- myFICO® Forums

- Types of Credit

- Credit Cards

- Credit line reduced by the bank

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit line reduced by the bank

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit line reduced by the bank

Barclays Uber credit card reduced my credit line from $2000 to $500. Without notice.

I just paid my balance in full two days ago. I did carry a large balance over the past four months, but I always made sure to pay the minimum required two weeks ahead of the deadline. So, there wasn't late payment issue.

My question is: does Barclays often reduce their clients' credit line simply because they carry a balance?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

From what I have seen around here - Barclay's and Synchrony both have skittish reputations. Notice I don't have cards from either of them. Usually it is a combination of factors in your profile that causes AA, though.

I would just move on, it seems they are through with you. Also, fix whatever else might be going on to scare your creditors.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

Apparently, something in your report spooked them, but the good news is they didn't close your account. If this is a card you want to keep, just use and pay it on time for 3-4 months then ask for a CLI. You can of course call and ask why they reduced your credit limit - there is a chance of restoring the account limit doing that, but you might have to provide some documentation such as pay stubs or tax returns.

Barclays is known to be a bit skittish especially on new accounts and I suspect when they did a routine AR (soft pull monitoring of accounts) something in your report bothered them (high balance and minimum payments would do that on a new account).

Your options are a) Call and recon the credit limit decrease, b) continue to use the card "some" for 3 or 4 months and pay in full every month then request a CLI, c) close the card and say who needs the grief.

Personally, I close cards that balance chase or reduce my limits because they "no longer like my profile" - however, I have a lot of cards and a lot of available credit so even if I want the card, I don't need them - I understand that for many it's not that easy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

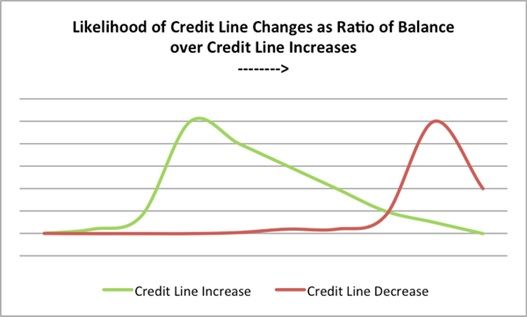

Below is a graph from Barclays Card USA. It may be a little difficult to understand, so I will attempt to walk through it. On the horizontal scale the left side of the graph represents zero usage and the right side indicates 100% credit line usage. The vertical scale (on the bottom) represents 0% chance and the top indicates 100% chance. The green line represents “chance of getting a credit line increase” while the red line represents the chance of getting a “credit line decrease.” According to Barclays this is a risk/reward analysis chart.

You can see that for a credit line increase the customer who does not use any (or a small portion) of their available credit, the likelihood of an CL increase is low. This is due to the fact that since they do not use the card it is unlikely that Barclays will reap any additional reward. As a result, the additional risk of a CL increase, is not warranted. For the CL decrease the higher the % of CL the customer uses, the greater the risk for Barclays. Thus this is a trigger for a CL decrease. You can see that there is a sweet spot that runs about 25% of CL usage.

Of course, Barclays does not discuss other factors, such as too many cards with high balances, too many new cards/accounts, too many recent inquiries, too much debt to income, large changes to usage, etc. This is simply how they explain their basic strategy.

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

@Anonymous wrote:Barclays Uber credit card reduced my credit line from $2000 to $500. Without notice.

I just paid my balance in full two days ago. I did carry a large balance over the past four months, but I always made sure to pay the minimum required two weeks ahead of the deadline. So, there wasn't late payment issue.

My question is: does Barclays often reduce their clients' credit line simply because they carry a balance?

Barclays has long had a reputation for taking adverse action for no logical reason.

They closed my accounts one day, without giving me any reason, let alone a logical reason.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

@Gmood1 wrote:

The red flag was paying minimum payments.... Unless absolutely necessary, always pay more than minimum payments with CC lenders. That and any baddies hitting your reports is a sure fire way to get their attention.

I agree with Gmood (though it was made worse by some other things, see below). We can comment even more meaningfully on what might have caused your CLD if you tell us:

(1) What were your scores in the 30 days prior to the CLD?

(2) What was your individual utilization on this card?

(3) Did you have any other cards with a high individual U and if so, how many cards and what was the individual util?

(4) What was your total util in the 30 days prior to the CLD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

OP, did you have any negative information (such as a 30 day late) introduced to your credit file from an account other than the one you received the CLD on?

Many times when someone receives AA from a lender, they look only to what they may have done wrong with respect to that account only, where many times the issue was elsewhere on your credit report.

The only account that I ever received AA on was a CC that I didn't have very high utilization on, always paid on time and had a $400/mo autopay set up on for years. When my CR had negative information introduced from other unrelated accounts, my CCC quickly took AA and closed the card on me. Things like this can and do happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

@Gmood1 wrote:

The red flag was paying minimum payments. Yes Barclays is worthless. If you do a forum search. You'll find many that have experienced the same issue. I suggest you find a better lender when you are able. Sorry for your CLD. Unless absolutely necessary, always pay more than minimum payments with CC lenders. That and any baddies hitting your reports is a sure fire way to get their attention.

This one. OP had a good idea with paying early, but Barclays probably didn't care about the payment date. Double minimum payments would have been better recieved.

Unless it wasn't payment related. Barclays can be jealous.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit line reduced by the bank

While in this case we can likely chalk it up to making minimum or near-minimum payments, Barclay can (and does) seemingly balance chase or just CLD seemingly at random. DW got the Ring card a couple of years ago (when it was like an 8% APR card). Took them up on an offer from a convenience check, paid it off in a couple of months, took them up on a 2nd offer, made 4-digit payments each month and they hit her with a CLD down to $6400 with a letter stating that her monthly payments had been too low ("low" as in only about 15x the minimum payments?!). Her scores were in the 760-780 range then (all 800ish now), better than when she applied with only 1 new account opened at the time since receiving the Barclay card. On the other hand, many others have reported no problems with their cards.