- myFICO® Forums

- Types of Credit

- Credit Cards

- Choosing a new Credit Card, Advice needed

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Choosing a new Credit Card, Advice needed

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@bourgogne wrote:

@Anonymous wrote:Got it ! Thanks, will decide between the 2 and give it a shot...

@Strike while the iron is hot. serious. if you can do $3K in 3 months then I would advise doing the venture. I did 300>3300>8300>12300>14300 @ P>QS1>WMC and combined it into a venture I pc'ed into a qs. my venture sl was $ 20K. do the math, its a lot easier starting with a high limit then spending time to cli all the time. just my .02 - answer my other query, are you military of xmil or do you have linkage to the forces?

No I am not. Both of them could work it terms of spending though i don't travel more than twice a year but I read It cab be cashed with gift card etc. The quicksilver seems more "easy start" but yea I understand your view..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:

@bourgogne wrote:

@Anonymous wrote:Got it ! Thanks, will decide between the 2 and give it a shot...

@Strike while the iron is hot. serious. if you can do $3K in 3 months then I would advise doing the venture. I did 300>3300>8300>12300>14300 @ P>QS1>WMC and combined it into a venture I pc'ed into a qs. my venture sl was $ 20K. do the math, its a lot easier starting with a high limit then spending time to cli all the time. just my .02 - answer my other query, are you military of xmil or do you have linkage to the forces?

No I am not. Both of them could work it terms of spending though i don't travel more than twice a year but I read It cab be cashed with gift card etc. The quicksilver seems more "easy start" but yea I understand your view..

@got it. read up on how to join nfcu via the navy league of sd. that should be your next step. travel has nothing to do with this card, after you make the bonus you cli @ 90+ days, convert it to $ and then c1 sends you a check and pc to the qs. in a way you are buying a bigger sl. the sl should be huge vs a qs. it has nothing to do with an easy start, it is about is high limits and with a decent apr's although I pif so I really don't care. I strongly suggest you don't mess around, if you want into the credit game in a big way pull the pin. I just had this very exchange 2 days ago with a well known individual on this forum. baller. she told me to get the csr on the spot when the offer came up, the rest is history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:

@bourgogne wrote:

@Anonymous wrote:

@Anonymous wrote:Those prequalifying offers are from some of the eastiest banks except for Chase. If I was in your shoes I would apply for Discover. They are people getting them with a lower credit score then you and have the best customer service of any bank. You get a free credit score and rewards are really good. Once your credit improve, I would PC the Captial One credit card to something better such as quicksilver. My guess Chase would be the hardest credit card to get and I would hold off until your credit score is closer to 700.

With Amex they are the Disneyworld of credit world. They have a really good side and a dark shadow side to them. If you go down this path make sure you never miss a payment and preferable pay full every month (This is probably common sense, this the one bank you do not want to be on your bad side). You probably qualify for the Blue or Everyday cards. The Amex Green is not worth it.

As for regional or another other banks they are going to be very difficult to get.

Thank you for your comment, I definitely consider Discover even with a low limit would help me showing improvement as my currant CC is on 2,500 which is not enough but the max i could deposit with capital one.

assuming you are a guy, DUDE! do not get a discover when you have a solid pq for 2 of the top c1 cards. its not about showing improvements it about getting a high limit. here you go, I was mid 500s in 9/14 and I had a single $ 300 c1 card. read my sig. there you go, now go and post your results

So your'e saying I should apply for C1 Ventur and then change to Quicksilver? Just wanted to confirm

Another thing to be careful and start slow. In my case having more then lender helped with increasing credit limits as they tried to increase the limit more then other. Amex and Discover helped alot in that respect and it became easier to get higher limits to start with. bourgogne is right too. You can get a really high credit score just from one credit card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:

@Anonymous wrote:

@bourgogne wrote:

@Anonymous wrote:

@Anonymous wrote:Those prequalifying offers are from some of the eastiest banks except for Chase. If I was in your shoes I would apply for Discover. They are people getting them with a lower credit score then you and have the best customer service of any bank. You get a free credit score and rewards are really good. Once your credit improve, I would PC the Captial One credit card to something better such as quicksilver. My guess Chase would be the hardest credit card to get and I would hold off until your credit score is closer to 700.

With Amex they are the Disneyworld of credit world. They have a really good side and a dark shadow side to them. If you go down this path make sure you never miss a payment and preferable pay full every month (This is probably common sense, this the one bank you do not want to be on your bad side). You probably qualify for the Blue or Everyday cards. The Amex Green is not worth it.

As for regional or another other banks they are going to be very difficult to get.

Thank you for your comment, I definitely consider Discover even with a low limit would help me showing improvement as my currant CC is on 2,500 which is not enough but the max i could deposit with capital one.

assuming you are a guy, DUDE! do not get a discover when you have a solid pq for 2 of the top c1 cards. its not about showing improvements it about getting a high limit. here you go, I was mid 500s in 9/14 and I had a single $ 300 c1 card. read my sig. there you go, now go and post your results

So your'e saying I should apply for C1 Ventur and then change to Quicksilver? Just wanted to confirm

Another thing to be careful and start slow. In my case having more then lender helped with increasing credit limits as they tried to increase the limit more then other. Amex and Discover helped alot in that respect and it became easier to get higher limits to start with. bourgogne is right too. You can get a really high credit score just from one credit card.

Hey, never said anything about scores and a single card but you are right. listen, there is lots missing from this picture; why are his scores low to being with, what does he earn, etc. for me if I got a dual pre-qual of those cards at a fixed 18% for both and had a solid history with c1 the only thing I would be typing is my name into the web app lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

I think misinterpted sorry ![]() Captial One is another lender you do not want on your bad side as it loves lawsuits (They are no where as bad as Amex, but still). Hopefully whatever caused his low scores are behind him. Doing something similar to Captial One will not turn out well at all. Overall Captial One is a good bank and their customer service has really improved over the years. Just dont miss any payments.

Captial One is another lender you do not want on your bad side as it loves lawsuits (They are no where as bad as Amex, but still). Hopefully whatever caused his low scores are behind him. Doing something similar to Captial One will not turn out well at all. Overall Captial One is a good bank and their customer service has really improved over the years. Just dont miss any payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:I think misinterpted sorry

Captial One is another lender you do not want on your bad side as it loves lawsuits (They are no where as bad as Amex, but still). Hopefully whatever caused his low scores are behind him. Doing something similar to Captial One will not turn out well at all. Overall Captial One is a good bank and their customer service has really improved over the years. Just dont miss any payments.

I agree though i did a few mistakes but this was over 5 years ago and since then I was able to settle w/citi bank debt. i have no plans of doing this again. my chase acc manager also state I should apply for another secured or regular credit cards from a "smaller" bank for another 6 month of full balance + paying on time or even before and then try again applying for one of the major cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:

@Anonymous wrote:I think misinterpted sorry

Captial One is another lender you do not want on your bad side as it loves lawsuits (They are no where as bad as Amex, but still). Hopefully whatever caused his low scores are behind him. Doing something similar to Captial One will not turn out well at all. Overall Captial One is a good bank and their customer service has really improved over the years. Just dont miss any payments.

I agree though i did a few mistakes but this was over 5 years ago and since then I was able to settle w/citi bank debt. i have no plans of doing this again. my chase acc manager also state I should apply for another secured or regular credit cards from a "smaller" bank for another 6 month of full balance + paying on time or even before and then try again applying for one of the major cards.

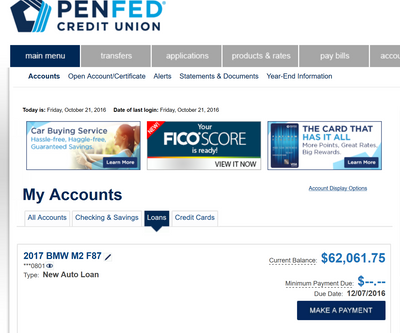

let me get this straight, you are going to ignore 2 solid offers that inc a low fixed % from a lender that you have established relationship with that is known for their solid pre-quals and instead listen to advice from someone at a far more conservative bank? It’s obvious that you have not researched this board that much – it’s almost a fact that c1 and nfcu that the most lenient lenders for rebuilds. Ignore what I suggested and send a pm to YIM or Baller and ask their opinion. They and a few others have been instrumental in my rebuild of 2 years. My sig is proof that a solid plan works. Here is more proof, nothing down, self-employed, no poi or tax returns and a check cut and overnighted in > 7min. find the pros on the board not the card collectors and heed their advice – don’t get store or secure cards. my final suggestions for you. Do as you will and good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

Great News! I just applied for the Capital One Venture and got approved w/12,000 limit! Finally after years of NO I got the YES ![]()

Thank You bourgogne and everyone here for the advise and directions, I truly appreciate that!

P.S. The bank/chat agent mention I could do an upgrade/pc each 6 month, Hope i would be able to make the switch at some point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Choosing a new Credit Card, Advice needed

@Anonymous wrote:Great News! I just applied for the Capital One Venture and got approved w/12,000 limit! Finally after years of NO I got the YES

Thank You @bourgogne and everyone here for the advise and directions, I truly appreciate that!

P.S. The bank/chat agent mention I could do an upgrade/pc each 6 month, Hope i would be able to make the switch at some point.

Congratulations on your approval! That is really great news and I am happy for you. Sorry to pressure you into it, that was not my intention, but solid pre-approval are hard to find and yours was, imo solid and too good to pass up based on you wanting a new card. what I would do it funnel all your spending through the venture, meet the bonus, cli 3 months post your 3rd statement, chat to see if you can pc to qs and have the agent convert your miles to cash, send you a check and pc the card. this is assuming you don’t want to mess with taking a flight lol.

If you want to continue your credit quest I will leave the below copy/paste here. Good luck on your journey.

This is how to join nfcu if one does not qualify via a military affiliation. The reason to join nfcu aside from them being the largest CU in the US is because they are very lenient towards rebuilders in terms of starting limits on cards. The reason joining now vs later is one never knows when the rules will change in the future. you will receive an eq hp for both membership and for any credit card or loan product. For a rebuild esp when self-employed I general recommend nfcu vs penfed – nfcu can yield large sls vs penfed and with penfed if you are self emp they might require poi or taxes. That said penfed is excellent; once you are in getting products can be painless as I just saw with an auto loan. They are delightful to deal with, fantastic customer service. Even if one does not plan on getting a card with nfcu right now I recommend joining for the future if you don’t mind the eq hp.

There are other forms of procedures and documentation that can work. I used the below so it worked for me and I joined both organization done within a day. I recommend email vs an online or mail as you can do it all in one shot and open a dialog channel with them.

one entrée for non-military into the cu is via membership with the navy league of san diego. It must be san diego. Here is the site www.navyleague-sd.com its $ 25 for a year. Use a credit card for membership. Retain the transaction receipt for membership as well as the membership welcome email. Put both into a pdf.

Download, print and fill in the nfcu application

www.navyfederal.org/pdf/applications-forms/NFCU97.pdf

If you have bad handwriting enter line for line the info into the body of an email. I recommend this anyway. Under B select association and under C select navy. Put the form into a pdf. Get 3 envelops from a utility or bank that show the name of the company and your name and address. Lay them out and take a pic of them and put it into a pdf. Take a pic of your driver’s license and you passport and pdf them. I would label the pdfs as to what they are.

membershipdocs@navyfederal.org is where you want to send:

nfcu application

nlus-sd welcome aboard email

nlus-sd payment receipt

driver’s license and passport

examples of mail addressed to you

credit card splash page (optional)

My note:

Attached please find my application to NFCU and some supporting documents; my affiliation with the Navy League of the United States - San Diego Council as well as mail I receive at my home address, driver’s license, passport, splash page from penfed, etc.

Put >> NEW MEMBERSHIP << in the subject line of your email

once approved call them and fund the account with a credit card. the min is $ 5.

Once in there are a variety of loan products and cards to choose from. nfcu uses a fico model called nextgen, you will receive a sm that has this score # in it so you can judge your chances of a card approval.

Again, address anything that is holding down your scores that you can and never ever be late with a payment to a lender.

//