- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase Marriott 100K SUB returns

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Marriott 100K SUB returns

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Marriott 100K SUB returns

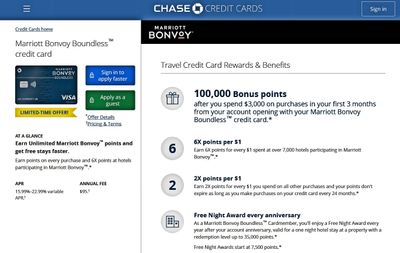

Chase previously offered 100K Bonvoy points SUB on their Marriott Bonvoy Boundless Visa but it's been 75K for almost a year, I believe. They just restored the SUB to 100K points. Marriott points are worth on average about 8/10 of a cent each per estimations from thepointsguy website. So that SUB just grew by about $200 from $600 to $800 in redemption value!

This card also offers 6x points on spending in Marriott hotels (worth about 4.8%). It does have a $95 AF but it gives you an annual free night starting in year two. (The 35K free night award value can be estimated at up to $280 which more than pays for the AF.) And with automatic Bonvoy "Silver Elite" status, you earn 10% more in points on Marriott spending in addition to other benefits like priority late checkout and free wifi. Outside of Marriott, it earns 2x points or about 1.6% value in rewards.

*Points valuation can vary widely so this is only a ballpark estimate. YMMV, more or less, depending on how you choose to redeem.

I've seen postings about Chase also refreshing the Welcome offers on the Freedom and Freedom Unlimited with Cash SUB plus now earning 5% cash back on grocery store purchases (not including Target® or Walmart® purchases) on up to $12,000 spent in the first year. But I hadn't seen any postings about the new Marriott offering yet. It's a good time to apply.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

Interesting. The main credit card page says $5k spend for the 100k points but clicking on the card says $3k spend on its personal page. Anyone else seeing that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

@TSlop wrote:Interesting. The main credit card page says $5k spend for the 100k points but clicking on the card says $3k spend on its personal page. Anyone else seeing that?

Actually, no, all I'm seeing is the $3K spend for 100K points on either page.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

I received an email inviting me to apply for the Marriott Bonvoy Boundless™ Card by 9/29/20. If approved, I get 100,000 bonus point after spending $3,000 on purchases in the first 3 months from account opening. If you think if your credit file qualifies, you should apply! This offer is sweeet!!!! I'm on Chase's naughty list until mid-July 2021 so I know better than to apply. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

@WhiteCollar wrote:I received an email inviting me to apply for the Marriott Bonvoy Boundless™ Card by 9/29/20. If approved, I get 100,000 bonus point after spending $3,000 on purchases in the first 3 months from account opening. If you think if your credit file qualifies, you should apply! This offer is sweeet!!!! I'm on Chase's naughty list until mid-July 2021 so I know better than to apply.

Yes, you'd need to be under their "5/24" rule and I understand some also don't consider Chase because of previously burning them.

I got this 100K offer last spring but soon afterward they rolled it back to 75K. The 100K point SUB is an awesome deal, though! ![]()

And the card has been quite useful to me, even beyond the obvious SUB and earnings.

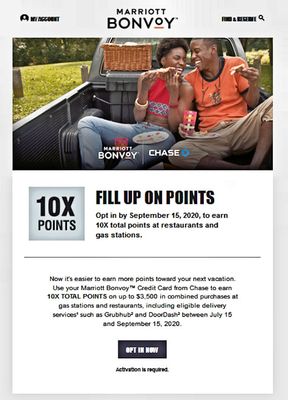

With Covid-19, Chase offered the 6x point bonus on grocery spending through July 31st (effectively 4.8% rewards value.)

They also had an additional offer for 10x point bonus (on up to $3500 spend) for restaurants and gas stations for the 60-day period between July 15 - September 15. That is effectively 8% in rewards using the approximately 8/10 ccp valuation. I posted about this in a separate thread recently.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

What is the 5/24 rule?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

@WhiteCollar wrote:What is the 5/24 rule?

If you google it or type "5/24" in the search bar of My Fico, you'll have hours of postings to read explaining it! Lol ![]()

Most banks have some (internally-kept) criteria about how many inquiries or new credit accounts they allow to approve a new card. With Chase being a large bank with lots of applications, their "internal" policy has become known by collaboration of postings of applicants on the web and these forums.

Basically, 5/24 means that to get approved for a new Chase card, you must have been APPROVED for LESS THAN *5* new credit accounts in the past (24) months. This is simply REVOLVING credit accounts, mainly credit cards, so auto loans or mortgages are excluded. This is also APPROVALS not just APPLICATIONS. So if you have added four cards in the last two years, you won't be denied for 5/24. If you've already added 5 cards in last two years, you'll probably be denied for 5/24, regardless of other credit factors.

Chase uses the cards that show up on your PERSONAL credit report, so if you have business cards that don't report on your personal credit report, that card is excluded after it's approved. (In other words, I have a Chase INK card that doesn't show up on my personal report; however, I had to be under 5/24 to get approved for that card.)

The idea with 5/24 and similar policies is to discourage churners seeking new card sign up bonuses, basically people who have no intent to keep the cards or use them for the long term.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

I was LOL/24![]()

but only 75,000 points

but only 75,000 points![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

@M_Smart007 wrote:I was LOL/24

but only 75,000 points

Dang, I'm impressed @M_Smart007. I've never had a black star with Chase! Isn't that pretty much a guaranteed approval?? ![]() Very much more impressed since I know how you're LOL/24. Chase must really love you! Do you have this card yet? If not, I say go for it! Even the 75K offer is very good, worth $600!

Very much more impressed since I know how you're LOL/24. Chase must really love you! Do you have this card yet? If not, I say go for it! Even the 75K offer is very good, worth $600!

I forgot to mention that there is "fine print" (of course) to qualify for the 100K offer. If you have other Chase-branded or AMEX-branded Marriott cards or have only recently closed them, you may not be eligible for approval of this card. Also, having received other Marriott SUBs may prohibit you from qualifying for the 100K SUB on this card depending on when you received them.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Eligibility for this product: The product is not available to either:

- current cardmembers of the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless™ credit card (also known as Marriott Rewards® Premier Plus), Marriott Bonvoy Bold™ credit card, or

- previous cardmembers of the Marriott Bonvoy™ Premier credit card (also known as Marriott Rewards® Premier), Marriott Bonvoy Boundless™ credit card (also known as Marriott Rewards® Premier Plus), or Marriott Bonvoy Bold™ credit card, who received a new cardmember bonus within the last 24 months.

If you are an existing Marriott Rewards Premier or Marriott Bonvoy™ Premier customer and would like this product, please call the number on the back of your card to see if you are eligible for a product change.

Eligibility for the new cardmember bonus: The bonus is not available to you if you:

- are a current cardmember, or were a previous cardmember within the last 30 days, of Marriott Bonvoy™ American Express® Card (also known as The Starwood Preferred Guest® Credit Card from American Express);

- are a current or previous cardmember of either Marriott Bonvoy Business™ American Express® Card (also known as The Starwood Preferred Guest® Business Credit Card from American Express) or Marriott Bonvoy Brilliant™ American Express® Card (also known as the Starwood Preferred Guest® American Express Luxury Card), and received a new cardmember bonus or upgrade bonus in the last 24 months; or

- applied and were approved for Marriott Bonvoy Business™ American Express® Card (also known as The Starwood Preferred Guest® Business Credit Card from American Express) or Marriott Bonvoy Brilliant™ American Express® Card (also known as the Starwood Preferred Guest® American Express Luxury Card) within the last 90 days.

New cardmember bonus: To qualify and receive your bonus, you must make Purchases totaling $3,000 or more during the first 3 months from account opening. ("Purchases" do not include balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable.) After qualifying, please allow up to 8 weeks for bonus points to post to your Marriott Bonvoy™ account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment. If your account is not open for at least 6 months, Marriott and Chase reserve the right to deduct the bonus points from your Marriott Bonvoy account.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Marriott 100K SUB returns

This may answer a few of your questions?

I'm thinking it was guaranteed approval?

Approved on 11-16-2019

Just to add, have a very long Business history with Chase![]()