- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cash advance limits

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cash advance limits

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Cash advance limits

Hi all,

So I've been working on my credit and eventhough Im on a dirty profile, I've been pretty blessed to have the cards that I like and would want to keep.

I've noticed the variance in my cash advance limits and am here seeking insight. Is the limit a reflection of your credit worthiness, relationship with the lender or just more about the lenders practices? Perhaps it's a combination of factors? Let me add that I'm not planning on using a cash advance. Maybe-as is typical for me-I'm over analyzing, but still wanted to pose the question to the community for feedback.

Cards with cash advance:

NFCU -$32k sl / $9600 cash advance / 35 months old

AMEX- $40k sl/ $1200 cash advance/ 20 months old

BofA- $24 sl /$21k cash advance/ 39 years (I was fortunate to be added to my elderly relatives account)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

AMEX is known to be really stingy with cash advance limits. NFCU gives you 30% of the limit for cash advances. I don't know about BoA's policies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

Thank you for the info. I was wondering about that Amex. They're kinda particular.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

@Anonymous wrote:Thank you for the info. I was wondering about that Amex. They're kinda particular.

I have a $400 limit on my $5K BCE, $200 on my $3K Cash Magnet, $2800 on my $14K Business Amazon Prime. They definitely don't like cash advances and you can tell because of the small limit and the fact you can't even see your cash advance limit easily on the website. I had to look at a statement for the two personal cards and my mailed documentation for my business card since a statement hasn't generated for that one yet to figure out what they were.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

I don't like them either...the interest starts accruing immediately on them if I recall correctly from my telemarketing days 25+ years ago 🤣

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

Fairly recent big thread on this topic with lots of data points.

Varies wildly by lender fpr the most part, slight correlation with credit worthiness but not really.

Can't find the thread myself right now...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

@Anonymous wrote:I don't like them either...the interest starts accruing immediately on them if I recall correctly from my telemarketing days 25+ years ago 🤣

Yeah that's how the interest works on them. I actually took a $450 advance on my NFCU Platinum card back in April to cover some things because I didn't think a deposit was going to post in time and I paid it off the same day and got hit with $.10 of interest on my statement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

@Anonymous wrote:AMEX is known to be really stingy with cash advance limits. NFCU gives you 30% of the limit for cash advances. I don't know about BoA's policies.

BoA can use several factors but the product line is relevant. It can be anywhere from 10% on for example the BBR or up to 40% of the card's current CL on other cards like the Premium Rewards or the Cash Rewards variants.

FICO 8 (EX) 846 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

@Anonymous wrote:Hi all,

So I've been working on my credit and eventhough Im on a dirty profile, I've been pretty blessed to have the cards that I like and would want to keep.

I've noticed the variance in my cash advance limits and am here seeking insight. Is the limit a reflection of your credit worthiness, relationship with the lender or just more about the lenders practices? Perhaps it's a combination of factors? Let me add that I'm not planning on using a cash advance. Maybe-as is typical for me-I'm over analyzing, but still wanted to pose the question to the community for feedback.

Cards with cash advance:

NFCU -$32k sl / $9600 cash advance / 35 months old

AMEX- $40k sl/ $1200 cash advance/ 20 months old

BofA- $24 sl /$21k cash advance/ 39 years (I was fortunate to be added to my elderly relatives account)

Lender's practices. Period.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cash advance limits

@Anonymous wrote:

@Anonymous wrote:Thank you for the info. I was wondering about that Amex. They're kinda particular.

I have a $400 limit on my $5K BCE, $200 on my $3K Cash Magnet, $2800 on my $14K Business Amazon Prime. They definitely don't like cash advances and you can tell because of the small limit and the fact you can't even see your cash advance limit easily on the website. I had to look at a statement for the two personal cards and my mailed documentation for my business card since a statement hasn't generated for that one yet to figure out what they were.

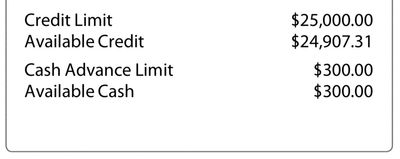

@Anonymous you've got it made with those AMEX CA limits! 😂 Look at my BCP!

FICO 8 Sep '23 EX 755 EQ 765 TU 739

TCL $199,800