- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase pre-qualified solid offers?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase pre-qualified solid offers?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@CivalV wrote:

No my current scores are high 640-650s as of right now. Itll go up in about a week but who knows if the offers will still stand lol

Be patient and don’t panic, wait.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@redpat wrote:

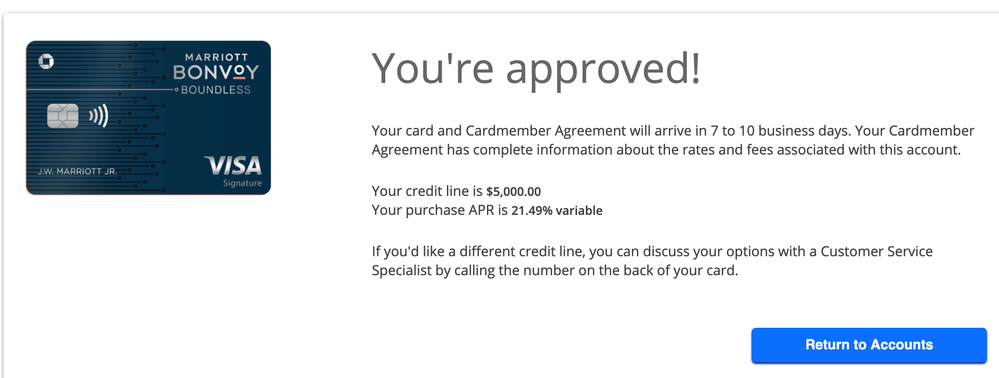

@Anonymous wrote:These seem to be solid offers. Here is another one for the team. I was to be gardening but i could definitely use the marriot points for an upcoming trip. After seeing the approval from @CreditCuriosity i couldnt stop myself. Got a high APR but will be PIF anyway. I want to recon the SL but i am not sure if it will be another HP, this is my first chase card and i am 8/24.

Congrats, don’t recon CL, you don’t want to draw attention to yourself. You are also correct that it will be another HP.

+1000 also it appears like a generous CL compared to your other cards as well.. Chase will usually give you what they feel comfortable with and are not afraid to hand out huge limits if they feel comfortable without trying to recon SL. That is why for profiles and income that support it you see alot of 20-35k approvals off the bat as they want to give you enough to not have to worry about CLI's etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@CreditCuriosity wrote:

@redpat wrote:

@Anonymous wrote:These seem to be solid offers. Here is another one for the team. I was to be gardening but i could definitely use the marriot points for an upcoming trip. After seeing the approval from @CreditCuriosity i couldnt stop myself. Got a high APR but will be PIF anyway. I want to recon the SL but i am not sure if it will be another HP, this is my first chase card and i am 8/24.

Congrats, don’t recon CL, you don’t want to draw attention to yourself. You are also correct that it will be another HP.

+1000 also it appears like a generous CL compared to your other cards as well.. Chase will usually give you what they feel comfortable with and are not afraid to hand out huge limits if they feel comfortable without trying to recon SL. That is why for profiles and income that support it you see alot of 20-35k approvals off the bat as they want to give you enough to not have to worry about CLI's etc.

True dat, that is why my jaw hit the bankers desk when I went to a branch to app for my CSR when I was over 5/24 when the card came out and I was approved for $31k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@M_Smart007 wrote:

@CreditCuriosity, you are a bad influence!!! .. just bad!

Geee what is going to happen from here @M_Smart007 ... see you in the approval section in a few minutes ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

Update: BTW they HPed EX and TU in CA for the DPs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@CivalV wrote:

I havent apped for anything in a year. My last app was nov 18th for the amex delta and I was denied. I want to go for the Marriot at 17% set APR but I am so nervous! Idk what to do. Its asking for income and phone number.

From experience, if it's just asking for income and phone number they're probably ready to give you a card. But like others stated, I'm a bit nervous score-wise. Personally, I would go for it since they are historically solid offers and even if the SL is low, Chase is receptive to (HP) CLIs in the future when your scores improve. But it will likely be two HPs to find out. Since you already have the Disney card and have in-branch preapprovals, it does seem that there's a good chance, but of course they're your HPs to deal with if you do get denied. Tough call!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

@K-in-Boston wrote:

@CivalV wrote:

I havent apped for anything in a year. My last app was nov 18th for the amex delta and I was denied. I want to go for the Marriot at 17% set APR but I am so nervous! Idk what to do. Its asking for income and phone number.From experience, if it's just asking for income and phone number they're probably ready to give you a card. But like others stated, I'm a bit nervous score-wise. Personally, I would go for it since they are historically solid offers and even if the SL is low, Chase is receptive to (HP) CLIs in the future when your scores improve. But it will likely be two HPs to find out. Since you already have the Disney card and have in-branch preapprovals, it does seem that there's a good chance, but of course they're your HPs to deal with if you do get denied. Tough call!

I agree should yield an approval esp if chase customer and already having card. Just not as good as terms nor limit if @CivalV score was higher say 690-700ish range. Score scares me a bit, but mine was just income question and phone number and accept terms and was a quick approval didnt spin forever.. I think he/she would be safe, but as mentioned could go either way and just a lower cl is how i see it playing out personally

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase pre-qualified solid offers?

I also get the three, SW ( never have flown them ) Marriott ( already have AMEX Too Expensive version ) and United. United is interesting but I already have too many accounts, including several this year not planned.

The application page is dangerously easy. What, two data points and some agreement check boxes and off you go.

Congrats to those getting approvals!

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765