- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Limit too high?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Limit too high?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

@UpperNwGuy wrote:I agree with BronzeTrader and climbfire.

I agree with BronzeTrader. climbfire. and UpperNwGuy.

I keep my CL's at a reasonable level and have reduces many of them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

In general, I keep about $100,000 each with the Big Three, AmEx, Chase + BA. Then have some limited relationship with Citi, Wells Fargo and Discover, mainly for benefits. So the total credit is like $300,000 to $400,000. I'll cut each time that I'm close to $400,000 total exposure.

I have a total of 3 new cards in 2017. Look to go below Chase 5/24 next year. The new card will push out the old cards. I do not worry about the AAOA since the closed old cards still age like 10 years. I still see a Target Red card I opened in 2005 and was closed in 2009.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

I like to remind...that this natural yet sustainable non GMO resource that banks spend Bil's mining at......comes from MT.Everyonespocket

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

Interesting discussion

I personally have never requested a CLD but, then I have never had more than 6 credit/charge cards. If credit cards are strictly used for personal spend an aggregate CL of 1x is more than sufficient to avoid drops in score even for those that allow charges to report naturally and pay by due date - if one spends within their means.

For those that need to cover an infrequent, high, single expenditure (say a $20k charge) without wanting a spike in utilization - Put the expenditure on an NPSL charge card or pay the affected credit card balance(s) before post date(s). Even if a near limit balance were allowed to post on a credit card, the impact on score would stop as soon as the balance is paid down.

There is value in "downsizing" aggregate credit limit (ACL) especially if the ACL was built on spend requirements for a company (T&E) that are no longer in play. In a prior life I traveled all the time (home every other weekend). My company T&E spend was 2x annual income. I "fortunately" had a company card. However, If someone was putting that level of company expenses on personal cards, their aggregate CL might need to be 5x income to safeguard against bumping up against spend limits.

If company expenditures are no longer in play on personal accounts why risk exposure to potential fraud and limit ability to simplify and re-allocate? Go for the CLD! For those with 20 or 30 cards that want to simplify, close accounts and reduce aggregate CL. Excessive credit has downside risk with no real upside benefit.

If I needed $100k to cover a personal "short term" expense, it would not be through personal credit cards!

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

Just wonder what short-term "personal expenditure" will take to $100,000? A fancy car? A rare paiting? I've not seen a regular credit card wtih $100,000 credit line.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

@BronzeTrader wrote:Just wonder what short-term "personal expenditure" will take to $100,000? A fancy car? A rare paiting? I've not seen a regular credit card wtih $100,000 credit line.....

Quite true, one would likely need to split cost among 3 regular credit cards. So, if a large amount of credit is needed, credit cards aren't the best approach.

Potentially auction purchases such as:

Rare coins/ paper currency, vintage cars, paintings, historical artifacts, certain antique furniture, gemstones. They often have a ROI that surpasses stock market returns.

I used to participate in US and World paper currency auctions as a collector. My bid LOC at the auction houses was typically high 5 figures but, I'd limit winnings bids to low 5 figures. However, more than a few pieces reached 6 figures and even 7 figures on rare occassions. It's a bit like gambling in that one can get over extended in obligations rather quickly. I avoided that pitfall but, came to realize that I might bid beyond my means if I continued to feed my indulgence.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

Pretty much the only reason I ever want lower credit limits are when I want to apply for a new card at a bank but I know I am near their limit on what they will extend across all cards with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

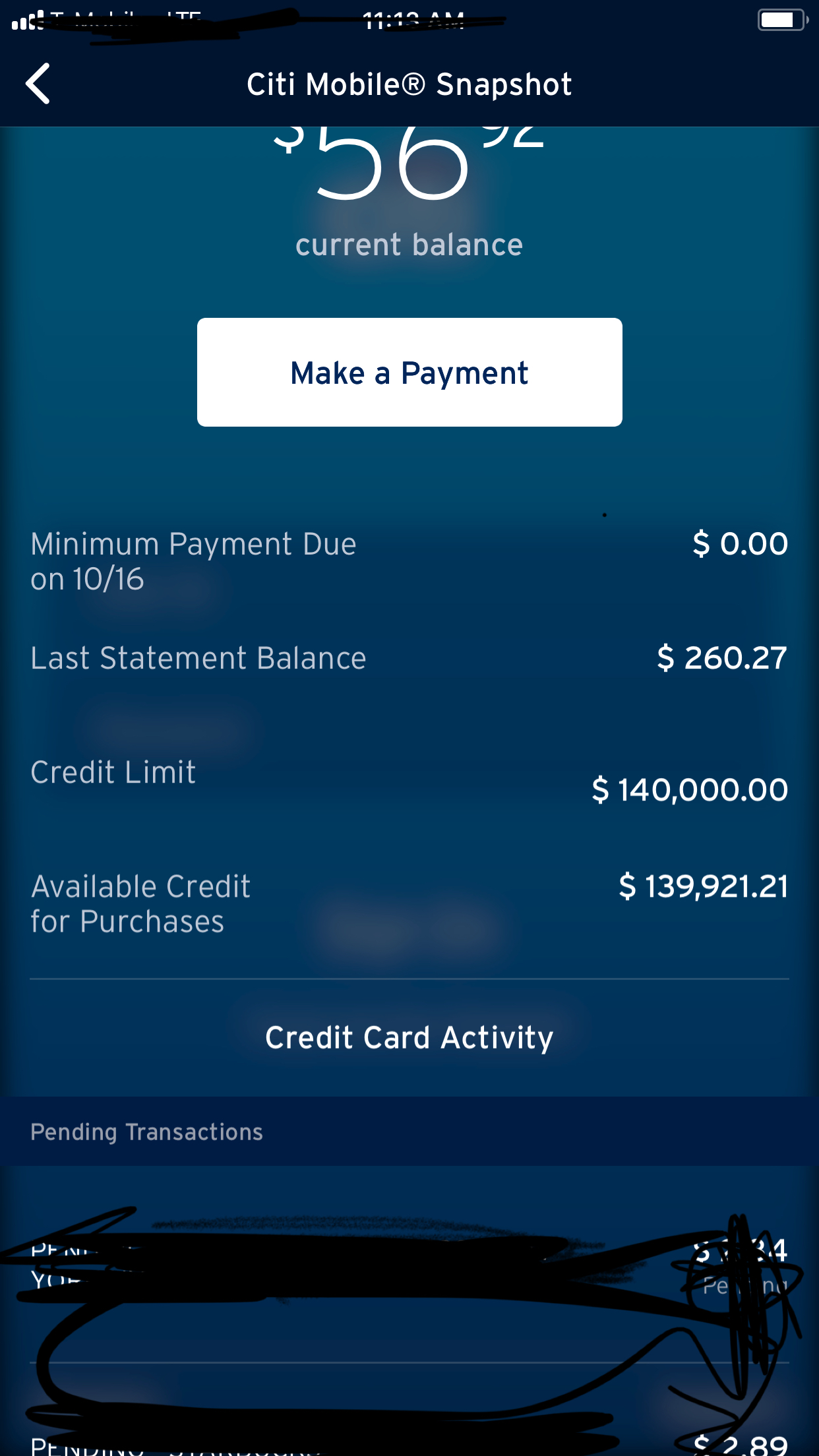

![]()

BCE- 50 k-BOA 123 100k -Freedom unlimited-95k- Citi DC- 200k-CSR 175k

Garden mode

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Limit too high?

@JaeJae12 How do you like the Citi Diamond Secured MasterCard? ![]()

Joking aside, that's great and what I hope to see from Amex and BOA in the not-too-distant future.