- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Credit card fraud

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit card fraud

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit card fraud

I just discovered some credit card fraud on one of my amex accounts. Someone setup a recurring netflix membership on my card about six months ago. I hadn't really noticed it before because I have a netflix membership and was paying it with a different amex credit card (on a different billing date) that sees very heavy use , so when I quickly scanned my amex card bill and saw a netflix charge it didn't jump out at me. However, when the freedom bonus category came up for streaming services I switched my netflix payment plan over. While reviewing my amex bill today I saw I just got hit with another netflix charge. I was certain I had changed the netflix account over to visa and I went and checked my chase account and sure enough I was paying the monthly fee there as well. Then I looked closer and saw the netflix charge was on a card that I would never have a reason to use for netflix. I contacted netflix and they confirmed that the visa card was linked to my account but that the amex card was being used by another account that appeared to be fradulent. Netflix banned that particular amex card from being used with netflix in the future and credited me back the most recent payment.

I then contacted amex and they reissued me a new card and opened a fraud investigation and are crediting me back the past six months of netflix fees. I have had netflix for over a year so its not like I would have reason to setup a new netflix account or anything. Upon searching the web apparently its very common for criminals to use stolen credit card info to open recurring subscription accounts like netflix, amazon, spotify etc, because the charges can blend in to a credit card statement, especially if the customer uses those services themselves. Just something people may want to be on the lookout for, but having the security of amex really paid off in this situation.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

Glad it was resolved quickly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

@Anonymous wrote:Glad it was resolved quickly.

Yes it was fairly painless.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

Seems a very low-reward risk for a thief with good credit card information. Even if they sold on the subscription it's not generating much cash for the risk. And some chanceof being tracked if they are not taking steps like using a VPN. Still, glad OP got it resolved.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

I am guessing smaller charges are less likely to trigger fraud alert. Amex called me immediately when somebody tried to use my card at an Exxon for a 100 transaction.

I read somewhere most credit card numbers are stolen and are already somewhere on the internet. So its probably just a matter of time this will happen to everyone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

I get the whole inconspicuous blending charge because it's reoccuring, but if I were a rep, I'd feel the card holder wanted the subscription for half a year for free suddenly alleging fraud. I'd also think the CCCs expect each account holder to be diligent by checking on their accounts.

I admittedly overthink thinks so would've talked myself out of calling for said reasons. Then I would've had to eat the charges.

Again, this is good to know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

@Anonymous wrote:

I read somewhere most credit card numbers are stolen and are already somewhere on the internet. So its probably just a matter of time this will happen to everyone.

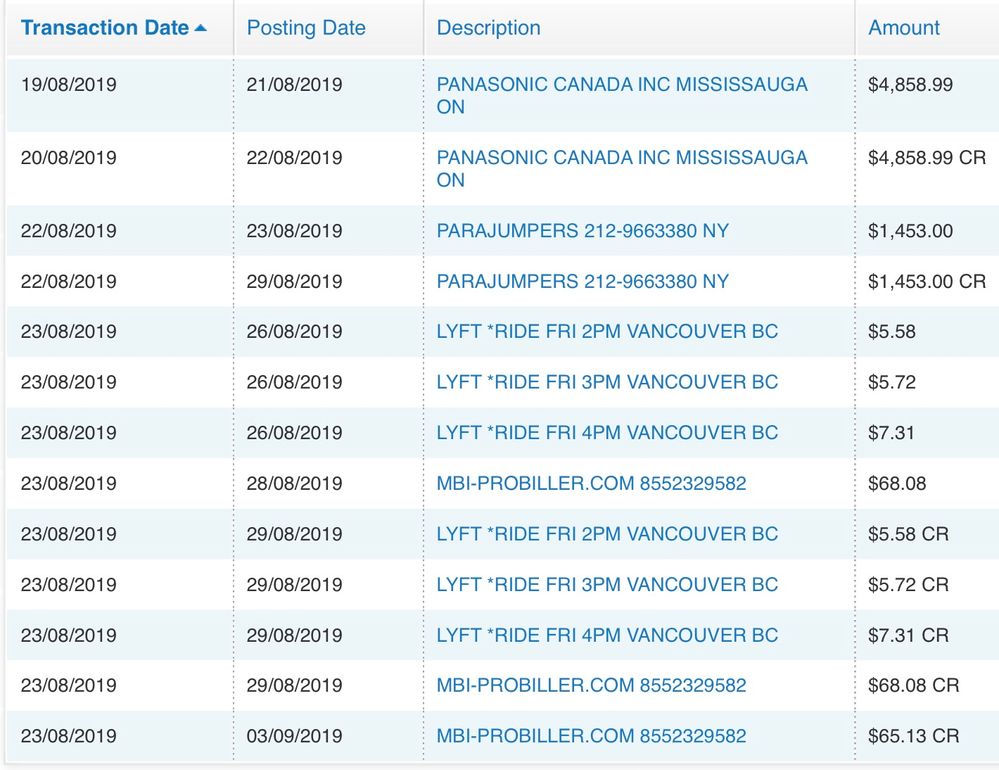

I was hit in August, on a card that had never leaves my house. When they were through with everything I ended up with a $65 credit on the account. These guys sure didn't start small!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

@JSS3 wrote:

I didn't know CCC would go back 6 months when crediting. I would've assumed they'd feel it was a lie(and harder to prove) since it went on so long.

I get the whole inconspicuous blending charge because it's reoccuring, but if I were a rep, I'd feel the card holder wanted the subscription for half a year for free suddenly alleging fraud. I'd also think the CCCs expect each account holder to be diligent by checking on their accounts.

I admittedly overthink thinks so would've talked myself out of calling for said reasons. Then I would've had to eat the charges.

Again, this is good to know.

One person hjaving another Netflix account, charged to a different card, makes little logical sense. Especially since you can go from two simultaneous logins to 4 for three dollars more, which you have to do for 4K anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit card fraud

I always have an alert on all my cards when any charge goes through. Even though it would look like a legitimate charge, if I got another one that I thought was too soon, I'd probably think I just paid that, and then look at the last charge. That would have raised a red flag.

It makes me think, and sometimes legitimate charges get my attention.

Was sitting at home, and got a diary queen charge on my disco. I thought, I didn't go to DQ recently, so I locked my card and looked at the charge. I did remember the amount, and then remembered that I went a week before, the charge took 7 days to post. Chatted with a CSR and yes it happens.

Makes me question charges, and will certainly draw attention to ones I didn't expect or expect that soon. I know to expect my cell phone bill not that often, 2 in one month would catch my attention.