- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit Line Increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Line Increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit Line Increase

What amount of your available credit do you recommend I use in order to get a higher credit limit increase?

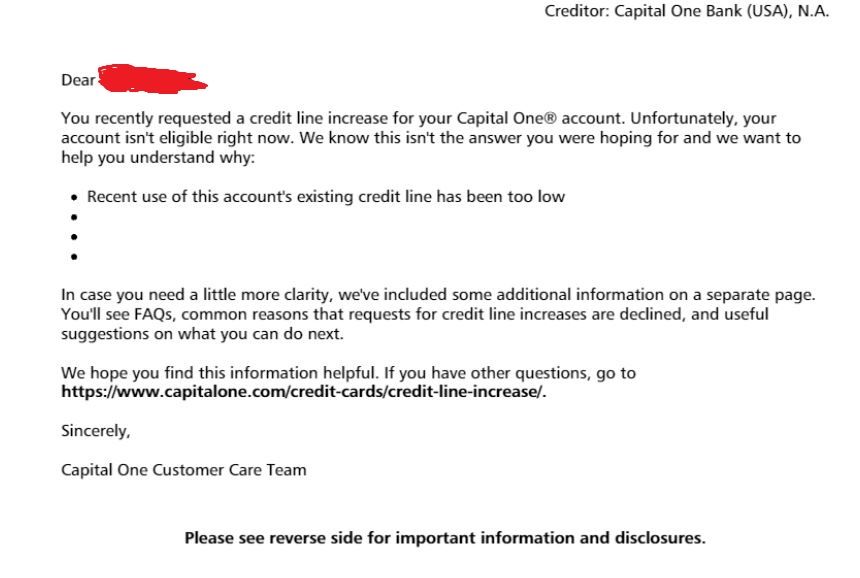

I've been told to make some small purchase and pay them in full but I was just rejected a credit line increase. Reason being "Recent usage on existing credit line too low".

EXP 720

TRANS 727

EQUIFAX 740

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

Make purchases you are comfortable paying in full. The CLIs will follow

Good luck

>5/2023 All 3 reports 840ish (F8) F9s = 850 but my app finger is still twitching

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

Depends on the lender. Some don't want you using too much, others want heavy spend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

@CreditFixy wrote:What amount of your available credit do you recommend I use in order to get a higher credit limit increase?

I've been told to make some small purchase and pay them in full but I was just rejected a credit line increase. Reason being "Recent usage on existing credit line too low".

EXP 720

TRANS 727

EQUIFAX 740

I would use it as normal, I am not doing back flips trying to get CLI's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

Discover 3,000

Capital One 1,000

Capital One 1,100

Merrick Bank 1,300

I'm trying to get some higher limits either by requesting CLI's or applying for new credit cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

Thanks for your response

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

@CreditFixy wrote:Thanks for your response

That sounds like the typical Capital One response. They want to see some good usage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

I would more than likely bet it was discover

Capital one 500, Discover 11.1k. UMB Signature visa 18.5k, DW UMB card Auth user 16K. Citi Costco anywhere 26.6k, Amazon Prime 22.3K

BH/Comenity Photo 10k Lowes advantage 35k

AAOA 2y4m, oldest 5 years. 0 collections. 125k income, Util 1% inq 1/12. 1/24. 30/60/90 = 0, No derog's, clean file. Rebuilding started 4 years ago.

Starting Score: 560

Starting Score: 560Current Score: 795

Goal Score: 850

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Line Increase

@JeffMO wrote:I would more than likely bet it was discover

Whenever I apply for a CLI with Capital One, that is the only reason they ever give me.