- myFICO® Forums

- Types of Credit

- Credit Cards

- Check from BOA

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Check from BOA

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check from BOA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

If they are convenience checks with balance transfer terms attached to them, yes you can deposit them directly into any account or write the check directly to a lender. BoA is loosey-goosey when it comes to cash advance vs balance transfer. Just be aware that the offer will come with a 3, 4 or 5% fee depending on your card terms. (i.e. you deposit $5000 to get 0% for 12 months, you will be charged $150 if your terms state 3% balance transfer fee)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

I just did this with a Capital One balance transfer check. Made it out to myself for $2,000, then used BoA's mobile app to deposit it into my BoA checking. I decided to do this because I have a pretty large Amex statement that's going to generate tomorrow, and will use the money to pay that off, instead of draining my cash reserves. $20 fee for 9 months of 0% APR was too good of deal to pass up.

As K said, just make sure you understand the terms and conditions associated with these checks. If they're not Balance Transfer conveinence checks with a promo 0% APR they're going to be Cash Advance (at your 23% or possbily higher Cash Advance APR) checks, and I would suggest you trash them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

@Anonymous wrote:

Today I received some blank checks in the mail from Boa. Can I write these out to myself and use them just as I would with a BT?

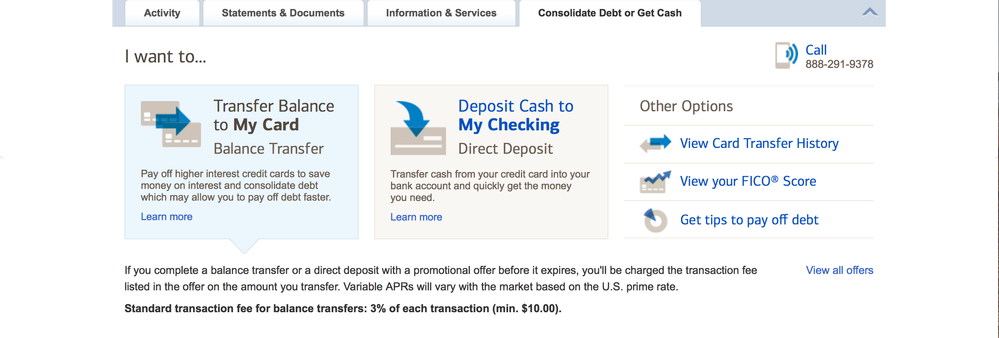

If you're planning on depositing the money then you can just go on their website and do a direct deposit, there will be a link to follow. Assuming you got the same thing I got then you'll have 0% APR until Sep or 1.99% until Dec along with a 3% transfer fee. Go to the 'Consolidate Debt or Get Cash' tab on the account home page and then select the 'Deposit Cash to My Checking'. It was an inexpensive way into some stock that I was looking at.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

Current CL with BOA is $5k, TCL is $100k, what amount can I safely write the check for? Is $3/4K a bad idea?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Check from BOA

@Anonymous wrote:

Definitely a BT offer with two different offers. Where can I go to request a CLI from BOA before taking one of them? Can a CLI be requested via mobile/app?

Current CL with BOA is $5k, TCL is $100k, what amount can I safely write the check for? Is $3/4K a bad idea?

If you don't have access to a desktop, you can request a desktop version of the site in your mobile browser. Hold down the refresh icon on the BOA page until the Request Desktop Version pops up if you have an iPhone or it's somewhere in the "three dots" I believe on Android. I am not aware of anywhere in the app to do the request.

Once logged in to the desktop site, go to the page for your card and if it is eligible for a CLI, there will be a blue link in the middle of the screen (slightly outdated screen shot but still relevant for CLIs):

Be sure to choose the most appropriate occupation, such as Arms/Ammunition Dealer or Cigarette Distributor (not joking):

And shoot for the moon as they will always counter-offer. Ask for whatever the highest amount you would feel comfortable having (no 3x rules like Amex, if your profile supports a $100k credit line go for it). Expect a HP on TransUnion unless they have pulled a credit report for another reason in the past 30 days. I have lost count of my 4 and 5 digit CLIs with BoA.

60-80% utilization on a single card can lower your credit score until the balance is lowered; BoA doesn't mind you having high utilization on their cards one bit. How much it will affect you depends on your profile and how many other cards are reporting balances and at what percentage.