- myFICO® Forums

- Types of Credit

- Credit Cards

- Changes coming to Amex Pay Over Time

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Changes coming to Amex Pay Over Time

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

I guess I just don't really understand what they're going for with the hybrid setup. If there's no longer any transaction threshold for POT it's a standard CC essentially. In fairness, they really don't market the consumer Gold/Green/Platinum as charge cards anymore and haven't in a little while, so I guess the move to revolving makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

@kdm31091 wrote:I guess I just don't really understand what they're going for with the hybrid setup. If there's no longer any transaction threshold for POT it's a standard CC essentially. In fairness, they really don't market the consumer Gold/Green/Platinum as charge cards anymore and haven't in a little while, so I guess the move to revolving makes sense.

Except that POT isn't always assigned to all accounts. Some accounts will have no POT options and individuals also have the capability to disable it if they choose to do so. By and large, during any AA, AENB can also remove the POT feature so this renders the "move to revolving" as not a universal SOP. Otherwise, all accounts would be assigned the POT feature.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

Thanks for sharing @ChargedUp

I wonder if this is only for Gold Card customers as I did not get that notification on my Plat.

I have a POT limit on my Plat of $35K and it's been there forever. I gotta say it was like maybe 10 years ago I got an email about "Turn on POT and charges over $100 will automatically go to that payment method" and I said yes. I use my card a lot for work and sometimes the reimbursement on my expense reports doesn't align to the payment due date so they've carried over when the statement hits and I eventually catch up once my reimbursement comes through. On those months, I am usually making more than 1 payment throughout the month.

My immediate instinct was to think that many people (perhaps not here but in general) may not notice and actually do make the minimum payment so they'll be paying more in interest on their $38 charge versus PIF when using POT. Seems like AMEX will make more in interest charges for people that don't recognize the difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

I got this email as well and it sounded to me like they were turning my Gold card into a revolver. That said, I've been enrolled in POT for at least a couple years and I don't think I've ever noticed a "minimum" payment amount below the total balance.

I always pay in full, so I don't suppose it matters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

@cashorcharge wrote:Thanks for sharing @ChargedUp

I wonder if this is only for Gold Card customers as I did not get that notification on my Plat.

Nope. Got the notice on my Platinum card. So come October 1, I essentially have a revolver with a $35k limit (PoT). Which is... OK, sure I guess?

American Express - No CLI or Appreciation Gift in 7 Years

Citibank - Handing Out Credit Limits Like Candy

Chase - Surprisingly, Still Tolerating My Credit-Chasing Ways

Bank of America - My Newest Bae.

Everyone Else.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

@cashorcharge wrote:Thanks for sharing @ChargedUp

I wonder if this is only for Gold Card customers as I did not get that notification on my Plat.

I have a POT limit on my Plat of $35K and it's been there forever. I gotta say it was like maybe 10 years ago I got an email about "Turn on POT and charges over $100 will automatically go to that payment method" and I said yes. I use my card a lot for work and sometimes the reimbursement on my expense reports doesn't align to the payment due date so they've carried over when the statement hits and I eventually catch up once my reimbursement comes through. On those months, I am usually making more than 1 payment throughout the month.

My immediate instinct was to think that many people (perhaps not here but in general) may not notice and actually do make the minimum payment so they'll be paying more in interest on their $38 charge versus PIF when using POT. Seems like AMEX will make more in interest charges for people that don't recognize the difference.

No problem!

I'm curious as to what charges they're going to allow to go POT now. My POT is $35K as well and they've literally allowed any charge over $100 to enter it, but the email states *some* charges under the threshold. I wonder if it'll be certain merchant categories?

I'd honestly consider using POT now and then if the interest rate wasn't so high! Especially as the Amex charge cards don't add into utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

I got a pop up around a month or two ago giving me bonus MR for enrolling in POT. I know I had it before that so not sure what it was about, but I accepted and since then my minimum payment is different. I had to change my auto pay setting to make sure the full statement balance was paid. Their terminology for that is also confusing so I got on chat to make sure I picked the correct choice.

Last app 09/21/2021. Gardening Goal Oct 2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

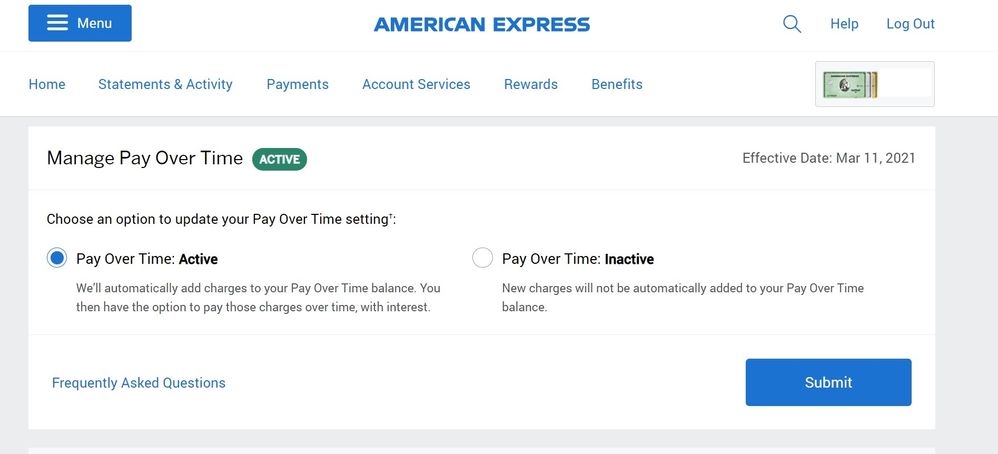

Ok, ground rules. Everybody who comments on their AMEX Charge cards needs to check their Pay Over Time status. A year ago, AMEX changed the naming of PoT, to Active or Inactive, moving away from Select and Direct. If your PoT is Inactive, you aren't going to see anything pushed into PoT.

On the AMEX website for your accounts, go to Account Services at the top tabs, then Payment & Credit Options on the left list of topics, then Manage Pay Over Time settings in the middle of the page. As of the end of 2020, all three of my Charge cards were "Inactive" for Pay Over Time. I took this step in 2020 as I didn't want anything inadvertently going to PoT.

For my Green card, I took the 20,000 MR offer to set PoT to Active in March 2021. My monthly statements since then have put all the charges into the Pay Over Time and / or Cash Advances summary on the right hand side of the monthly statement, even the $32 monthly MyFico charge. My Autopay is set to Pay In Full. My Gold card and Platinum card have not put anything into the Pay Over Time box, because PoT has been Inactive on those cards. I would have to select the items to push them into PoT. I put a Plan It on my Gold card, so now that is a third box / summary on that statement, for the Plan amount.

I accepted a recent offer for another 20,000 MR to turn on PoT for my Platinum card, and so that card now shows "active" in this window. The September statement just cut, and the PoT Active was recent enough that it hasn't started putting charges in that PoT box.

I don't expect my Gold card to change, as I still have that as Inactive on PoT ( until they offer me 20,000 MR to change THAT one to active ).

My suggestion for all is to change your AMEX autopayment setting to be "Adjusted Balance". That way you cover all the new charges, and the Plan It payment amount, and don't get stuck with Pay Over Time interest costs. But that's just me.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

I sense a lot of negativity in many people's posts about POT. I feel differently. It was enormously helpful to me during a financial rough patch and the fair and flexible way Amex handled my situation contributed to a sense of loyalty that I don't feel towards any other FI.

When I was falling deeper and deeper into CC debt several years ago, all of my non-Amex cards were essentially at their limits. My TCL on those cards was around $35k - $40k. I had had an Amex Green for more than a decade. It was my daily driver and, unfortunately, I got behind and couldn't PIF it every month... or any month. I just paid what I could each month and hoped for the best (not a wise tactic, obv.). Amex, on their own, moved my unpaid balance to POT each month. I don't know what my POT limit was, but I recall they kept raising it as I bumped into my own personal debt ceiling over and over. This went on for 4 or 5 years. All that time, the interest rate stayed reasonable -- around 15% I think -- and they never reported anything negative to the CRAs. At some point they sent me a letter saying I couldn't add any more to my POT balance, but it was around $38k so that seemed fair.

Eventually I got my debt under control, paid and/or BT'ed the balance down to zero, and have been a good little Amex PIFer for a couple of years. They have restored my POT privileges and set my POT limit at $50k.

Would I choose POT over PIF? Nope! And I am grateful to have the luxury of that choice now. But having POT as a safety valve when I couldn't manage with just my firm-limit cards probably saved me from BK. It's a nice feature that I hope to never use again.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Changes coming to Amex Pay Over Time

@Curious_George2 wrote:I sense a lot of negativity in many people's posts about POT. I feel differently. It was enormously helpful to me during a financial rough patch and the fair and flexible way Amex handled my situation contributed to a sense of loyalty that I don't feel towards any other FI.

When I was falling deeper and deeper into CC debt several years ago, all of my non-Amex cards were essentially at their limits. My TCL on those cards was around $35k - $40k. I had had an Amex Green for more than a decade. It was my daily driver and, unfortunately, I got behind and couldn't PIF it every month... or any month. I just paid what I could each month and hoped for the best (not a wise tactic, obv.). Amex, on their own, moved my unpaid balance to POT each month. I don't know what my POT limit was, but I recall they kept raising it as I bumped into my own personal debt ceiling over and over. This went on for 4 or 5 years. All that time, the interest rate stayed reasonable -- around 15% I think -- and they never reported anything negative to the CRAs. At some point they sent me a letter saying I couldn't add any more to my POT balance, but it was around $38k so that seemed fair.

Eventually I got my debt under control, paid and/or BT'ed the balance down to zero, and have been a good little Amex PIFer for a couple of years. They have restored my POT privileges and set my POT limit at $50k.

Would I choose POT over PIF? Nope! And I am grateful to have the luxury of that choice now. But having POT as a safety valve when I couldn't manage with just my firm-limit cards probably saved me from BK. It's a nice feature that I hope to never use again.

Can you be more specific where some of the perceived negativity is coming from @Curious_George2?

I see a lot of diverse opinions about POT in general. Some find good uses for it, some do not. And, that's ok. This is an open discussion that touches a variety of angles on how this new AENB change will pan out for lots of cardmembers. What am I missing?