- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Limit Decrease - USBank FlexPerks Select Re...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Limit Decrease - USBank FlexPerks Select Rewards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

NRB, you wrote this (I still don't know how to quote) - "I doubt US Bank is going to close the account. Making payments, with this lower credit line, should work out fine. Others are telling you to pay it off now: Do not panic and pay it off now. You have a balance on the card, you are paying within terms, and building credit is a long term process. This is one of those times when you build credit, build the relationship with the bank."

When you say "you have a balance on the card, you are paying within terms, etc." Well, in the real world, apparently doing those things ARE NOT within the terms of US Banks' computer or UW or else they would not have CLD'd him.

The problem I see is if the OP's CLD was computer generated, what makes you think that the computer won't balance chase the acct especially with the acct at 98% utiliz? He is in WORSE shape now than he was before the CLD so I would think he is at even more risk of AA. His scores are dropping, he's paying minimums, 34 INQ's, many new accounts, 6 mos AAoA, 50% utiliz overall, 98% utiliz on the US acct....it's hard to think that more AA won't be coming his way if the OP doesn't pay this stuff down...asap.

Is it not better to be safe than sorry? You wanna save the US Bank relationship?, I'd say give 'em their money. That's all they want obviously.

I get up every morning expecting to see my current 83% utiliz account at 99% if/when they CLD me again. (overall utiliz 16%)

p.s. - I'm not arguing or 'battling' as someone else said...I'm really just trying to understand the way of thinking and different POV's of others.

I DO realize you are pretty much the MASTER of surviving massive CLD's, AA, and paying off enormous amounts of debt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

I think the way the CRA report the Banks Decision to CLD

They can AA at any time for any reason CLD their accounts.... essentially putting it at 99% UTL

However, this makes UTL high and look like you were desperate and maxxed our an account

This is unfair reporting... it should show somewhere the actual CL and UTL on that card before CLD so in a manual review it can be seen they CLD

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

@JTC403 wrote:I think the way the CRA report the Banks Decision to CLD

They can AA at any time for any reason CLD their accounts.... essentially putting it at 99% UTL

However, this makes UTL high and look like you were desperate and maxxed our an account

This is unfair reporting... it should show somewhere the actual CL and UTL on that card before CLD so in a manual review it can be seen they CLD

I think the CRAs show high limit and high balance for multiple periods. At least with my report from Experian, all my cards have a bottom line where it states CL was x from dates a to b, then y from b to c.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

+1 on the way EX shows the dates of the original CL to a CLI to another CLI to a CLD. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

@racer-x wrote:+1 on the way EX shows the dates of the original CL to a CLI to another CLI to a CLD.

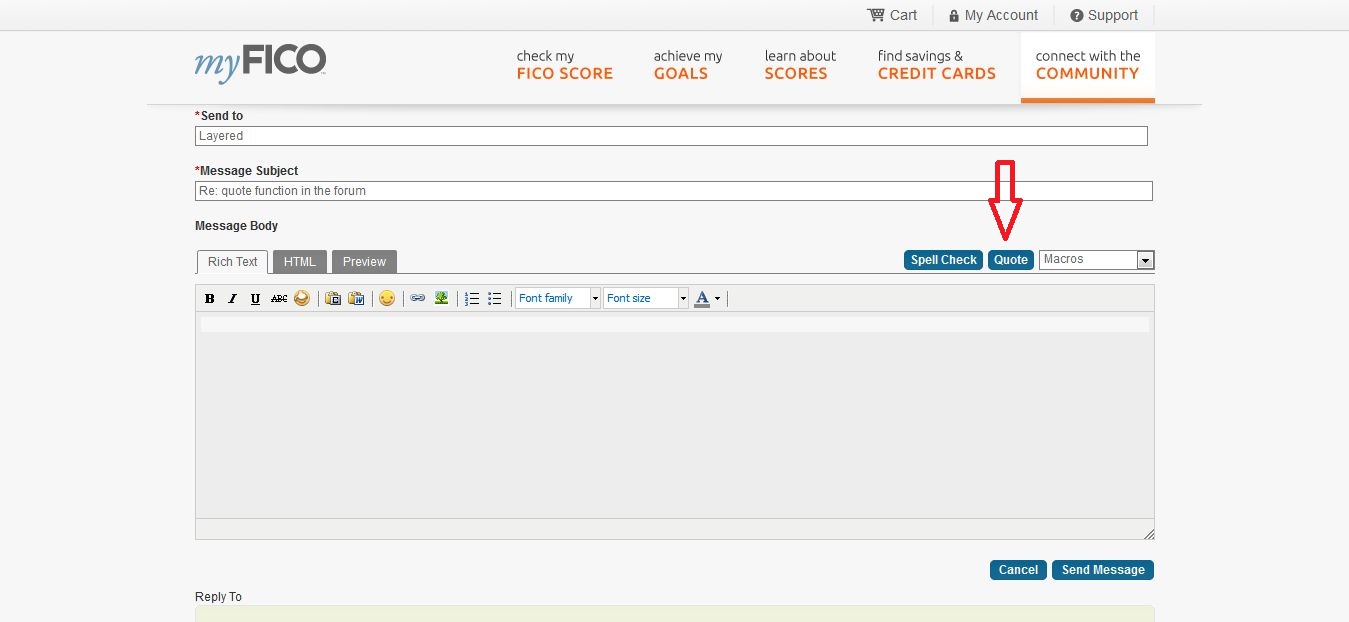

I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar, next to the MACRO drop down-- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

Didnt realize there was a series of steps to do it here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

Lexie, how come you're special and get the spell check option? I've never seen it before 😃

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

@racer-x wrote:NRB, you wrote this (I still don't know how to quote) - "I doubt US Bank is going to close the account. Making payments, with this lower credit line, should work out fine. Others are telling you to pay it off now: Do not panic and pay it off now. You have a balance on the card, you are paying within terms, and building credit is a long term process. This is one of those times when you build credit, build the relationship with the bank."

When you say "you have a balance on the card, you are paying within terms, etc." Well, in the real world, apparently doing those things ARE NOT within the terms of US Banks' computer or UW or else they would not have CLD'd him.

The problem I see is if the OP's CLD was computer generated, what makes you think that the computer won't balance chase the acct especially with the acct at 98% utiliz? He is in WORSE shape now than he was before the CLD so I would think he is at even more risk of AA. His scores are dropping, he's paying minimums, 34 INQ's, many new accounts, 6 mos AAoA, 50% utiliz overall, 98% utiliz on the US acct....it's hard to think that more AA won't be coming his way if the OP doesn't pay this stuff down...asap.

Is it not better to be safe than sorry? You wanna save the US Bank relationship?, I'd say give 'em their money. That's all they want obviously.

I get up every morning expecting to see my current 83% utiliz account at 99% if/when they CLD me again. (overall utiliz 16%)

p.s. - I'm not arguing or 'battling' as someone else said...I'm really just trying to understand the way of thinking and different POV's of others.

I DO realize you are pretty much the MASTER of surviving massive CLD's, AA, and paying off enormous amounts of debt.

First off, yes, I AM the CLD Master ![]()

I will also always chant the mantra: Don't worry about utilization when you want to save money or there is a purpose to the high utilization.

The thing about these CLD is, the bank is gonna do what they are gonna do. OP may very well have brought on some AA with too many inquiries and too many new accounts. That is a high probability here. But the fact of the situation is, even if the bank closes the account, OP still has a 0% APR (I think that is the situation) and those terms remain. OP would just not be able to charge new amounts to the card, just pay according to terms. So, OP can pay according to terms, pay so that OP takes advantage of the low interest, and shows payment action to US Bank. All US Bank can do at this point is watch, and either balance chase or close. Even if US Bank tries to raise the APR, it won't affect this purchase because it is on specific offer terms. Thus, OP can pay the account down, and if a year of good payments isn't enough to sway US Bank that maybe this borrower is worth having, then OP learns that, but at least one has to try.

Paying the full amount now is certainly an option, but OP has already gone through the trouble of getting this card, and has favorable terms in a short term contract. Why not get some payment mileage out of it?

Two of my cards that are closed have been paying down balances for several years. At least one of those cards is sending signals that I should ask to get it reopened, now that the balance is down and they see payment history. I will likely check with Citi later this year about just that possibility. So just because a card gets closed, that does not mean the banking relationship is over, not by a long shot.

My main advice in these situations is not to panic. If you are getting AA, that means you probably are done apping for a while, so who gives a flying donut what happens to the FICO score for a while? Work on figuring out how to make the best of the situation, maintain favorable terms if you have them, pay faster if the terms really go against you, but above all DO NOT PANIC. Do not assume the bank will do any number of possible actions until the bank actually decides if they are going to do ANY action. Don't listen to the commenters here who dredge up all manner of possible boogey men. Credit takes a while to build. Bank computers take a while to get around to another CLD. If they are only doing CLD, then your account is just being managed down to a level the bank feels more comfortable. It takes a lot for a bank to outright close your account, but even then, if you have favorable terms on a balance offer, they can't take that away from you until it expires according to terms.

And, on the bright side if they DO close your account with a balance on it, the whole mess pretty much moves out of your FICO score anyway, so it sort of becomes just an issue between you and the bank, not the entire credit world.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

Note: The US Bank card I have does not have 0% APR. It seemed to be a recon to a declined application where they offered me a card. I will be paying interest on this balance by choice. Just a heads up sorry I didn't clarify in the beginning.

Update From Executive Office Phone Call:

So a really nice woman called me today to discuss my credit limit decrease. She said it was flagged by the computer (probably carrying 0% apr balance) and my score that Transunion gave them (lol what?) was 589. I don't think they use a real FICO score which is quite sad; so conservative they can't use/provide FICO scores? I wish I kept my acceptance letter so I could see if there was FICO mentioned anywhere on it.

Anyways, there was nothing she would be able to do to reinstate my credit limit. So I asked her if they're balance chasing me. She stated that it's normal for the computer to flag an account and bring a credit limit down to just above what my balance is because it's against regulations to bring a credit limit below what your current balance is. It sounds like honesty to me. We will see what happens.

I told her my intentions of paying interest and the minimum for 12 months at least to build a relationship and she thanked my for putting money towards her paycheck. Ha. We both laughed it off. I explained that I am trying to build a relationship for a mortgage in 2-5 years. So perhaps they now have a note in my records for my intentions in the future. Good or bad I don't know.

She said to call her back in June and she will probably be able to get my credit limit back to where it was. So we'll see what happens. Paying minimum + interest is my own choice in the end and I fully realize what I'm doing. So for an experiment of just paying minimum+interest for 12 months I promise to update this thread if any of my other cards follow suit.

I see a credit card as a loan where I have the option of paying interest even if it's high. I guess one could argue why don't I go to the bank and just get a low interest installment loan. I don't like being locked to a static payment amount. I like the freedom of paying whatever I want. Is that a pretty stupid thing to say? Probably. But life happens and if I had a static loan payment of $300.00 a month compared to $50.00 minimum payment with interest; I'm going to always choose the $50.00 Credit Cards provide a lot of advantages over a loan. I can assure you I have no problems paying my bills for the foreseeable future. I am just a victim of having no prior credit history. I always believed in paying cash for everything. I'm trying to change that ideology.

Anyways, I still agree you should never pay interest but in this case; I'm just going to experiment. Thanks again everyone! I'll post what the letter stated if it ever gets here.

TU 695 -- 54 Inquiries

EX 668 -- 50 Inquiries

Utilization: 9% AAoA: 20 months Total History: 3Y

Updated: 08/04/2017 Premier 3B

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit Decrease - USBank FlexPerks Select Rewards

@Erusidhion wrote:

Note: The US Bank card I have does not have 0% APR. It seemed to be a recon to a declined application where they offered me a card. I will be paying interest on this balance by choice. Just a heads up sorry I didn't clarify in the beginning.

Update From Executive Office Phone Call:

So a really nice woman called me today to discuss my credit limit decrease. She said it was flagged by the computer (probably carrying 0% apr balance) and my score that Transunion gave them (lol what?) was 589. I don't think they use a real FICO score which is quite sad; so conservative they can't use/provide FICO scores? I wish I kept my acceptance letter so I could see if there was FICO mentioned anywhere on it.

Anyways, there was nothing she would be able to do to reinstate my credit limit. So I asked her if they're balance chasing me. She stated that it's normal for the computer to flag an account and bring a credit limit down to just above what my balance is because it's against regulations to bring a credit limit below what your current balance is. It sounds like honesty to me. We will see what happens.

I told her my intentions of paying interest and the minimum for 12 months at least to build a relationship and she thanked my for putting money towards her paycheck. Ha. We both laughed it off. I explained that I am trying to build a relationship for a mortgage in 2-5 years. So perhaps they now have a note in my records for my intentions in the future. Good or bad I don't know.

She said to call her back in June and she will probably be able to get my credit limit back to where it was. So we'll see what happens. Paying minimum + interest is my own choice in the end and I fully realize what I'm doing. So for an experiment of just paying minimum+interest for 12 months I promise to update this thread if any of my other cards follow suit.

I see a credit card as a loan where I have the option of paying interest even if it's high. I guess one could argue why don't I go to the bank and just get a low interest installment loan. I don't like being locked to a static payment amount. I like the freedom of paying whatever I want. Is that a pretty stupid thing to say? Probably. But life happens and if I had a static loan payment of $300.00 a month compared to $50.00 minimum payment with interest; I'm going to always choose the $50.00 Credit Cards provide a lot of advantages over a loan. I can assure you I have no problems paying my bills for the foreseeable future. I am just a victim of having no prior credit history. I always believed in paying cash for everything. I'm trying to change that ideology.

Anyways, I still agree you should never pay interest but in this case; I'm just going to experiment. Thanks again everyone! I'll post what the letter stated if it ever gets here.

You should pay interest sometimes. It is a price of admission if you don't have a 0% APR available, simple as that. Many (or rather most) others here will complain that you should not pay interest, but it's a personal choice. I've paid my share of interest over the years. And I've had use of money over the years.

The computer coming back with a low score may be if it were looking at a historical report of some kind. Thus, it is even more important to stretch the payments out on this one, to build that credit history of payments on a balance.

The lesson to learn: All the paperwork you get from the banks and credit card companies that you deal with is important. It should all go in a specific file folder just for that account so you have it at hand, or printed as a PDF file and saved in a folder on your computer. I can't believe how many people here shred or dispose of their documentation. If something goes sideways (like this situation) you need the paper trail to have any chance of clearing up issues. I even keep all the BT offers I get, just to be able to go back and see if there are any trends in what is being sent, such as US Bank going from offering me 0.0% 18 month BT to 2.99% 12-month BT. There is messaging in all this paperwork, and it helps keep track of your relationship to the bank.

Good luck!

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765