- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Chase Prequalified Offers

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Prequalified Offers

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Prequalified Offers

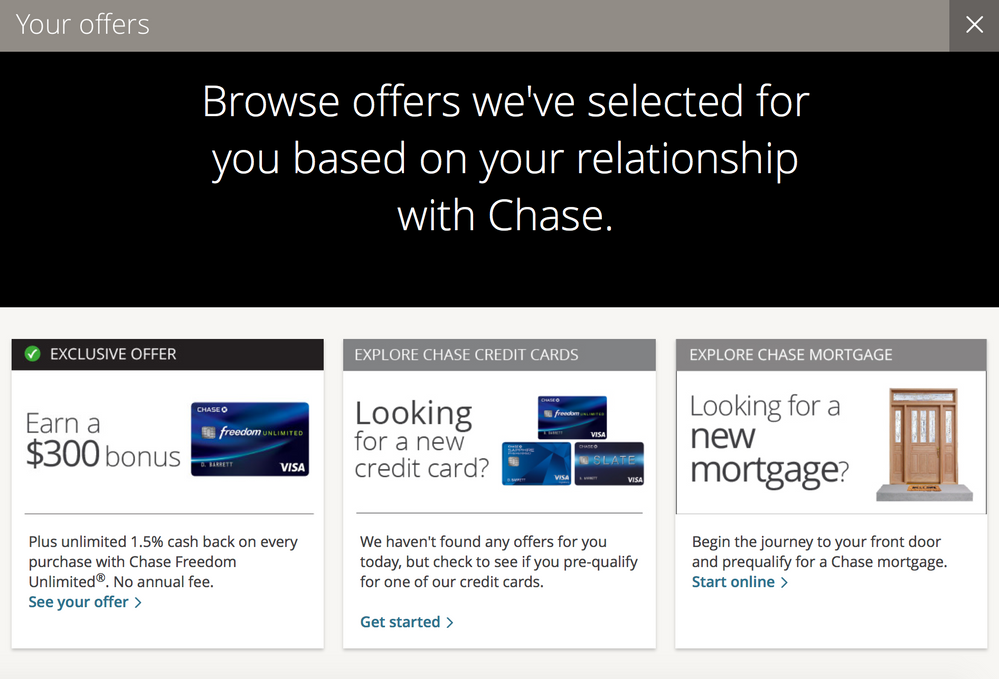

Ok, so this is about the picture below. I'm building credit so I can have one year history before I apply for my first Chase card (either Freedom or CSP). When I used to log in I would get an offer for CSP (because of CPC), and since I was denied for CSP I've only seen CFU offer. I don't get any offers when I do "explore offers". So, my question is two-fold:

One, are the "Your Offers" accurate, or are they just a way for Chase to get more applications?

Second, does Chase really need one-year, or should I cold app in June, and if I do apply should I apply for Chase Freedom and CSP at the same time to combine apps?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

WOW that offer is hot! Selected for you offers are usually more solid than standard pre-quals on Chase.com/prequalified.

Chase was my first CC and credit product. If you have a banking relationship with solid deposits and/or direct deposits, they will likely approve you, but with a ~$500 SL.

After 1 year, you should be good to go for CSP (or even CSR).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

You should be fine to apply directly through the offer and not wait until June. It's likely this offer is time-limited. When you get into the application page and open up the price terms, if you see the APR being a fixed number, then it should be reasonably solid.

It also somehow depends on your current credit status to see if it makes sense to get another card with Chase at the same time. If you don't mind the annual fee and spend a lot on travel, then the CSP may be good for you. But you still want to consider what other cards you currently have and their limit, and how many new accounts you have in the most recent 2 years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

I bank with Chase and on the very day my first credit card reported its one year statement, the website gave me a prequal offer for the CSP, which I signed up and was approved for the next day.

Here are some general tips that I found useful from members on this forum and a few others (that I wish I would have known the first time I applied). As always YMMV.

Chase tends to want to see a minimum of one year of credit on your oldest card before approving you for one of their VISA signature branded cards (CSP, CSR, etc)

Chase has been rumored to be wary of starting you out with your first “high limit card” so it’s advisable to have at least one card reporting with a minimum CL of $5k (as that’s the lowest starting CL of the CSP, if I’m not mistaken).

Make sure your overall utilization is under 9% when you apply (though some have even claimed its better to be equal to or less than 4%), and it’s best to have that all on one card.

Additionally, make sure you’re not over their 5/24 rule.

And about getting the Freedom and the CSP the same day, that’s what I did, and was instantly approved for both, so if you’re offered the Freedom if/when/after you’re approved for the CSP, go for it.

I’ve seen approvals for the CSP on the credit pulls database with FICOs in the high 600s, however the common rule/pattern seems to favor 730+, especially if you have a short history, no banking relationship with Chase (which is recommend starting up if you haven’t), and a lower overall CL across your accounts. Check the credit pulls database and see which of the three Chase pulls from in your state, and judge accordingly.

Finally, it’s been generally asserted (but take this with a grain of salt), that they tend to approve income of 30k+ for the Sapphire cards more frequently than apps reporting below that, so something to consider.

Again, all of this is highly anecdotal, however it worked for me. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

I logged into my Chase app and had the same "exclusive offer" for the freedom unlimited. $300 for $500 spend. Was at 4/24 at time of application. They pulled EX. 675 score. Got the 30 day message, but then called in and was approved after verifying my identity. When i received the card, Chase showed my internal score with them to be 696.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

I have the amex prg and quicksilver, do you mind telling me when you got the CSP and Freedom unlimited?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

I know, I had the check mark for CSP, with 60k bonus 2 months ago and was denied, even though CPC. CPC banker told me one year history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Prequalified Offers

I got the CSP in March of 2017 and the Freedom Unlimited I just got in January of this year.