- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Chase lowers APR on my Freedom Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase lowers APR on my Freedom Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

Congrats! That's certainly much better than the letters some of us received a few years ago when they raised our 12-14% APR cards to 15.99% (and with prime rate increases those are of course now 17.x%) "because your APRs are below the lowest APRs we currently offer on similar accounts." Always nice to hear about the rare unicorn from Chase, though!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

I don’t carry balance so it doesn’t make a difference to me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

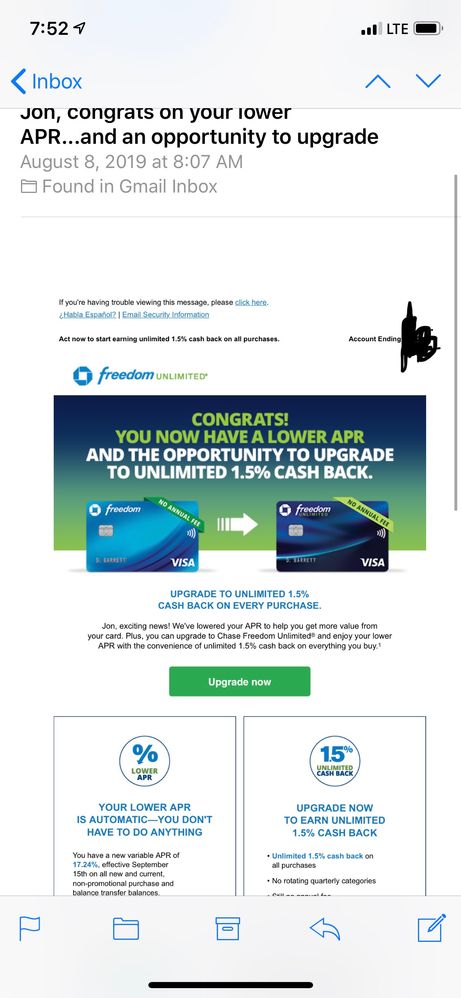

@Anonymous wrote: Got an email from Chase today stating that effective September 15 they were lowering the APR on my Freedom card from 25.99% to 17.24%. So on their own they cut the APR from the highest to the lowest available rate. Given all the comments about the impossibility of getting Chase to reduce APR this is certainly a nice surprise.

Wow, Congrats @Anonymous !! That is awesome! ![]()

I have been a credit customer (not banking) with Chase for 19 years now.

My oldest account (opened as a SLATE Visa) is now a Freedom Unlimited Visa.

I've never had a BK or any Derogs, rarely even any minor lates over all my credit history with any lender.

My credit scores for last few years have been solid 800-850 range with low utilization.

Chase is my largest lender (5 lines of credit worth $138,400 TCL.)

Chase has also been good to me with balance transfer offers when I was carrying some debt.

Yet many many years ago (15+?) for some reason which I don't even recall, they jacked

my APR on that oldest account to the penalty APR ... currently 29.49%!!!

It's abhorrent and no good reason for it; it's my biggest gripe with Chase.

I, too, have gotten the "we review our accounts periodically" line when I tried to lower it.

I choose to keep the account open because it's one of my older ones and I never pay interest anyway.

But it's the principle of the thing. Like they are holding a grudge for some reason.

So maybe this is good news and hope that they may finally soften on this penalty APR crap.

*Incidentally, on all the other cards they have approved me for in the past 15 months,

I've been given the best available rate for that card. So this one is very inconsistent!

And except for USAA, no other lender has been so stubborn when I approached them

for interest rate adjustments.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

I also received this offer. Honestly, it doesn’t really excite me that much. I’d rather have been offered a quarterly spending bonus or something like that. I honestly think that was a feel-good gesture intended to persuade me to “upgrade” to the Unlimited - not happening.

I will say though, Chase has been really good to me. I have five credit cards with them and I even got an unsolicited CLI on my Freedom last year. And they gave me my first two cards with sizable limits when I had not-so-great scores and no prior banking relationship.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

@Anonymous wrote:I also received this offer. Honestly, it doesn’t really excite me that much. I’d rather have been offered a quarterly spending bonus or something like that. I honestly think that was a feel-good gesture intended to persuade me to “upgrade” to the Unlimited - not happening.

I will say though, Chase has been really good to me. I have five credit cards with them and I even got an unsolicited CLI on my Freedom last year. And they gave me my first two cards with sizable limits when I had not-so-great scores and no prior banking relationship.

They have definitely been pushing people towards the Unlimited vs the regular Freedom for quite awhile. Obviously cheaper for them to pay out flat 1.5% vs the 5% on categories.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

@Anonymous wrote:

Chase just recently brought down my reserve from 19.24 to 18.99, I know it isn’t much but it did go down.

I don’t carry balance so it doesn’t make a difference to me

Sounds like Chase didn't lower your APR, but rather the Fed cutting the prime rate by .25% led to you having a lower APR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

I received the same offer email last week.

Received a letter yesterday stating the same thing.

Decided I'll just keep the regular Freedom and sky high APR. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase lowers APR on my Freedom Card

Wish I could get it. I called and asked to lower and they said call back after the promotional 0% APR.