- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: City National Bank / Crystal credit card revie...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

City National Bank / Crystal credit card review

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

City National Bank / Crystal credit card review

Hi All,

This thread is meant to be my personal review of City National Bank and their Crystal credit card that I acquired 2 months ago. The motive is to provide clarity on certain aspects of being a CNB customer that isn't obvious or published about in the various threads/blogs I've read about it on.

Why I got it:

As someone who tries to travel at least a few times a year and moderately churns credit cards, I found the card to be a great supplement to my CSR card because it has its own travel perks that not only benefits me, but also my friends/family members (more on that in a bit).

Application process:

As many have wrote about, the process is more involved than your typical bank credit card. I'm fortunate enough to have a CNB branch in the office building I work at in NYC. All that I brought with me was 2 recent pay-stubs and my driver's license. The banker was very professional and courteous, and walked me through the process and benefits despite him already having a hunch I knew what to expect. I was verbally asked how much liquid cashflow I have, and if I had any brokerage/investment accounts. I do not recall having to provide details into the investment accounts or who my brokerages were. As far as the "high income" prerequisite for the Crystal card, yes, I do have a six-figure income. However, I've heard of people in NYC getting approved with less than $100k income. I was told the underwriting process would take 3 days before they provide me an answer. 3 days later, I got a call from my banker that I was approved for a $15k credit limit, and the card would be expedited.

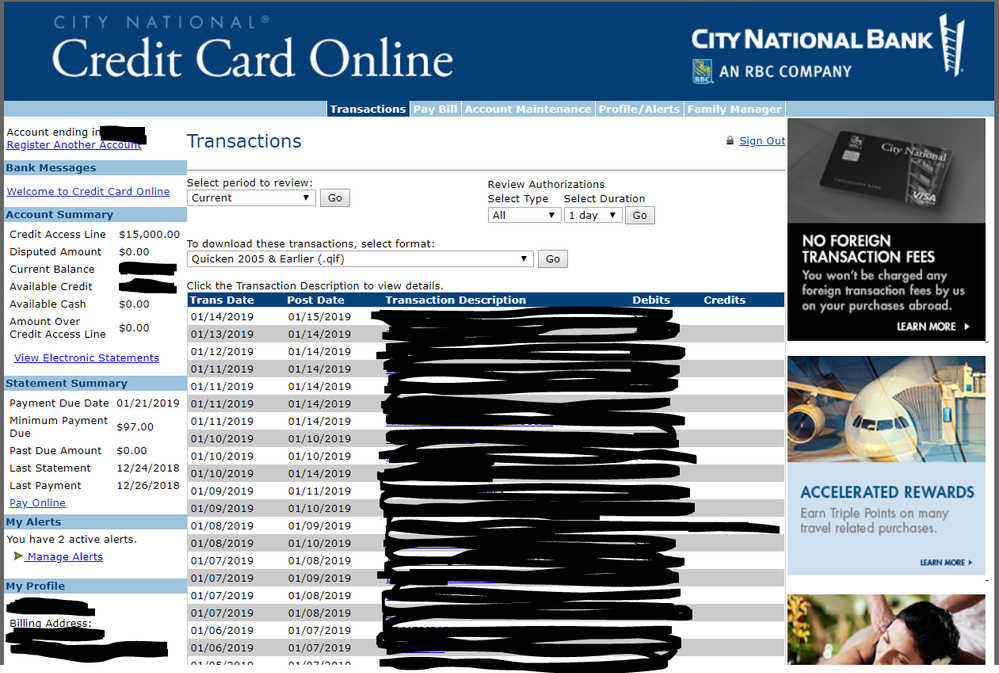

Online Banking interface (screenshot below):

As far as the online banking UI, let's say it technically works. Compared to major banks like Chase and BofA, CNB's UI looks very primitive (like something from the 1990s) and is very limited in features/functions. You can see your transactions, statements, pay your bill manually, adjust how much spending power your AU's have, set up alerts, edit account profile details, and provide permission for your AU's to have their own online banking logins. That's pretty much it. Very scarce functionality, indeed.

Other Noteworthy Mentions:

Auto Pay - technically, they do have an auto-pay functionality but it is not available via the online banking UI. You actually have to call/email your personal banker to set it up. Even once it's set up, you don't actually see that it's set up on the online banking portal. You pretty much just have to take it up to faith that it will auto-pay when it's supposed to. Eh...

Adding authorized users - You can only add authorized users by reaching out to your personal banker once again. You'll be provided a client profile sheet for each AU to fill out. It will require their name, phone, address, SS#, ask what work they do, work address, work phone. They will then all be provided cards with unique 16-digit numbers

(2) Priority Passes - The Crystal card is unique in that it provides 2 Priority Passes, instead of 1 like most travel cards. It also advertises unlimited guests compared to the 2 guest limit that most cards have as well. Since I already have a Priority Pass from my CSR card, I deferred the passes to 2 of my AU's.

Customer Service:

Although there is an unusual reliance to have to reach out to the Customer Service line or personal banker for relatively simple requests and functions, Customer Service has been solid thus far. There is no automated prompt for anything. Once you call Customer Service, there is a knowledgeable and professional rep that picks up right away.

Credit limit increases:

Given that I like to have a lot of headroom for purchases, especially during the 90 day period of meeting the minimum spend, and to keep the utilization % low, this part was underwhelming. After the 2 month mark, I asked my banker what the process is like to get a CLI, and if CNB gives automatic CLI over time given that I always pay on time and the account remains in good standing. He followed up saying that they've already approved me for the max credit they can. Any changes to the credit limit would be dependent on "significant" changes in income or expenses. Also, it would require that I provide a new paystub as proof of income change, and it would be a hard inquiry as well. Looks like I'll be stuck at $15k. Demoralizing to say the least.

Overall Summary:

Despite how CNB operates the online banking and customer service features, this is still a very solid card to have. Customer service is great as mentioned above, as well as the perks and bonus. This is definitely a keeper card for as long as they keep the $250 airline incidental fee credit per account holder (quick maths: Me + 3 AU's @ $250 each per calendar year = $1000 credit. Credit can and will be used to purchase AA e-gift cards every year). Basically, this card makes you money, even with the $400 AF. Even if I spent nothing on the card and only bought gift cards, I'm still profiting $600/year at the minimum. Hard to argue with that. Aside from that, it has many overlapping benefits as other premium travel cards regarding travel and purchases protection. I will exclude going into them as that is easily found with a quick online search.

Hope this helps to clarify and dispell some of the mystery with CNB and what it's like being a client of their's.

Update (All following questions in thread are added here for convenience):

1. How well does the earnings process work?

So far the the earnings process is working well. No complaints. 3x on travel, dining, groceries, and gas. Once I had hit the $5k spend about 5-6 weeks into having the card, I saw the 75,000 bonus points added on top of the points earned from the $5k spend. I currently have 93k total points after $8.5k spend.

2. How do the redemptions work?

There is a separate website that CNB has for rewards redemption. That's another thing that is a bit annoying about CNB. They have a different website for just about every product/service they offer. We're talking about 25 websites - not joking. Once you're in the rewards site, you have the option to redeem your points through 3 main categories: Merchandise, Travel (book flights, hotels, car rental, activities), Digital Awards (their version of iTunes). They also have something called Rewards Plus, which looks like it functions similar to eBates (cashback vendor). Like most travel cards, you'll get the most out of your points by redeeming via booking flights. If I recall correctly, we're talking about 1.2x per point. It's not as great as the 1.5x from the CSR, but I'm still not complaining as this aspect of the card is not the main selling point (referring to the $1000 incidental credit per year).

3. Are there any airline transfer of points, or is it all booked through one of their portals?

There is no function to transfer points to different airlines. You'd book flights through their own portal.

2 things to note:

1. Their portal's rates are competitive and identical to what I've found with searching flights via Expedia and Google Flights. This is different from Chase's travel portal where they clearly upcharge for every flight I've seen so far.

2. You get a $100 discount on every domestic flight booking when you book for 2-5 people. There is no limit to how many times you can use this perk.

4. As far as proof of income, for someone who is self-employed, what types of proof do you think could be accepted?

As I am not self-employed, my response is based on an educated assumption on what they would accept and require as proof of revenue. As business can greatly fluctuate month-to-month, I would recommend bringing in consolidated statement(s) showing evidence of your income for the past 1-2 years to indicate you have a steady income stream and that you are not a potential risk to them as a client. As with any creditor, you want to give them every reason to want to approve you, and no reasons to think you are a risk.

5. What kind of credit history do you have? Recent inquiries or new accounts? Did you feel that was a major factor?

My credit history has been fairly solid thus far. My FICO score typically hovers between high 790s to 810s depending on how many recent credit card applications I've put in and my spending habits. I had an app spree back in Aug/Sep '18 of 10 cards, which brought my score of 823 to 790s. My oldest account is 18 years old. I've always paid on time, so no delinquent payments. In terms of inquiries, I have 5 with TU, 4 with EQ, and 10 with EX.

In terms of whether these are a major factor, I think it's just more so that the FICO score likely matters more to them than the number of inquiries. Given the questions from the application process, I'd say the order of importance is as follows: Total income > amount of money in liquid cashflow / investment portfolios, credit score, credit history, inquiries. Regardless, you should aim to have all of these things on point to maximize your chances of approval.

@jdbkiang, based on your signature at the time of this writing, I believe you'd have no problem getting approved for this card.

6. How does the $550 Airline Lounge Credit work?

This is statement credit given to you for an airline lounge membership of your choice if you spend $55k/year on the Crystal card. As I am not someone to spend $55k/year on credit cards a year, at least on average, this perk is something I'm not partial to or focus on as it is not within my means to reach, but all the power to you if you have the means to acquire this. The Priority Passes offered by this card as a separate perk is more than enough for me personally.

7. What bureau(s) did they pull for you?

They only pulled from Experian for me.

8. Did the banker give any hard income figure as to the minimum they want to see from applicants?

It wasn't a discussion I had with my banker as I came prepared knowing what I needed to know about the application and approval process from various sources online. Based on those sources, the minimum figure likely fluctuates greatly on where you're located. For example, the minimum is likely to be higher in higher-earning cities such as NYC, San Fran, LA, etc., than in other cities.

I do not want to give out any incorrect data to you, but personally, I would not apply unless my income was at least $70k, and all other factors such as liquid cash flow, investment accounts (if any), credit score, and credit history are in a good place.

If anything, you can always call your local CNB branch and request to speak to a banker to get his opinion.

Chase IHG 8.5K | Chase Freedom 5K | Chase Sapphire 3K

Bank of America Cash 40K | Bank of America Travel 40K

AMEX Delta Gold 30K | AMEX Everyday 25K | AMEX Delta 13K | AMEX Blue Cash Everyday 2.62K

Citi Rewards Plus 31K | Citi ThankYou Premier 18.7K

PenFed Pathfinder 5K | PenFed Platinum 5K

TD Cash 14K | Uber Visa 13K | USBank Cash+ 10K

Wells Fargo Cash Wise 6.5K | Discover IT 5.2K

Overstock 13K | Target RedCard 2.5K | Victoria Secret Angel 1K | LOVE LOFT .25K

BP Visa 5K | Walmart MC 3.3K

08/18: TCL 246.95K | AoOA: 18Y | AAoA: 5.0Y || TU: 820 | EQ: 823 | EX: 815 || INQ - TU: 3 | EQ: 3 | EX: 7

12/18: TCL 386.95K | AoOA: 18Y | AAoA: 3.1Y || TU: 805 | EQ: 813 | EX: 769 || INQ - TU: 5 | EQ: 4 | EX: 10

11/19: TCL 421.55K | AoOA: 18Y | AAoA: 4.2Y || TU: 818 | EQ: 820 | EX: 794 || INQ - TU: 6 | EQ: 5 | EX: 9

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

wdkwang ... excellent write up with lots of useful information! As you stated, there is a lack of information on this card and you filled in with the real world blanks. Appreciate that ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

Good review. I'd be interested in hearing about the following two topics in addition to the ones you discussed above:

-- How well does the earnings process work?

-- How do the redemptions work?

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

Scores - All bureaus 770 +

TCL - Est. $410K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

@UpperNwGuy wrote:Good review. I'd be interested in hearing about the following two topics in addition to the ones you discussed above:

-- How well does the earnings process work?

-- How do the redemptions work?

I'm glad you like the review.

I've updated my original post to answer your questions. Please let me know if you have any other questions. Thanks

Chase IHG 8.5K | Chase Freedom 5K | Chase Sapphire 3K

Bank of America Cash 40K | Bank of America Travel 40K

AMEX Delta Gold 30K | AMEX Everyday 25K | AMEX Delta 13K | AMEX Blue Cash Everyday 2.62K

Citi Rewards Plus 31K | Citi ThankYou Premier 18.7K

PenFed Pathfinder 5K | PenFed Platinum 5K

TD Cash 14K | Uber Visa 13K | USBank Cash+ 10K

Wells Fargo Cash Wise 6.5K | Discover IT 5.2K

Overstock 13K | Target RedCard 2.5K | Victoria Secret Angel 1K | LOVE LOFT .25K

BP Visa 5K | Walmart MC 3.3K

08/18: TCL 246.95K | AoOA: 18Y | AAoA: 5.0Y || TU: 820 | EQ: 823 | EX: 815 || INQ - TU: 3 | EQ: 3 | EX: 7

12/18: TCL 386.95K | AoOA: 18Y | AAoA: 3.1Y || TU: 805 | EQ: 813 | EX: 769 || INQ - TU: 5 | EQ: 4 | EX: 10

11/19: TCL 421.55K | AoOA: 18Y | AAoA: 4.2Y || TU: 818 | EQ: 820 | EX: 794 || INQ - TU: 6 | EQ: 5 | EX: 9

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

@xaximus wrote:

Excellent write up and very informational. Seems like a great card but the UI and the reliance on CSR to do simple changes would be a bit of a negative in my book. The perks look pretty good though...

I appreciate your feedback, xaximus.

To your point, it is definitely something to get accustomed to while you get yourself set up in the beginning (Auto Pay / AUs), however, you get used to it fairly quickly. It also helps in appreciating the UI that other major banks provide ![]()

Chase IHG 8.5K | Chase Freedom 5K | Chase Sapphire 3K

Bank of America Cash 40K | Bank of America Travel 40K

AMEX Delta Gold 30K | AMEX Everyday 25K | AMEX Delta 13K | AMEX Blue Cash Everyday 2.62K

Citi Rewards Plus 31K | Citi ThankYou Premier 18.7K

PenFed Pathfinder 5K | PenFed Platinum 5K

TD Cash 14K | Uber Visa 13K | USBank Cash+ 10K

Wells Fargo Cash Wise 6.5K | Discover IT 5.2K

Overstock 13K | Target RedCard 2.5K | Victoria Secret Angel 1K | LOVE LOFT .25K

BP Visa 5K | Walmart MC 3.3K

08/18: TCL 246.95K | AoOA: 18Y | AAoA: 5.0Y || TU: 820 | EQ: 823 | EX: 815 || INQ - TU: 3 | EQ: 3 | EX: 7

12/18: TCL 386.95K | AoOA: 18Y | AAoA: 3.1Y || TU: 805 | EQ: 813 | EX: 769 || INQ - TU: 5 | EQ: 4 | EX: 10

11/19: TCL 421.55K | AoOA: 18Y | AAoA: 4.2Y || TU: 818 | EQ: 820 | EX: 794 || INQ - TU: 6 | EQ: 5 | EX: 9

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

@wdkwang wrote:To your point, it is definitely something to get accustomed to while you get yourself set up in the beginning (Auto Pay / AUs), however, you get used to it fairly quickly. It also helps in appreciating the UI that other major banks provide

I guess the key thing it to remember to do it! Consumers Credit Union has a similar process for setting up auto pay. Since I always set it up on my cards via a website, for some reason I assumed I had there, and after about 15 months, let the non-existent auto-pay take care of a payment, and then incurred interest and late fee! Purely my mistake (well, also their fault for being clunky!) but sounds like you should do it first think with CNB!

Also, is there any airline transfer of points, or is it all booking through one of their portals.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

@longtimelurker wrote:

@wdkwang wrote:To your point, it is definitely something to get accustomed to while you get yourself set up in the beginning (Auto Pay / AUs), however, you get used to it fairly quickly. It also helps in appreciating the UI that other major banks provide

I guess the key thing it to remember to do it! Consumers Credit Union has a similar process for setting up auto pay. Since I always set it up on my cards via a website, for some reason I assumed I had there, and after about 15 months, let the non-existent auto-pay take care of a payment, and then incurred interest and late fee! Purely my mistake (well, also their fault for being clunky!) but sounds like you should do it first think with CNB!

Also, is there any airline transfer of points, or is it all booking through one of their portals.

Absolutely, autopay setup is always priority for me. Even though I've had 3 reps confirm the autopay is setup to pay the balance in full, I've manually paid the minimum balance just in case anything goes wrong with the autopay. This should protect me from any late fees or being flagged for a delinquent payment.

To answer your question, there is no function to transfer points to different airlines. You'd book flights through their own portal. 2 things to note:

1. Their portal's rates are competitive and identical to what I've found with searching flughts via Expedia and Google Flights. This is different from Chase's travel portal where they clearly upcharge for every flight I've seen so far.

2. You get a $100 discount off every domestic flight booking when you book for 2-5 people. There is no limit to how many times you can use this perk

Chase IHG 8.5K | Chase Freedom 5K | Chase Sapphire 3K

Bank of America Cash 40K | Bank of America Travel 40K

AMEX Delta Gold 30K | AMEX Everyday 25K | AMEX Delta 13K | AMEX Blue Cash Everyday 2.62K

Citi Rewards Plus 31K | Citi ThankYou Premier 18.7K

PenFed Pathfinder 5K | PenFed Platinum 5K

TD Cash 14K | Uber Visa 13K | USBank Cash+ 10K

Wells Fargo Cash Wise 6.5K | Discover IT 5.2K

Overstock 13K | Target RedCard 2.5K | Victoria Secret Angel 1K | LOVE LOFT .25K

BP Visa 5K | Walmart MC 3.3K

08/18: TCL 246.95K | AoOA: 18Y | AAoA: 5.0Y || TU: 820 | EQ: 823 | EX: 815 || INQ - TU: 3 | EQ: 3 | EX: 7

12/18: TCL 386.95K | AoOA: 18Y | AAoA: 3.1Y || TU: 805 | EQ: 813 | EX: 769 || INQ - TU: 5 | EQ: 4 | EX: 10

11/19: TCL 421.55K | AoOA: 18Y | AAoA: 4.2Y || TU: 818 | EQ: 820 | EX: 794 || INQ - TU: 6 | EQ: 5 | EX: 9

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: City National Bank / Crystal credit card review

As far as proof of income, for someone who is self-employed, what types of proof do you think could be accepted?

Also, what kind of credit history do you have? Recent inquiries or new accounts? Did you feel that was a major factor?

Edit: How does the $550 Airline Lounge Credit work?

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content