- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase United Gateway vs. Explorer

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase United Gateway vs. Explorer

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase United Gateway vs. Explorer

Interesting that there appears to be 2 versions of the Gateway card; a Visa Signature, and a ... what is the other one? There isn't even a Visa logo on it.

Honestly, none of the MP cards interest me, even this new no-AF one. They just aren't nearly competitive enough with the Sapphire/Freedom lineup, to me. But I'm glad they're available for people who do find use for them.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase United Gateway vs. Explorer

@coreysw12 wrote:Interesting that there appears to be 2 versions of the Gateway card; a Visa Signature, and a ... what is the other one? There isn't even a Visa logo on it.

Honestly, none of the MP cards interest me, even this new no-AF one. They just aren't nearly competitive enough with the Sapphire/Freedom lineup, to me. But I'm glad they're available for people who do find use for them.

Actually, the Explorer is the perfect complement to the Sapphire/Freedom lineup if you live in a United hub and fly United regularly, especially for award flights. The key is use Sapphire/Freedom cards for all your spending. Transfer your UR points to United miles as needed to redeem for award flights. Keep the Explorer card only for the perks (extra award seat availability, two club passes each year, first bag free, early boarding, etc). The perks more than pay for the annual fee.

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase United Gateway vs. Explorer

@UpperNwGuy wrote:

@coreysw12 wrote:Interesting that there appears to be 2 versions of the Gateway card; a Visa Signature, and a ... what is the other one? There isn't even a Visa logo on it.

Honestly, none of the MP cards interest me, even this new no-AF one. They just aren't nearly competitive enough with the Sapphire/Freedom lineup, to me. But I'm glad they're available for people who do find use for them.

Actually, the Explorer is the perfect complement to the Sapphire/Freedom lineup if you live in a United hub and fly United regularly, especially for award flights. The key is use Sapphire/Freedom cards for all your spending. Transfer your UR points to United miles as needed to redeem for award flights. Keep the Explorer card only for the perks (extra award seat availability, two club passes each year, first bag free, early boarding, etc). The perks more than pay for the annual fee.

Ya, it works well for some people but as a United 1k it doesn't do much for me personally

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase United Gateway vs. Explorer

@UpperNwGuy wrote:Actually, the Explorer is the perfect complement to the Sapphire/Freedom lineup if you live in a United hub and fly United regularly, especially for award flights. The key is use Sapphire/Freedom cards for all your spending. Transfer your UR points to United miles as needed to redeem for award flights. Keep the Explorer card only for the perks (extra award seat availability, two club passes each year, first bag free, early boarding, etc). The perks more than pay for the annual fee.

This! Most people don't realize that the Explorer card is a complimentary card to use along side the CSP/CSR. Unless you're someone who only wants 1 CC.

The ONLY spending i'd put on the UA Explorer is the round trip flight, to get the checked bags free, and any on-board snacks/drinks you purchase. For me, even for those charges go on my Platinum, at least until my travel credit is exhausted. But not everyone has platinum as well. ALL other flights and charges go on your CSP/CSR which your UR points can be xfered to United when you need them.

@coreysw12 wrote:Ya, it works well for some people but as a United 1k it doesn't do much for me personally

Correct, the UA explorer card isn't for people with United Status. If you utilize the United Lounge, then the Club card would be for you. If not, and you utilize other lounges, or none at all, then the CSP/CSR is the better card for you. The UA Explorer card is only for those of us who travel multiple times per year, but not enough to earn status with United, and to squeeze perks out of. My daily spend, and even United flight purchases, go on my CSR. Except for a single round trip flight, annually, so i can utilize the free checked bag.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase United Gateway vs. Explorer

@Anonymous wrote:Thanks for the tip. Won't be getting another Chase card for another three to four months, but that is good to know.

In the meantime, I hope they do add that perk for the Explorer card eventually. I commute a lot and I live in United's largest hub so it would be a win-win for me.

@Anonymous You may want to look into the United Business MileagePlus card. It provides 2x on local transit and commuting.

Plus when you have both Personal and Business United cards, you get a bonus 5k miles annually. If you travel enough, the extra two club passes and extra free checked bags annually, will pay for the additional annual fee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

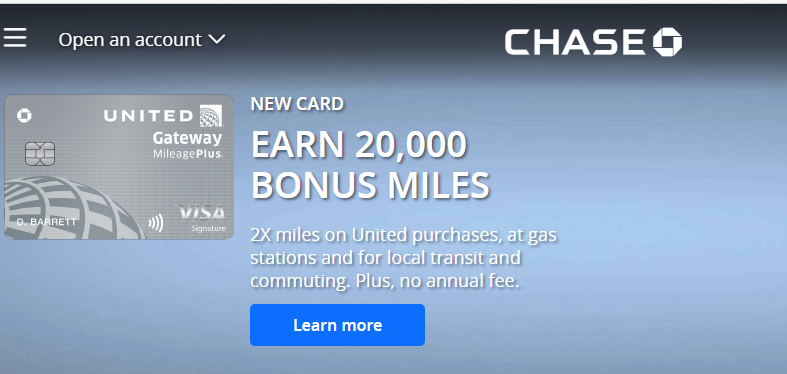

New Chase Card-United Gateway Mileage Plus

It's a Visa Signature and the first time I saw it so I'm not sure if there is a forum already but looks like they have a New Card to offer for Travel peoples with no AF ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Chase Card-United Gateway Mileage Plus

Interesting!