subject to the same coverages you have on your personal policy. To rephase what @designated_knitter said, if you only have liability coverage, you could be responsible for any collision and comprehensive damage.

- Most car insurance (and credit card primary or secondary insurance) have time limitations on how long a rental car is covered. Read the fine print of your policy or benefits but especially before you rent for more than a couple of weeks.

- Your personal car insurance policy may not cover damage to a rental car if you're using it for business purposes.

- Your personal car insurance will normally cover a rental car in the same class as what you currently drive. If your insurance is on a 10-year old economy car and you rent an expensive new luxury car, it might not fully cover the damages. Again, read the fine print for exclusions. Your policy may also have a cap on the covered value of the vehicle.

- Your personal car insurance may not cover those additional costs pointed out above by @rgd51 such as the rental car company's loss-of-use of the car until it is replaced . Some credit cards, especially those with primary coverage, may provide better protection.

- If you cover a rental with your personal car insurance, it will be subject to your paying your normal deductible (probably between $100 to $1000) and filing a claim might affect your future rates. Secondary car insurance provided by a credit card will normally reimburse you for the deductible. However, your future insurance rates might still be affected. Primary insurance coverage (such as on Chase Sapphire Reserve) directly covers an accident without having to file claims with your personal insurance company, and protects you from obligation to pay a deductible and from possible changes to your insurance rates.

- Neither Rental Car CDW coverage or credit card insurance coverage normally cover damage to vehicles or property besides the rental car, or for injuries and medical payments. Personal insurance might be helpful to fill that gap.

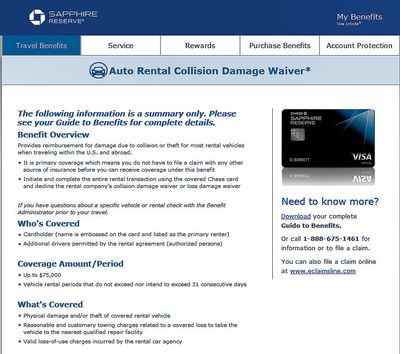

Even though I have a good personal auto insurance policy, I picked my Chase Sapphire Reserve in part for the excellent rental car coverage.

- Coverage is primary and included in the AF cost, not "available for additional purchase."

- Coverage is valid for vehicles worth up to $75K.

- Coverage is valid for rental periods up to 31 days.

- Covers theft, damage, valid loss-of-use charges, administrative fees, and reasonable and customary towing charges.

- Benefit is available in the US and most foreign countries. (*"If you have questions, contact the Benefits Administrator before you travel.")

https://www.chase.com/card-benefits/sapphirereserve/travel

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.