- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Considering BofA Premium Rewards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Considering BofA Premium Rewards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@wasCB14 wrote:

@Turbobuick wrote:Looks well thought out. We are platinum honors members for going on a year. A couple things that may help you. I have not read all 4 pages here, so I apologize for any redundancy.

1. Open a BofA Advantage Relationship Checking Acct. ASAP. Your 90 day clock doesn't start until you open it. We got a $300 SUB but that was 11 months ago. If you can open the account inside the bank you may get it too. YMMV.

2. Merrill Edge offers $900 cash for $100K deposited often. The 90 day average is 90 days, whether you deposit a million or a billion. Unless you have a previous current personal banking relationship, then it can be shorter.

3. BofA cash rewards cards. The 3% becomes 5.25%. We got 3 of them to cover most catagories. My Paypal acct points to BofA cash rewards. Ebay gets 5.25 off as does any retail that takes Paypal.(even some charitable donations got full rebate)

4. Costco online offers Cash/Shop cards. We buy them in lots of $500 with our BofA cash card set to Online Shopping. Everything is 5.25% off at Costco including gasoline. We never refill the cash card, always buy new.

I think year-to-date, we've recieved almost $2000 just in SUB's from BofA. No doubt there's tax consequences, but free money is free money.

Good luck!

1. I'll see what promos I can find and get on opening one.

2. Unfortunately I wasn't aware of that but did get a $600 offer I had often seen before. The Edge account is already open and funded.

3. I may get a CR card. I've passed on it so far due to the smaller bonus, but haven't really looked since the old gas/groceries/other days.

4. I'll look into that. My Costco takes contactless payments and Samsung/Chase Pay on Freedom should cover me for at least October.

Thanks!

A Merrill rep called and things are looking good. ![]()

I'll move another ~$80k and get not $600 or $900 but $1500 total ($500k threshold). The commitment is 9 months, but it's almost all shares with only a little cash so the low yield on cash doesn't really matter.

Also they'll code my account for free trading immediately.

And I will set up the checking today.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@wasCB14 wrote:A Merrill rep called and things are looking good.

I'll move another ~$80k and get not $600 or $900 but $1500 total ($500k threshold). The commitment is 9 months, but it's almost all shares with only a little cash so the low yield on cash doesn't really matter.

Also they'll code my account for free trading immediately.

And I will set up the checking today.

Cool! Glad the SUB worked out. We also were assigned a rep by ME that allowed free trades from day one and 100/mo since. Nice not to have to consider costs of typical trading.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@Turbobuick wrote:

@wasCB14 wrote:As I look forward 12 months, I find I have a lot of what I'll call "perishable travel":

- Marriott's $300 credit and annual night will renew in 6 months

- Hyatt's annual night will renew in about a month

- IHG's annual night will expire in 9 months

- Delta's companion pass will arrive in 9 months

- CSR's $300 travel credit renews in 9 months

- Schwab Platinum's "airfare extras" credit will renew in 3 months

I don't think I'll have trouble using these, so there's not really a need to close any of them.

But when I think in terms of:

Total travel

(less) certificates and credits

(less) travel at independent places, or with no reasonably-priced award availability

(equals) travel with points

With various accumulated miles/points and lots of MRs/URs available for transfer, it seems like it will be a while before the MRs and URs I earn today actually translate to award flights and hotel stays. So even though I have gotten a bunch of award redemptions at good cpp point values, I think I may get a BofA Premium Rewards card in the next few months.

I opened a Merrill Edge account yesterday which will give me a $600 bonus (moving shares, not cash which I know will yield next to nothing at BofA), and a Premium Rewards card would give me another $500 and give 2.625% cash back. So even if I go back to earning MRs and URs, I'll still have nice cash bonus.

I would not necessarily close any of my AF travel cards. They have given me a good value. I'd still want them for perks and credits, and my revenue flights/hotels and Uber spend would keep CSR worthwhile. I'd just move my Costco spend and off-category spend to a Premium Rewards card.

It's possible that by earning more cash back and fewer MRs/URs I'll lack the miles needed for some exotic premium redemption, but when dealing with other people, so much travel ends up getting booked at the last minute (when award availability can be limited). At present, I feel like I'd rather have cash I can spend or invest rather than points that I may not actually get around to using for a while, the value of which can always change. It's not that I dislike miles at all...it's that I'm uneasy with earning more miles when I already have all I will likely use in the near future...and cash is such a readily available alternative for much of my spend.

Can anyone see a flaw in my thinking?

Looks well thought out. We are platinum honors members for going on a year. A couple things that may help you. I have not read all 4 pages here, so I apologize for any redundancy.

1. Open a BofA Advantage Relationship Checking Acct. ASAP. Your 90 day clock doesn't start until you open it. We got a $300 SUB but that was 11 months ago. If you can open the account inside the bank you may get it too. YMMV.

2. Merrill Edge offers $900 cash for $100K deposited often. The 90 day average is 90 days, whether you deposit a million or a billion. Unless you have a previous current personal banking relationship, then it can be shorter.

3. BofA cash rewards cards. The 3% becomes 5.25%. We got 3 of them to cover most catagories. My Paypal acct points to BofA cash rewards. Ebay gets 5.25 off as does any retail that takes Paypal.(even some charitable donations got full rebate)

4. Costco online offers Cash/Shop cards. We buy them in lots of $500 with our BofA cash card set to Online Shopping. Everything is 5.25% off at Costco including gasoline. We never refill the cash card, always buy new.

I think year-to-date, we've recieved almost $2000 just in SUB's from BofA. No doubt there's tax consequences, but free money is free money.

Good luck!

As to 1, does it have to be a Advantage Relationship Checking Account? Does an Advantage Plus checking account work too? I have read the fine prints but couldn’t find it mentioned anywhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

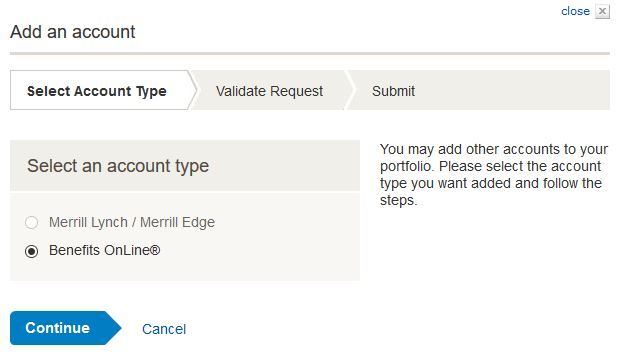

So I need a separate login for BofA than the one I have for Edge? Then I link the two accounts so I can access both from either login?

Do I have to link them from the BofA side? When I went on ME to see what the linking process was, I could only see:

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@wasCB14 wrote:So I need a separate login for BofA than the one I have for Edge? Then I link the two accounts so I can access both from either login?

Do I have to link them from the BofA side? When I went on ME to see what the linking process was, I could only see:

I don't believe so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@wasCB14 wrote:So I need a separate login for BofA than the one I have for Edge? Then I link the two accounts so I can access both from either login?

Do I have to link them from the BofA side? When I went on ME to see what the linking process was, I could only see:

When we went into the bank to open the checking account. She linked the accounts. If in doubt, call them or better yet, make an appointment and go into the bank. It's important to get everything going in the same direction instead of finding out 90 days later, some rule wasn't followed. They really don't make the process easy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@FieryDance wrote:As to 1, does it have to be a Advantage Relationship Checking Account? Does an Advantage Plus checking account work too? I have read the fine prints but couldn’t find it mentioned anywhere.

Quote from BofA page... "You are eligible to enroll in the Preferred Rewards program if you have an active, eligible Bank of America® personal checking or Bank of America Advantage Banking account and maintain a 3-month average combined balance in your qualifying Bank of America deposit accounts and/or your qualifying Merrill investment accounts of at least $20,000 for the Gold tier, $50,000 for the Platinum tier, or $100,000 for the Platinum Honors tier."

The key word is "eligible". While it sounds like you're okay, I would call to be sure and take names for your records. You get 4 free checking accounts, so get the account that has the most value. If you have a qualified pre-existing personal relationship with BofA, your 90 day average may already have started. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@Turbobuick wrote:

@wasCB14 wrote:So I need a separate login for BofA than the one I have for Edge? Then I link the two accounts so I can access both from either login?

Do I have to link them from the BofA side? When I went on ME to see what the linking process was, I could only see:

When we went into the bank to open the checking account. She linked the accounts. If in doubt, call them or better yet, make an appointment and go into the bank. It's important to get everything going in the same direction instead of finding out 90 days later, some rule wasn't followed. They really don't make the process easy.

I was surprised they hadn't done a better job of integrating the two, given that they've had a decade.

I may just go into a branch.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

@wasCB14 wrote:So I need a separate login for BofA than the one I have for Edge? Then I link the two accounts so I can access both from either login?

Do I have to link them from the BofA side? When I went on ME to see what the linking process was, I could only see:

You should be able to link from the BofA side. As mentioned upthread, I've had a BofA Cash Rewards credit card for about three years and recently opened an Advantage Plus Banking Account and a Merrill Edge account. The Advantage Plus Banking account automatically showed up in my existing online account and I linked the Merrill Edge account using the "Link Account" option under the Tools & Investing tab.

I used the same login and password for both the BofA and Merrill Edge accounts and I guess that made it easier since I was able to do everything online and never had to call for assistance or visit a branch location. Now all I have to do is click on the CMA account listed under "Investment Accounts at Merrill" in my BofA Account Overview and I'm automatically transferred to the Merrill Edge account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Considering BofA Premium Rewards

BofA still hasn't mailed me my checking account number. I was approved for the account Sept 23. The ME rep said I'd get free trades right away but the website is still trying to charge me. I wouldn't be surprised if they charge me a low-balance fee because they won't give me the information to actually link my accounts.

Now Schwab is eliminating most fees. https://www.businesswire.com/news/home/20191001005489/en/Conjunction-Chuck-Schwab's-New-Book-%22Inve...

So I don't have to suffer unreliable service and an unintuitive website for free trades. BofA's free trade plan seems to be not about giving customers something of value, but realizing that their platform simply isn't as good as others. I don't see how anyone who has tried Fidelity or Schwab would pay a higher price for Merrill Edge.

Maybe I'll keep $100k for the Premium Rewards card, and $200k long enough for $600, but so far this has not been pleasant. I'd be reluctant to keep $500k in the account for 9 months for the full $1500.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select