- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi Bank CLI - HP :(

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi Bank CLI - HP :(

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi Bank CLI - HP :(

Based on what I've read, I assumed that the Citi Bank CLI was a soft pull. I received an alert and Citi HP'd Equifax. Can I fight it??? ☹ Just trying to balance my UTIL % without HP's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

@CreditTara16 wrote:Based on what I've read, I assumed that the Citi Bank CLI was a soft pull. I received an alert and Citi HP'd Equifax. Can I fight it??? ☹ Just trying to balance my UTIL % without HP's.

How did you request it? I've gotten SP CLIs, but always by calling the number on the back of my card.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

It's a soft pull until it asks you if you want to do a manual review. If you click on that second part, it's a hard pull. Do you remember something like that?

Not something you can legitimately dispute, it sounds as if you click through too fast.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

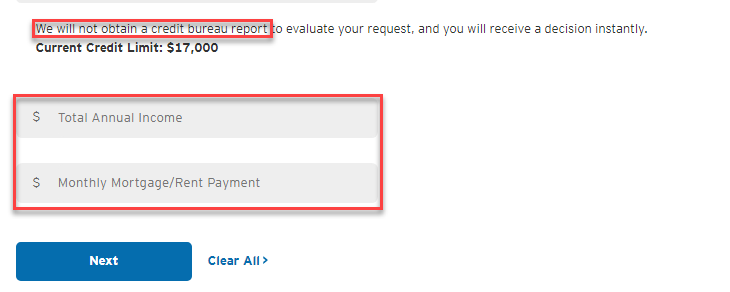

If you see this....

Then it's a SP..... If you see 3 or more boxes asking for info then it's going to be a HP for sure and will state as much.

If your card isn't a legacy CITI product then it's usually a HP either way.

Any CBNA / DSNB store / co-brand could be a HP as well depending on the product.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

Citi is sometimes a SP, but looking at verbage there is always a chance it could be a HP when applying for a CLI with any lenders.

No you "can't fight it ", you applied for an increase .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

@Anonymous wrote:If you see this....

Then it's a SP..... If you see 3 or more boxes asking for info then it's going to be a HP for sure and will state as much.

If your card isn't a legacy CITI product then it's usually a HP either way.

Any CBNA / DSNB store / co-brand could be a HP as well depending on the product.

I went for a CLI last January for my DC card. Requested 10K increase from 40K to 50K. My last CLI on the card was November 2007. I thought since my income is up 40K since then, I can get a CL more in line with 2019 and a higher income.

I was denied. Reason, income not high enough for an increase. Times are different. Income up 40K, never missed a payment, no CLI in 12 years, not good enough. It may also be their top line is 40K for DC, who knows.

It was a hard pull.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

@Anonymous wrote:

@Anonymous wrote:If you see this....

Then it's a SP..... If you see 3 or more boxes asking for info then it's going to be a HP for sure and will state as much.

If your card isn't a legacy CITI product then it's usually a HP either way.

Any CBNA / DSNB store / co-brand could be a HP as well depending on the product.

I went for a CLI last January for my DC card. Requested 10K increase from 40K to 50K. My last CLI on the card was November 2007. I thought since my income is up 40K since then, I can get a CL more in line with 2019 and a higher income.

I was denied. Reason, income not high enough for an increase. Times are different. Income up 40K, never missed a payment, no CLI in 12 years, not good enough. It may also be their top line is 40K for DC, who knows.

It was a hard pull.

While none of us may be privvy to your overall profile, there's typically other internal reasons besides the income factor that Citi did not feel comfortable with a CLI. It's also plausible they feel your current CL may be adequate in their eyes.

And, as mentioned above and upthread, unless the language specified no CR pull, then the review is handled at the SP level. But, as far as the max CL on Double Cash, I've seen anywhere from $60K to $80K on those.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi Bank CLI - HP :(

@FinStar wrote:

@Anonymous wrote:

@Anonymous wrote:If you see this....

Then it's a SP..... If you see 3 or more boxes asking for info then it's going to be a HP for sure and will state as much.

If your card isn't a legacy CITI product then it's usually a HP either way.

Any CBNA / DSNB store / co-brand could be a HP as well depending on the product.

I went for a CLI last January for my DC card. Requested 10K increase from 40K to 50K. My last CLI on the card was November 2007. I thought since my income is up 40K since then, I can get a CL more in line with 2019 and a higher income.

I was denied. Reason, income not high enough for an increase. Times are different. Income up 40K, never missed a payment, no CLI in 12 years, not good enough. It may also be their top line is 40K for DC, who knows.

It was a hard pull.

While none of us may be privvy to your overall profile, there's typically other internal reasons besides the income factor that Citi did not feel comfortable with a CLI. It's also plausible they feel your current CL may be adequate in their eyes.

And, as mentioned above and upthread, unless the language specified no CR pull, then the review is handled at the SP level. But, as far as the max CL on Double Cash, I've seen anywhere from $60K to $80K on those.

Yeah, there could have been. I used the card a lot. Would average 2500/mo 5 years ago, and now about 700/mo. Haven't carried a balance with them since 2004.