- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Citi AAdvantage Platinum Select World Elite Ma...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

I was approved for the Citi AAdvantage WEMC card last month on the 24th with an SL of $11K and a APR of 24.24% - just 2.00% shy of the Maximum APR for the card. I always PIF, so I wasn't really concerned about the APR assigned to my account, AT THAT TIME.

The card has a SUB of 60K miles with a $3K spend.

Since then, my 1st statement cut on Feb. 5th with a balance due of $1,118.98 and I PIF on the 15th. After Feb. 5, my balance grew an additional $2,170.55. Before the March 5th statement is cut, today I PIF the $2,170.55, leaving a ZERO balance.

Next, I decided to focus on that Large APR of 24.24% and started an online Chat. The Rep could only give me an reduction to 22.24%. I wasn't satisfied with that offer and politely declined it, picked up the phone and dialed the number on the back of the Card.

Spoke to a very nice lady at Citi and requested an APR reduction. She came back with the same 22.24% as the Chat Rep offered. So, I asked if she had a better offer and she said that this was the ONLY offer 'The System' was giving to her. Without me saying a word about my Citi PIF payments, she said let me see what i can do and puts me on hold.

About a minute later, she comes back on the line and offers me - WAIT FOR IT - 18.24%!!!

I verified the new APR with my online account while she was still on the phone. OH HAPPY DAY!!!

Citi Custom Cash WEMC $7.8K | Synchrony (PayPal Credit $6K, Care Credit $15K, & PayPal 2% MC $10K, VENMO VS $6.5K)

PNC Cash Rewards VS $10.5K | NFCU cashRewards VS $14K | NFCU More Rewards AMEX $37.5K | NFCU Flagship Rewards VS $23K

Discover IT $22.5K | BB&T Cash Rewards $4.5K | Macy's AMEX $25K | Bloomingdales AMEX $20K | Apple Card WEMC $9K

PenFed Power Cash Rewards VS $7.5K

Total CL - $284K+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

@Marz2002 wrote:I was approved for the Citi AAdvantage WEMC card last month on the 24th with an SL of $11K and a APR of 24.24% - just 2.00% shy of the Maximum APR for the card. I always PIF, so I wasn't really concerned about the APR assigned to my account, AT THAT TIME.

The card has a SUB of 60K miles with a $3K spend.

Since then, my 1st statement cut on Feb. 5th with a balance due of $1,118.98 and I PIF on the 15th. After Feb. 5, my balance grew an additional $2,170.55. Before the March 5th statement is cut, today I PIF the $2,170.55, leaving a ZERO balance.

Next, I decided to focus on that Large APR of 24.24% and started an online Chat. The Rep could only give me an reduction to 22.24%. I wasn't satisfied with that offer and politely declined it, picked up the phone and dialed the number on the back of the Card.

Spoke to a very nice lady at Citi and requested an APR reduction. She came back with the same 22.24% as the Chat Rep offered. So, I asked if she had a better offer and she said that this was the ONLY offer 'The System' was giving to her. Without me saying a word about my Citi PIF payments, she said let me see what i can do and puts me on hold.

About a minute later, she comes back on the line and offers me - WAIT FOR IT - 18.24%!!!

I verified the new APR with my online account while she was still on the phone. OH HAPPY DAY!!!

I am not sure what the point of you doing that was. If you want a lower interest card there are plenty of cards with lower rates. Plenty of cards with 0 percent introductory rates. I am not sure what you gained going from 24% to 18%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

Citi, like Discover and some others, tend to usually lower the APR if the account is eligible. So, a step in the right direction for the OP.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

@FinStar wrote:

The gain was providing other members with their experience in lowering the APR on a rewards/co-branded product with Citi.

Citi, like Discover and some others, tend to usually lower the APR if the account is eligible. So, a step in the right direction for the OP.

Thanks for the assist @FinStar!

@frogman1, I know that I am able to get lower interest rate credit cards, but I wanted this particular card since I fly AA most of the time and one of the Card's benefits is 1 FREE checked bag per flight. Also, if I ever had to carry a balance on the Card, I now have a LOWER interest rate.

Citi Custom Cash WEMC $7.8K | Synchrony (PayPal Credit $6K, Care Credit $15K, & PayPal 2% MC $10K, VENMO VS $6.5K)

PNC Cash Rewards VS $10.5K | NFCU cashRewards VS $14K | NFCU More Rewards AMEX $37.5K | NFCU Flagship Rewards VS $23K

Discover IT $22.5K | BB&T Cash Rewards $4.5K | Macy's AMEX $25K | Bloomingdales AMEX $20K | Apple Card WEMC $9K

PenFed Power Cash Rewards VS $7.5K

Total CL - $284K+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

|   |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

@FinStar wrote:

The gain was providing other members with their experience in lowering the APR on a rewards/co-branded product with Citi.

Citi, like Discover and some others, tend to usually lower the APR if the account is eligible. So, a step in the right direction for the OP.

The lowest possible rate for a Citi AA card is loan shark like rates. I think the better advise would be to point people to the hundreds of better choices if they have the need to carry a balance. I currently have 4 Citi AA cards. Don't know the rates on them other than they are way too high to carry a balance. The same as any co-branded card airline or hotel card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

@Anonymous wrote:

@FinStar wrote:

The gain was providing other members with their experience in lowering the APR on a rewards/co-branded product with Citi.

Citi, like Discover and some others, tend to usually lower the APR if the account is eligible. So, a step in the right direction for the OP.The lowest possible rate for a Citi AA card is loan shark like rates. I think the better advise would be to point people to the hundreds of better choices if they have the need to carry a balance. I currently have 4 Citi AA cards. Don't know the rates on them other than they are way too high to carry a balance. The same as any co-branded card airline or hotel card.

Unfortunately, the bolded part is not entirely accurate for those folks who can get their APRs to a farily low rate. Also, the OP's initial post did not mention anything about carrying a balance. The OP explicitly mentioned they PIF. If Citi has the flexibility to lower the go-to APR for an accountholder, why not? I have 10 Citi 'core' cards an a variety of them have pretty low APRs which are comparable and or similar to a variety CU low rate CCs. I never carry a balance but there is nothing wrong with anyone providing advice or sharing on being able to request a lower APR, especially on this product and whether or not they PIF.

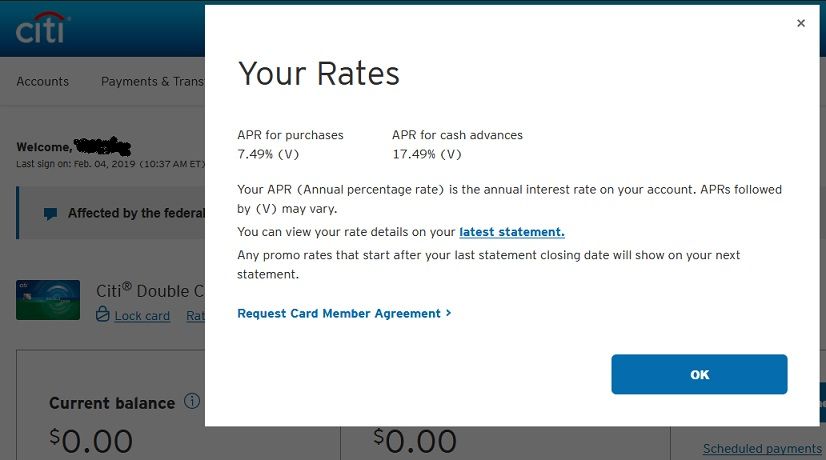

As an example, here's one of mine that currently offers a fairly low variable APR.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

@Priory_Man wrote:

Nice job on not giving up, appreciate the info bud.

@Priory_Man Always good to hear from you and Thanks!

Citi Custom Cash WEMC $7.8K | Synchrony (PayPal Credit $6K, Care Credit $15K, & PayPal 2% MC $10K, VENMO VS $6.5K)

PNC Cash Rewards VS $10.5K | NFCU cashRewards VS $14K | NFCU More Rewards AMEX $37.5K | NFCU Flagship Rewards VS $23K

Discover IT $22.5K | BB&T Cash Rewards $4.5K | Macy's AMEX $25K | Bloomingdales AMEX $20K | Apple Card WEMC $9K

PenFed Power Cash Rewards VS $7.5K

Total CL - $284K+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

If you dont ask you wont get it magically. Not everyone will be born with a silver spoon and get huge limits all the time with the lowest aprs, some of us actually have to work for better credit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi AAdvantage Platinum Select World Elite Mastercard APR - REDUCTION!

AJC, You...

Thanks for the acknowledgment and the additional advice!

Thanks for the acknowledgment and the additional advice!

I totally agree with you!

Citi Custom Cash WEMC $7.8K | Synchrony (PayPal Credit $6K, Care Credit $15K, & PayPal 2% MC $10K, VENMO VS $6.5K)

PNC Cash Rewards VS $10.5K | NFCU cashRewards VS $14K | NFCU More Rewards AMEX $37.5K | NFCU Flagship Rewards VS $23K

Discover IT $22.5K | BB&T Cash Rewards $4.5K | Macy's AMEX $25K | Bloomingdales AMEX $20K | Apple Card WEMC $9K

PenFed Power Cash Rewards VS $7.5K

Total CL - $284K+