- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: DISCO advice Moving Forward

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DISCO advice Moving Forward

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

@sxa001 wrote:Personally I tend to be more conservative and wouldn't really ask any more than once every 6 months. It is Disco and you have no idea what they will do, they certainly aren't happy leaving me at 9K but I probably won't ask again until sometime next year.

I guess if you fear AA or if a CLD would cause an adverse impact outside of a buzzkill I agree. For me personally, they can CLD me down to $5k and my monthly spend (which I always PIF) would still never exceed single-digit utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

@sxa001 wrote:Personally I tend to be more conservative and wouldn't really ask any more than once every 6 months. It is Disco and you have no idea what they will do, they certainly aren't happy leaving me at 9K but I probably won't ask again until sometime next year.

I suppose it depends on your risk tolerance, but a conservative approach is not a bad thing. I've been somewhat conservative on my CLI requests and I was able to get approved $80,000 on one card. It hovered around $76,000 for a bit until the last CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

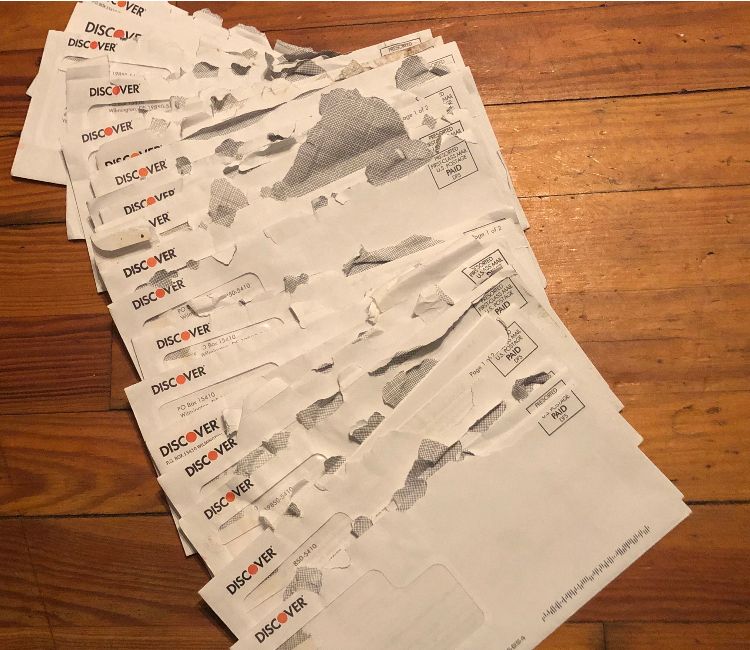

I ask and have gotten denied monthly for over a year and half. The advantages outweigh the negatives though.

1.) I get a free F8 TransUnion score monthly.

2.) If there's another TP shortage during this pandemic, I'll be ready! 😂😉

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

Agreed on #2 above, but your TU8 score is already available to you from your account. The score you see on your denial letter will match the score visible when you log into your account at the time the denial letter is generated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

@FinStar wrote:I suppose it depends on your risk tolerance, but a conservative approach is not a bad thing. I've been somewhat conservative on my CLI requests and I was able to get approved $80,000 on one card. It hovered around $76,000 for a bit until the last CLI.

But would a less conservative approach on a profile otherwise identical to you (income, CR, the whole act) have yielded a better or worse approval than that $80k? No way of knowing for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

@Anonymous wrote:

@FinStar wrote:I suppose it depends on your risk tolerance, but a conservative approach is not a bad thing. I've been somewhat conservative on my CLI requests and I was able to get approved $80,000 on one card. It hovered around $76,000 for a bit until the last CLI.

But would a less conservative approach on a profile otherwise identical to you (income, CR, the whole act) have yielded a better or worse approval than that $80k? No way of knowing for sure.

My approach was my own choice having 2 Discover cards, with the higher CL one being on a different tranche dating back to the mid-90's. I didn't really care to know whether my approach would be better or worse or who would have a similar profile. Simply stating individuals can choose their own path which may work for some and not for others given Discover's quirkiness over the years. My approach has been fine for me 😁.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

Disco is not same as last years Disco nor is it same as the Disco from previous year. Use it, pay it, hulk smash when appropriate, request apr redux after 1 year, and enjoy![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

My point is that I don't believe a conservative approach landed you an $80k card, which may or may not be something you were suggesting anyway. I simply believe you landed an $80k card while taking a conservative approach, if that makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

All I know is if DISCO loves me enought to grant me 80k in the future no matter the circumstances I'd probably never use my other cards but for simple things or maybe a date night LMAO but I honestly love my cards (even though I have a love/hate with my AMEX) lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DISCO advice Moving Forward

@Girlzilla88 wrote:All I know is if DISCO loves me enought to grant me 80k in the future no matter the circumstances I'd probably never use my other cards but for simple things or maybe a date night LMAO but I honestly love my cards (even though I have a love/hate with my AMEX) lol.

You know you're not going to get anywhere with Amex till utilization goes down.

Your scores are almost 80-100 points lower than when you got approved.

Once it's down, there won't be any hard feelings and hopefully you'll enter love/love business relationship with them.

When I had a whole lot less credit, Disco never denied CLI request. My card grew from $1000.00 to more than $20,000.00 in less than 18 months.

Once I passed whatever gives their computer tickles, it stopped.

Since you aren't too heavy in terms of limits, I'd expect to see decent growth, but no clue as to when it may happen.

For right now, I'd just relax while chanting "10% back, 10% back, 10% back" ❤️