- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Chase Freedom Flex top spend category

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Freedom Flex top spend category

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

I thought I was left out, but found it burried in the inbox.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

Since the SUB is very small, I requested to PC my CF to CFF and the card should arrive early next week ![]()

BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclay View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

@xenon3030 wrote:Since the SUB is very small, I requested to PC my CF to CFF and the card should arrive early next week

SUB is identical to (or higher) to at least 5 cards in your sig and higher than at least 3, so obviously not a main criteria for you, correct?

If you cannot max quarters on both Freedoms, that's definitely a reason to do PC instead of applying, but if you can, "SUB too small" kinda doesn't make sense since you have CSP to transfer URs to, from SUB and purchases.

Even if you weren't transferring, it's $150 per quarter with two Freedoms, and that's a rather nice return.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

@xenon3030 wrote:Since the SUB is very small, I requested to PC my CF to CFF and the card should arrive early next week

I don't know, for a cashback sub $200 is pretty nice. Especially if you consider it only requires a $500 spend. In fact, I will probably get my own Freedom Flex (yes, first stop being an AU on my wife's card) for the nice sub, and just because this card has a ton of potential.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

SUB of 200$ after spending only 500$ is very excellent. I was comparing the 200$ SUB to CSP and US Bank Connect in my mind ![]() .

.

Since I may want to purchase a new car at the end of the year, I did not risk to apply for CC now. Having one CF or CFF is sufficient for the moment for me. I have BOA CCR for online shopping (3%*1.75=5.25%), Discover 5% rotating categories and AMEX BCP for 6% groceries.

BOA (CCR, UCR), Chase (CFF, CSP, Amazon, CIC, CIU), US Bank (Cash+, AR, Go, Ralphs), Discover, Citi (CCC, DC, SYW), Amex (BCP, HH, Biz Gold, BBC, BBP), Affinity CR, Cap1(Walmart), Barclay View.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

This discussion and the options are making my head hurt. I think I need to wait to see if the "highest spend category" bonus becomes regular or even permanent. With six Chase cards, I need yet another Chase card like I need a hole-in-the-head. And it appears heavy new apps was an epidemic in November 2019. Lol ![]() (I'm over 5/24 until just before Thanksgiving anyway.) Like others upthread, I kept my original Freedom after CFF came out because of Costco, and I got the added 3% drugstores/dining and 5% travel rewards added to my CFU when CFF came out.

(I'm over 5/24 until just before Thanksgiving anyway.) Like others upthread, I kept my original Freedom after CFF came out because of Costco, and I got the added 3% drugstores/dining and 5% travel rewards added to my CFU when CFF came out.

I've debated closing Freedom since it has the low caps and I often don't max it out. Maybe it's their intent, but these frequent changes to rewards programs in my cards makes mapping out a simple long term strategy difficult. I honestly don't want a wallet full of various rewards cards, and would prefer more of a set-it-and-forget it approach. Still, it's hard to ignore the enticement of higher rewards, so I'm conflicted.

However, if the high-spend bonus becomes permanent in addition to the 5% rotating categories, CFF could be much more worthwhile than my CF and worth the PC. It appears to me that Chase is trying to make the original Freedom obsolete.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

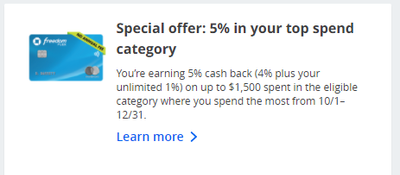

@kilroy8 wrote:Just got the below email:

Hmmm. I switched to freedom flex last month and I haven't received this email. I was planning on using it for 7% on dining. I wonder if you have to be targeted to receive the top spend option since you have to activate or it's for all freedom flex card holders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

@Anonymous wrote:

@kilroy8 wrote:Just got the below email:

Hmmm. I switched to freedom flex last month and I haven't received this email. I was planning on using it for 7% on dining. I wonder if you have to be targeted to receive the top spend option since you have to activate or it's for all freedom flex card holders.

We have it on my wife's card. But we already had the quarter activated so no email is necessary I guess because we never got one. Take a closer look, it is not too obvious but it is there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

@Crowhelm wrote:

@Anonymous wrote:

@kilroy8 wrote:Just got the below email:

Hmmm. I switched to freedom flex last month and I haven't received this email. I was planning on using it for 7% on dining. I wonder if you have to be targeted to receive the top spend option since you have to activate or it's for all freedom flex card holders.

We have it on my wife's card. But we already had the quarter activated so no email is necessary I guess because we never got one. Take a closer look, it is not too obvious but it is there.

I decided to log on the full website(been looking on my phone on the app) and I saw it.

thanks @Crowhelm

I hope this becomes something they continue, but ugh at all the trouble I went through for the last 3 months to obtain the custom cash.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Freedom Flex top spend category

@Anonymous wrote: I hope this becomes something they continue, but ugh at all the trouble I went through for the last 3 months to obtain the custom cash.

+1 That's kind of what I was talking about too, @Anonymous (except I didn't get Citi Custom Cash.) You're kind of like me in not wanting dozens of cards to manage. We go through the process of selecting ones that seem like a long term fit and then the card market gets shaken up again with changes. It's annoying when you take hits for inquiries and new accounts only to feel like they weren't necessary in hindsight. Still, if this change turns into something permanent to compete with CCC, it's a positive change if they'll just leave it alone.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.