- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase CSR Letter - Threatened to Close Account b/c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase CSR Letter - Threatened to Close Account b/c of refunds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

Ok, so I want to provide some more additional detail about this issue. There are two problematic months April and May.

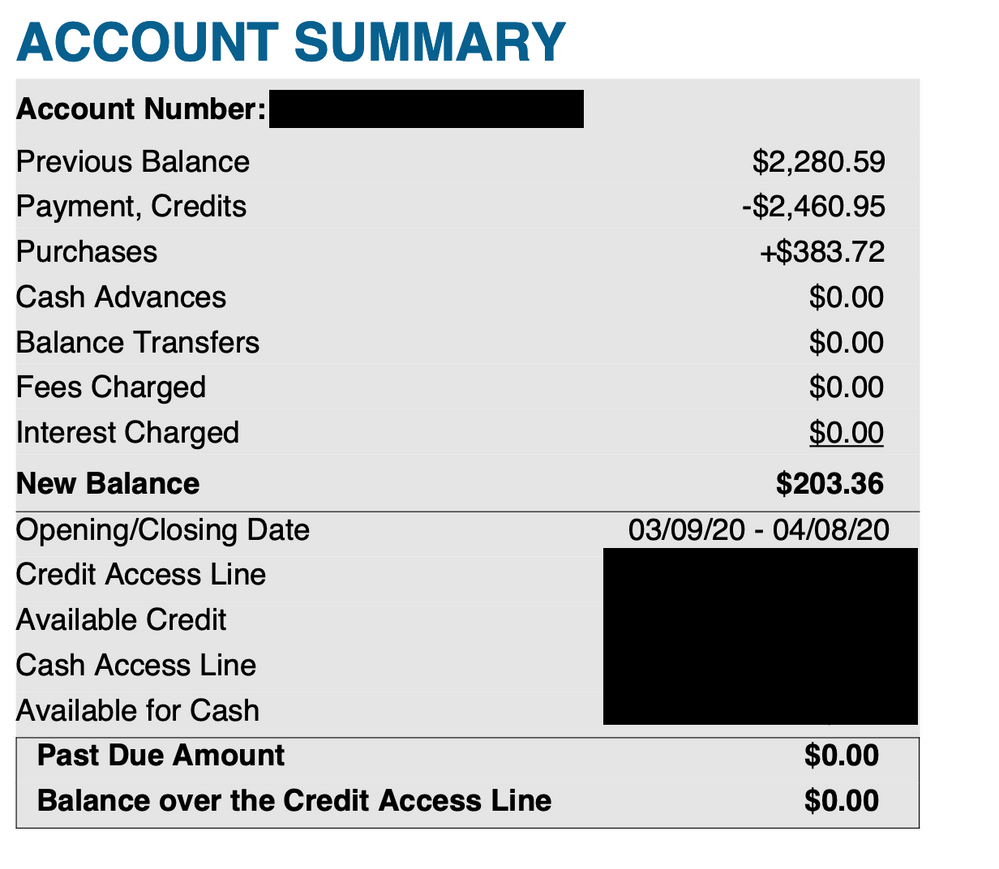

April Statement - Statement balance $203. Minimum payment $35

On April 9th received a $320. The total account balance was approx $-100. Nothing at all due. As of April 9th, how could I owe a minimum payment my account balance was in the negative? I continued to use my card as normal. No payments made.

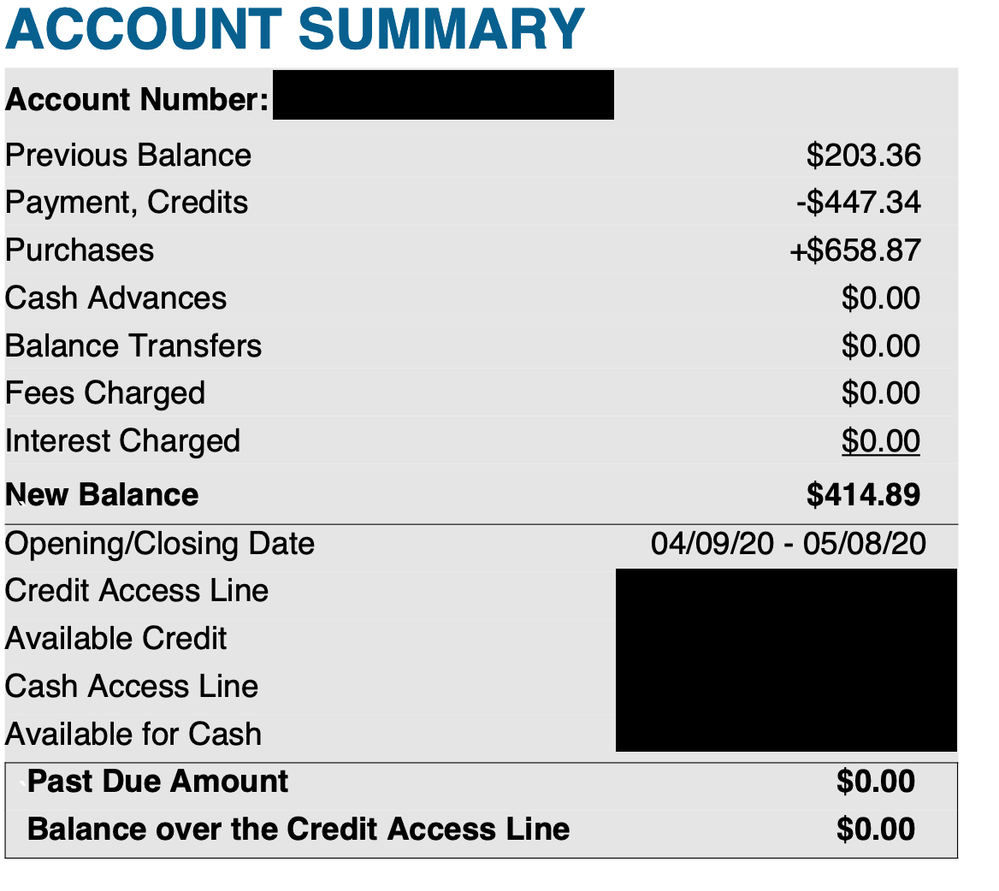

May Statement - Statement balance $414. Minimum payment $35.

Used card as normal, received three credits $448, $5.60 (x 2). After the credits posted, my account still had a balance of around $250. This month my account was not in the negative, but the credits fufilled the entire previous statement balance. No payment was made.

Both months the app/online showed $0 remaining statement balance and $0 remaining minimum payment due. No statement show any past due amount and show no amount subejct to interest charges.

April statement. I disagree that I could have possibly owed anything at all in April. The 4/9 credit brought my account into a negative balance. There is no logic as why any payment would be due at all.

May statement. I understand your logic that I still owed the minimum or statement balance. I disagree, but we can move on past that point.

Regardless, Chase treated this credits as payments. I relied on their system and their intrepretation of the cardmember agreement, based upon how their system processed the payments. If Chase wants to do things differently, then they should have showed that I had a remaining statement balance / minimum payment OR that my account was past due. None of these things happened. Expecting someone to pay a minimum payment when the bank owes you money is the most illogical thing I've ever heard before. But, it could make sense if Chase had this in their card member agreement, did not treat the credits as payments, or showed my account past due. There is none of this. Again, I would have paid, if Chase had put me on notice that I actually owed something.

April Statement Summary

May Statement Summary

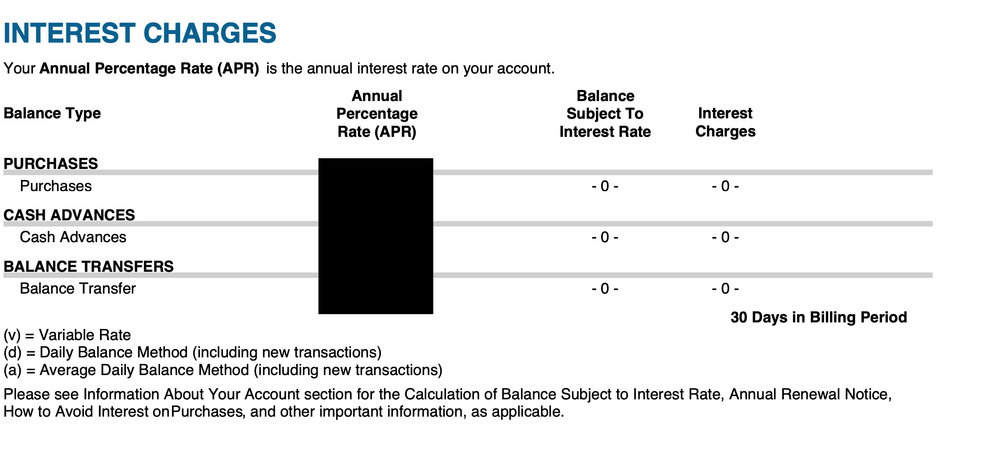

May Statement Interest Calculation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

It has nothing to do with caution, I ended up with a large credit after some school activities got cancelled for my daughter.

I called and asked, answer given to me was that I owe for current charges reflected on the statement.

Blast from the past credit can be used to offset future charges, or they can mail me a check.

As to why only minimum is being mentioned, well, minimum payment keeps you out of the hot water while you look over cardholder member agreement or bother with calling/secure message.

Obviously that approach must have worked as intended because I did not get a letter from Chase telling me my account is delinquent and could be potentially closed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

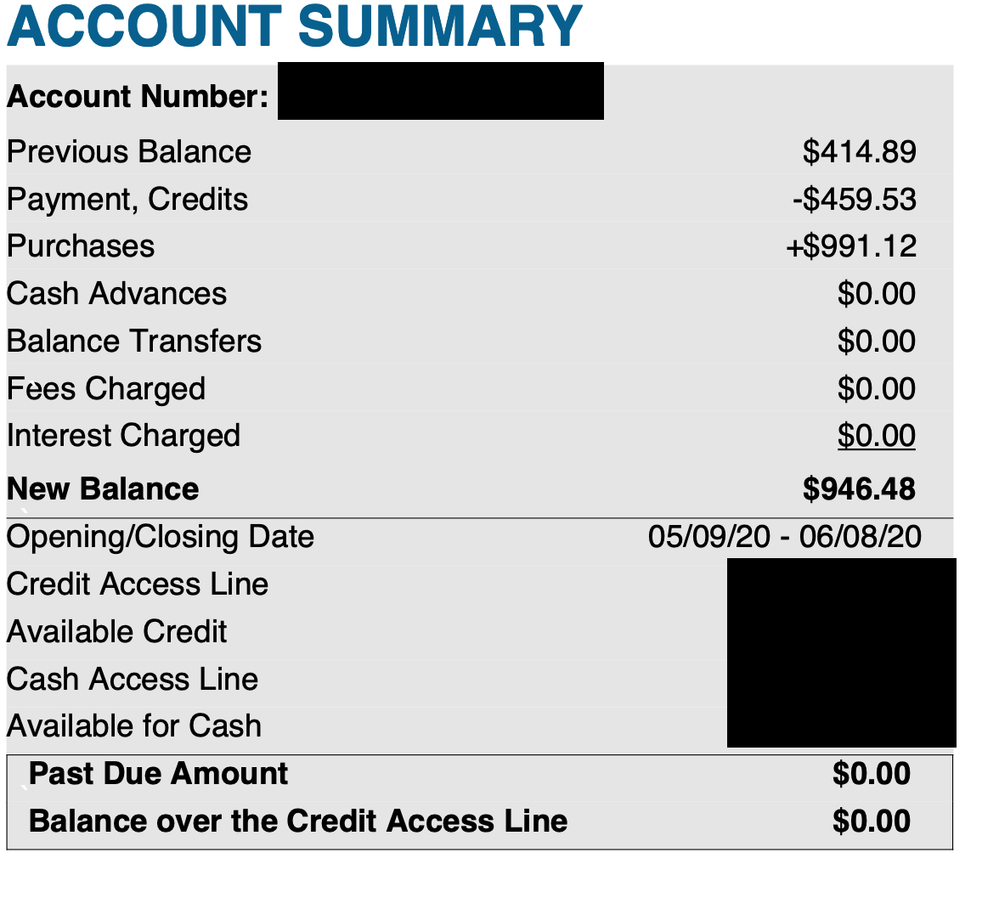

The June statement summary didn't post for some reason. Here it is.

June Summary

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

You already filed a complaint, right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Remedios Yes and I absolutely stick by my complaint. Quite honestly, I am shocked how many people on this forum think that I somehow am in the wrong. Even if I am (which I am not), Chase confused this issue so far that it is, without a doubt, unfair and depective at a minimum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

This thread reads like a Twilight Zone episode script.

Credit Cards 101: ALWAYS pay the statement minimum payment, regardless of account credits.

If you overpay, you simply charge your next tank of gas to use up the credit. Simple stuff.

Why you opted to go scorched earth over what could be an easy account fix eludes me. You're a lawyer. Surely you know that blowing this thing up will not end well for you.

Current scores (EQ, EX, TU): 787, 788, 796

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

I don't think anyone has stated that you are in the wrong (other than filing the CFPB complaint, particularly before they even have a chance to get back to you as they stated they would). But you're trying to apply common sense to the situation (I owed X and got credit of Y which was more than X), and common sense is not always what is laid out by bank policy. The account is now current and no adverse action was taken by Chase, so the net result is that this did not harm you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

The problem is that you're looking online. The statement that you get is what you should be going by. If I get a statement with a minimum balance, I will pay it, even if I got a credit inbetween. This is pretty common with credit cards and I imagine that many people are finding out the hard way now and will be educated by your thread. If this had happened with AMEX or Synchrony, your credit would have been affected for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Anonymous wrote:@Remedios Yes and I absolutely stick by my complaint. Quite honestly, I am shocked how many people on this forum think that I somehow am in the wrong. Even if I am (which I am not), Chase confused this issue so far that it is, without a doubt, unfair and depective at a minimum.

I really do not think this is issue of you being "in the wrong"

For all I know, they could have told me wrong thing, and I didnt need to make the payment.

It makes sense from the following perspective, I purchased goods, Chase paid on my behalf. Refund is issued to me, applied to my account, not to Chase. So, I pay chase, and merchant pays me.

The part where I personally think you're in the wrong, is jumping the gun proactively, when they are working with you, not against you.

Had you given them chance to complete the process on the backend, then filed a complaint because you think their practices are deceptive, that would be fine. Instead, you got offended, and really, there is no way to tell what possible ramifications may come out of your actions, not theirs.

I'm not in Lender Defense League, they arent my fuzzy buddies, but if someone is trying to help me, there is no need to pull the rug from underneath their feet.

Whomever you were working with may not be allowed further contact with you, due to the nature of your complaint.

You went from "hard to understand why it happened this way" to involving legal and compliance departments.

I wish you the best, I hope your accounts remain opened.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase CSR Letter - Threatened to Close Account b/c of refunds

@Caught750 wrote:

@tacpoly wrote:

@Anonymous wrote:I really don't agree. I didn't owe Chase anything. There was nothing to pay. The statement balance was paid by a credit. I get a grace period on all new purchases.

Regardless, I would have paid if Chase told me to. Instead their app and website said I had $0 remaining statement balance/$0 remaining minimum payment due. If Chase wants this policy they should update their app and website and the cardmember agreement.

I think you have a case if, after the credit posted, the app and site indicated that $0 is due. That change in amount due suggests that Chase applied the credit against the current balance. I hope you got screen shots.

LOL about people here saying they'd still pay the minimum* even when a credit balance is showing. If that's true, this is the most conscientious bunch of credit card users that have walked the earth

* For all PIFers (aren't we all), if you believe that Chase does not have to apply the credit as payment towards the balance, why only pay the minimum? Shouldn't you be paying the statement balance? If you, all of a sudden, pay the minimum, aren't you expecting Chase to apply some of the credit as payment?

I'd call it responsible but conscientious works. I'd pay the minimum because the TOS say I have to pay and the credit is not a payment...

Right, because end of day that is essentially all that matters. Period. You could have a $40K credit coming with only a $200 balance, but if you miss the required minimum payment you're in default per the agreement you signed. Furthermore, what's wrong with paying the minimum if you know you'll get it back anyways? I sure wouldn't be arguing over a few nickels if it keeps issues such as this from happening.

Could Chase be less confusing between the app and online statments? Possibly, but I've never tried this type of haggling over whether my payment was made by the fact there's a credit coming. Just as I don't assume that when I redeem statement credits, they're applied to the minimum payment resulting in me owing less or nothing at all.

Of all the issues to stand on principle over, I don't believe this is one of them. I'm not for or against anyone here, just stating the facts per wording of how CC's treat credits. You may or may not have a case for some slight confusion, maybe not. Is it really worth burning a bridge over though? Considering you would have eventually gotten that Money back as a check?