- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase Sapphire Reserve $80K

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Sapphire Reserve $80K

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Sapphire Reserve $80K

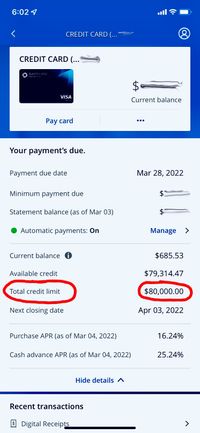

My Chase Sapphire Reserve credit limit was increased from $55K to $80K today via credit limit consolidation. High limits on this card has been a long-term objective and I'm excited to make this step! ![]() I'm going to focus my Chase spending on this card alongside my Freedom Unlimited, which is also one of my oldest cards from almost 22 years ago.

I'm going to focus my Chase spending on this card alongside my Freedom Unlimited, which is also one of my oldest cards from almost 22 years ago.

Backstory: I had a Chase Freedom (original) card approved 01/2019 which had a $25K limit. Despite my lack of enthusiasm for rotating category cards, I bought into it as a part of building the "trifecta." However, over time I had found that I wasn't even including it in rotation and some careful calculations showed that my realistic incremental additional savings over my other cards was probably only about $100 to $150 a year at best. My plans for about the last year have been shifting towards fewer cards anyway, but Chase pushed the issue. I hadn't swiped the card in over a year (horrors, I know) and they sent me a letter that I needed to use it or close it. In part, I had left it idle since I've toyed with closing it and had hoped to transfer the full credit limit instead of having to leave a token $500 or $1K limit on it. I learned that if the card has been completely idle with them for six months or more, they will allow the full credit limit to be transferred.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

Congrats on getting rid of the deadweight by vacuuming it's CL into the CSR!

I can think of a few things a heavy limit like that would be great for, only know of one that actually didn't squawk about $50k on a CC, was a retainer for an out of state attorney.

[2020-12-09]=[EQ8|786]-[TU8|746]-[EX8|772] .... gardening until I can't (again).

[2023-10-01]=[EQ8|797]-[TU8|776]-[EX8|775]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

Amazing @Aim_High ! Shoot I'm just trying to figure out how to get to 50K with them lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

@Aim_High wrote:My Chase Sapphire Reserve credit limit has increased from $55K to $80K today via credit limit consolidation. High limits on this card has been a long-term objective and I'm excited to make this step!

I'm going to focus my Chase spending on this card alongside my Freedom Unlimited, which is also one of my oldest cards from almost 22 years ago.

Backstory: I had a Chase Freedom (original) card approved 01/2019 which had a $25K limit. Despite my lack of enthusiasm for rotating category cards, I bought into it as a part of building the "trifecta." However, over time I had found that I wasn't even including it in rotation and some careful calculations showed that my realistic incremental additional savings over my other cards was probably only about $100 to $150 a year at best. My plans for about the last year have been shifting towards fewer cards anyway, but Chase pushed the issue. I hadn't swiped the card in over a year (horrors, I know) and they sent me a letter that I needed to use it or close it. In part, I had left it idle since I've toyed with closing it and had hoped to transfer the full credit limit instead of having to leave a token $500 or $1K limit on it. I learned that if the card has been completely idle with them for six months or more, they will allow the full credit limit to be transferred.

Congratulations on reaching your goal.

Slightly O/T. I always understand the need for data privacy (we have ways around that anyway) but I am interested why you have hidden minimum payment due and statement balance, while leaving current balance. What is the attack model you are attempting to mitigate!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

@SPChaser Chase rarely issues SLs over $50k. Typically you'll need to apply for CLIs (which require a HP) or reallocate CL from other Chase cards (as done by @Aim_High in this case).

@SPChaser wrote:Amazing @Aim_High ! Shoot I'm just trying to figure out how to get to 50K with them lol.

TCL: $401.4k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

Congratulations on your $80K CSR! The ability to reallocate limits is one of the most underrated things about Chase and is a great way to optimize a strategy with Chase cards, which is particularly useful to grow low SL cards or close cards that are no longer useful, especially if those cards have AFs with no downgrade path.

Current FICO 8 | 9 (February 2024):

Credit Age:

Inquiries (6/12/24):

Banks & CUs:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

@DONZI wrote:Congrats on getting rid of the deadweight by vacuuming it's CL into the CSR!

I can think of a few things a heavy limit like that would be great for, only know of one that actually didn't squawk about $50k on a CC, was a retainer for an out of state attorney.

Thanks, @DONZI!

Yes, the "deadweight" ... lol ![]() The funny thing is that in-theory, the 5% Freedom/Freedom Flex when combined with Sapphire Reserve sound awesome with the ability to magnify URs by 50% in-travel-portal or 100% when transferred to partners. In practice, however, you're not only limited by the $6K annual cap but also how much you will organically spend in the selected categories. In my case, I probably would never use more than about 50% to 60% of that limit. (Some quarters I might spend more; other quarters would be $0.) And even that made some generous assumptions. And I'm more likely to just use my URs in-portal, so I'm not doubling the value. Plus, I have already have excellent rewards in some of the main spending categories that would get the majority of that spend such as gas, groceries, or online shopping. So when I looked closely, the bottom line was a fairly nominal incremental rewards for carrying and managing an additional card. In about the last 12 months, I've been shifting towards a more simple lineup. I've been experimenting with some new cards and lenders in the last few years, but I'd like to refocus my cards to the most valuable.

The funny thing is that in-theory, the 5% Freedom/Freedom Flex when combined with Sapphire Reserve sound awesome with the ability to magnify URs by 50% in-travel-portal or 100% when transferred to partners. In practice, however, you're not only limited by the $6K annual cap but also how much you will organically spend in the selected categories. In my case, I probably would never use more than about 50% to 60% of that limit. (Some quarters I might spend more; other quarters would be $0.) And even that made some generous assumptions. And I'm more likely to just use my URs in-portal, so I'm not doubling the value. Plus, I have already have excellent rewards in some of the main spending categories that would get the majority of that spend such as gas, groceries, or online shopping. So when I looked closely, the bottom line was a fairly nominal incremental rewards for carrying and managing an additional card. In about the last 12 months, I've been shifting towards a more simple lineup. I've been experimenting with some new cards and lenders in the last few years, but I'd like to refocus my cards to the most valuable.

While I'm not a regular "big-spender," this card could see some occassional larger charges and it's good to know I've got lots of padding to run up a big charge in one month without hitting a high utilization. This card and my Premium Rewards are now in the same ballpark ($80K/$85K) which gives me two cards for large expenses. ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

@longtimelurker wrote:Congratulations on reaching your goal.

Slightly O/T. I always understand the need for data privacy (we have ways around that anyway) but I am interested why you have hidden minimum payment due and statement balance, while leaving current balance. What is the attack model you are attempting to mitigate!

Thanks @longtimelurker.

Well, I thought it was obvious why I blanked out the minimum payment. What if someone knew the exact amount I owed and impersonated me by making a payment on my card!!! That would be simply awful! ![]() Seriously, I started blanking out data and then decided to stop partway down. We post the screenshots for "proof" of our claims and leaving some of the other numbers just made it more legitimate. And showing my current balance showed that I do actually use this card regularly!

Seriously, I started blanking out data and then decided to stop partway down. We post the screenshots for "proof" of our claims and leaving some of the other numbers just made it more legitimate. And showing my current balance showed that I do actually use this card regularly!

If anyone wants the minimum payment information, I'll be glad to PM that along with the account number. Lol ![]()

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

@DJRobbieD wrote:@SPChaser Chase rarely issues SLs over $50k. Typically you'll need to apply for CLIs (which require a HP) or reallocate CL from other Chase cards (as done by @Aim_High in this case).

@SPChaser wrote:Amazing @Aim_High ! Shoot I'm just trying to figure out how to get to 50K with them lol.

@CreditAggie wrote:

Congratulations on your $80K CSR! The ability to reallocate limits is one of the most underrated things about Chase and is a great way to optimize a strategy with Chase cards, which is particularly useful to grow low SL cards or close cards that are no longer useful, especially if those cards have AFs with no downgrade path.

Thanks very much @SPChaser, @DJRobbieD, @CreditAggie!

Yes, you don't typically see super-high Chase SLs on most of their cards. The exception might be if you're a HNW client with large deposits. @californiaboy935 posted about an approval for the JP Morgan Reserve card which is basically the HNW-equivalent of the Sapphire Reserve. I believe his SL was $100K. My SL was a pretty decent $35K in 2018. As @DJRobbieD said, $35K to $50K is an excellent SL approval for mainstream Chase cards. Since I've been a Chase customer since 2000, already had other credit with them, and then added new Chase cards in 2018 to 2020, I had the ability to reallocate credit previously from $35K to $55K and now from $55K to $80K. Totally agree, @CreditAggie, that the ability to reallocate credit limits with them is underrated! Even with high income, the only other way most of us would get there besides high assets or CL consolidation would be consistent heavy spending with HP CLIs.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$850K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Aug 2023)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Sapphire Reserve $80K

Congratulations on the nice increase