- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Citi MC New Offer - Worthless?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi MC New Offer - Worthless?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

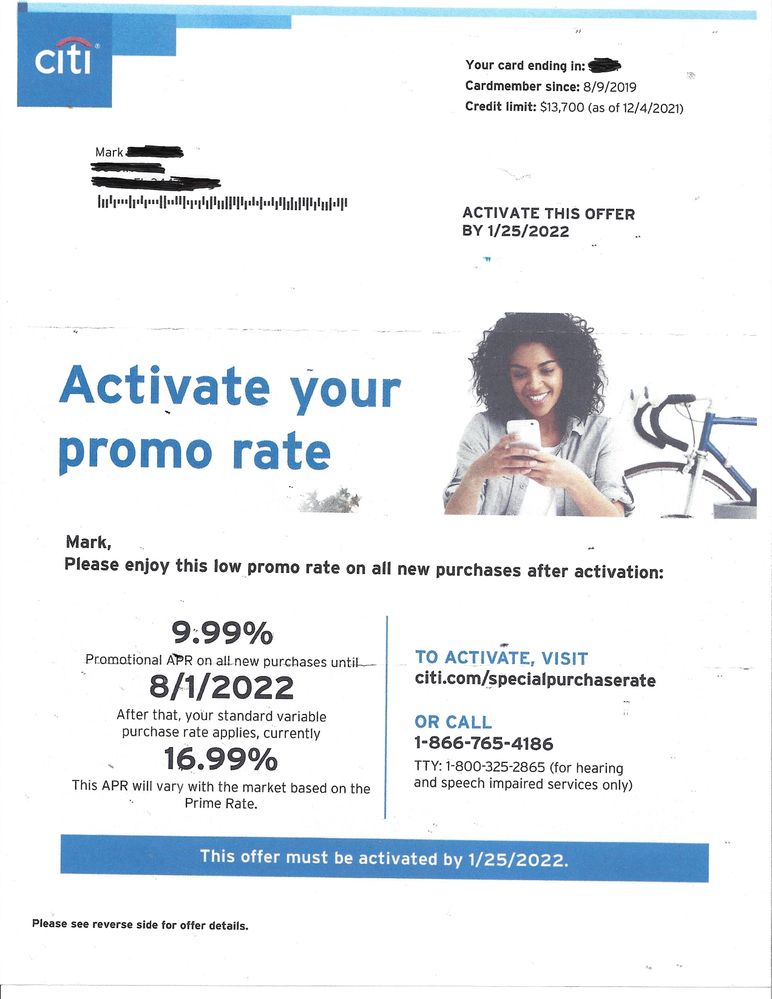

Citi MC New Offer - Worthless?

Citi sent me this Valuable (worthless) offer. I mean I do love Citi Bank but really? What are they thinking?

Thanks

Mark

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@Anonymous wrote:Citi sent me this Valuable (worthless) offer. I mean I do love Citi Bank but really? What are they thinking?

Thanks

Mark

For someone in your position, ie lots of options, not great but for someone with high aprs/balances not bad![]() . Citi can be weird on what offers they offer lol.

. Citi can be weird on what offers they offer lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@Yasselife wrote:How're your scores now, Mark? I read you have over 100 inquiries, makes me wonder.

@Anonymous

As of yesterday there where between 809 and 825 off of memory. As I stated before, some people reallly worry that a HP will kill your scores and I have as you said just over 100 between all three agencies. I think it is more my thick profile and age of some very old cards. I check my reports daily and no matter how many new inquries and no matter how many fall off my scores never change at all over inquries that I can pick up on.

I was always in the 775 to 788 range until my new car loan showed at 52% paid off then I had the score jump about 2 months ago, other then that just the typical new cards that I always get. I assume that the car loan pay down was the reason for the jump in scores but do I know for sure? not at all LOL

Thanks

Mark

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

Well, in FICO scoring, the first item affects score a lot the second a bit less, third less still, and so on. By the time one reaches 100 INQ, the score is really tired of them, and doesn't move.

There are other aspects, including new accounts, but there again, piling on the same thing eventually stops impacting score.

Even lates of exactly the same type will stop affecting score if one has enough. With lates, however, multiples of lates tend to lead to escalating issues, --> 60 days, then 90 days, then charge off or BK.

So someone with a very thick file, low utilization, and no lates should be near 850... except for all the INQ and new accounts ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@NRB525 wrote:Well, in FICO scoring, the first item affects score a lot the second a bit less, third less still, and so on. By the time one reaches 100 INQ, the score is really tired of them, and doesn't move.

There are other aspects, including new accounts, but there again, piling on the same thing eventually stops impacting score.

Even lates of exactly the same type will stop affecting score if one has enough. With lates, however, multiples of lates tend to lead to escalating issues, --> 60 days, then 90 days, then charge off or BK.

So someone with a very thick file, low utilization, and no lates should be near 850... except for all the INQ and new accounts

Yeah, I was in the same boat, hovering around 740 with almost 100 between all 3 (32 ex, 39 TU and like 26 eq) the late from 4 years ago is what's really holding my scores back lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@NRB525 wrote:Well, in FICO scoring, the first item affects score a lot the second a bit less, third less still, and so on. By the time one reaches 100 INQ, the score is really tired of them, and doesn't move.

There are other aspects, including new accounts, but there again, piling on the same thing eventually stops impacting score.

Even lates of exactly the same type will stop affecting score if one has enough. With lates, however, multiples of lates tend to lead to escalating issues, --> 60 days, then 90 days, then charge off or BK.

So someone with a very thick file, low utilization, and no lates should be near 850... except for all the INQ and new accounts

I don't even think you have to wait till you have a lot of inquiries to not move. My credit score on Experian was 738 with 10 inquiries. I added 5 more inquiries and new accounts and it still was stuck at 738, never budged. Finally this month it moved to 739 🤔

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@NRB525 wrote:Well, in FICO scoring, the first item affects score a lot the second a bit less, third less still, and so on. By the time one reaches 100 INQ, the score is really tired of them, and doesn't move.

There are other aspects, including new accounts, but there again, piling on the same thing eventually stops impacting score.

Even lates of exactly the same type will stop affecting score if one has enough. With lates, however, multiples of lates tend to lead to escalating issues, --> 60 days, then 90 days, then charge off or BK.

So someone with a very thick file, low utilization, and no lates should be near 850... except for all the INQ and new accounts

Exactly. In my case, once I hit 9 inquiries I stop losing points. In addition, iirc, a good amount of his inquiries were auto.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

@Anonymous wrote:Citi sent me this Valuable (worthless) offer. I mean I do love Citi Bank but really? What are they thinking?

Thanks

Mark

Agreed that it's pointless, but I usually "activate" these offers, just in case. Of course I never use them.

But I must admit I've never seen one for 9.99% APR, which is only 7 points lower than your standard APR. I'm pretty sure the ones I've seen have been for 0%.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi MC New Offer - Worthless?

I get offers on my Citi card all the time, most of my offers are 5.99% to 0.00% for 9 to 12 months at a time my standard rate is 7.5% and had the card since 2007. I look at it 9.99% APR offer is better then the 16.99% APR on the account.