- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit One Bank & a 2nd Premier Bank card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit One Bank & a 2nd Premier Bank card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit One Bank & a 2nd Premier Bank card?

I received an email about signing up for a Credit One Bank card - what is the general concensous on this card?

I also received an email from First Premier Bank for a credit card. I already have one through them - should I try opening a 2nd card with them or they wouldn't do that?

Starting Transunion Score 5/12/14: 553

Starting Experian Score 5/12/14: 544

Goal Score: 680-700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

@johnnyscience wrote:I received an email about signing up for a Credit One Bank card - what is the general concensous on this card?

I also received an email from First Premier Bank for a credit card. I already have one through them - should I try opening a 2nd card with them or they wouldn't do that?

I have a creditone bank card and I have not had any issues with them. I have not gotten much love or "benefit" (aside from them reporting to the CRAs) such as rewards, but I had no issues with them.

From what i understand (from reading) First Premier Bank is not the best and you may want to stay away from them. Too many fees and issues.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Starting Scores: 590s on 12/2013. Hover over card image to view details! *After Amex approvals - [I was supposed to be] Gardening!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

Aren't there a lot of fees with Credit One?

I have zero fees for first year with my new Premier Card. They paid off my old written off debt & transfered the balance to a new card to help me re-establish credit.

Starting Transunion Score 5/12/14: 553

Starting Experian Score 5/12/14: 544

Goal Score: 680-700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

@johnnyscience wrote:I received an email about signing up for a Credit One Bank card - what is the general concensous on this card?

I also received an email from First Premier Bank for a credit card. I already have one through them - should I try opening a 2nd card with them or they wouldn't do that?

Stay far away! First premier starts with a very low limit, and immediately lowers your limit by taking out a $75 fee. And the APRs are ridiculous. Is your score ok or are you rebuilding?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

Yes trying to rebuild. As mentioned they transfered an old charged off account I had with them to a new card with 0 fees & interest for first year. I figure pay it off, build credit & cancel card before 2nd year fees hit.

It's been pretty painless so far & 100% of my payment goes to principal. (only $250 to start, now down to $195 after a couple of payments)

Starting Transunion Score 5/12/14: 553

Starting Experian Score 5/12/14: 544

Goal Score: 680-700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

@johnnyscience wrote:

Aren't there a lot of fees with Credit One?

I have zero fees for first year with my new Premier Card. They paid off my old written off debt & transfered the balance to a new card to help me re-establish credit.

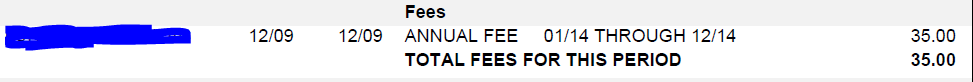

My annual fee for Credit One Bank was $35. Since I put very little use on it until this month (Netflix recurring payment which has been stopped as of this month - it will be SD-ed) I have only paid $1.25 in interest after my very first statement. It was one of my first cards and didn't realize how reporting worked, so I allowed it to report a balance and didn't pay it until the due date. Other than that, no fees were ever charged on my account.

With that said, however, I have heard that some versions of the CreditOne Bank card come with a $75 annual fee.

Here is when they charged me the annual fee

Just my 2 cents..

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Starting Scores: 590s on 12/2013. Hover over card image to view details! *After Amex approvals - [I was supposed to be] Gardening!*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

Everyone has different opinions on this but I would personally stay away from sub prime lenders like credit one and first premier. Look into adding a secured card with cap one or boa. Also, I would look into adding a gettinton card its like my fingerhut card but only the prices are cheaper.

Card Ring $5000 Chase Marriott $5000,Chase Hyatt $5000, Sallie Mae Mastercard $4400, Paypal smart connect $4000,Chase Freedom $3200, Capital one Quicksliver visa $3000, Chase IHG Rewards $2300, Chase Southwest Premier $2000, Citi Double Cash $1500, AMEX BCE $1000

Last app July 22nd 2015- No apps for two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

Run from both of them!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

In my opinion get a secured card from sdfcu no credit check and reports to the credit bureaus.

https://www.sdfcu.org/emv-creditcards

Sam's Mastercard $15k / Walmart Mastercard $10k / Blispay $7.5k PayPal Ex MC $10.8k

CareCredit 5k / Husq $5k / Cap1 QS $4.5k / Barclay Ring $5.35k / Citi DC (WMC) $12k

Gardening Date 7/01/16 / MyFico 08: EQ 801 / TU 777 / EX 771 / 06/08/17

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One Bank & a 2nd Premier Bank card?

Hey johnnyscience!

I started my rebuilding with these cards. Had the Credit One and 2 First Premiers. UGH! Everyone has to start somewhere. ![]() I never had a problem with either one and they helped me along pretty well. That being said, they are terrible cards. If you can afford all the fees, then it might not hurt you to have them for a short while but they will nickle and dime you to death.. Interest starts with no grace period, monthly maintanance fees and fees for just about anything you want... like even asking for a credit limit increase. I got my Credit One up to $1250 limit before I nixed them and both my FPs were at $1000 too and that helped with other lenders. If you can afford to make a deposit with a local credit union to secure a card, I'd go that route first. If not, then use these builder lenders for what they are and dump them as soon as your profile will allow.

I never had a problem with either one and they helped me along pretty well. That being said, they are terrible cards. If you can afford all the fees, then it might not hurt you to have them for a short while but they will nickle and dime you to death.. Interest starts with no grace period, monthly maintanance fees and fees for just about anything you want... like even asking for a credit limit increase. I got my Credit One up to $1250 limit before I nixed them and both my FPs were at $1000 too and that helped with other lenders. If you can afford to make a deposit with a local credit union to secure a card, I'd go that route first. If not, then use these builder lenders for what they are and dump them as soon as your profile will allow.

Current Score: EQ 773, EX 780, TU 777 (All FICO)

Goal Score: 800+

Cards: NFCU Flagship 50K, DC 30K, BCP 28.6K, Arrival+ 25K, Citi DP 22.8K, CSR 20.5K, TotalRewards 25K, QuickSilver 20K

Starting Score: 580

Starting Score: 580